Oil market considerations over Center East hostilities turned nearly completely centered over the previous week on the Strait of Hormuz and the potential for short-term disruption.

That’s what analysts at Commonplace Chartered Financial institution, together with the corporate’s commodities analysis head Paul Horsnell, suppose, a brand new report despatched to Rigzone by the Commonplace Chartered Financial institution staff on Tuesday revealed.

“We don’t suppose any enhance generally Center East threat or different geopolitical implications was priced in; the Strait of Hormuz was the important thing issue, with potential injury to Iran’s export infrastructure additionally taking part in a task, albeit a lesser one,” the analysts mentioned within the report.

“The conclusion of the speedy sizzling warfare has seemingly eliminated Hormuz worries nearly fully from the market, creating the catalyst for the sudden elimination of all of the previous two weeks’ value features,” they added.

“The obvious change in President Trump’s rhetoric in direction of a extra dovish and fewer interventionist stance has supplied additional gasoline for the downwards transfer now that the Hormuz impact has largely been faraway from market pricing,” they continued.

Within the report, the Commonplace Chartered Financial institution analysts mentioned they’ve argued that the risk to Hormuz was all the time a defensive technique for Iran, “a risk saved credible as a way to deter assaults on Iran’s oil export infrastructure, particularly the Kharg Island loading amenities”. They added that “the motion right into a quieter section of the battle leaves the Hormuz questions unanswered”.

“An Iranian coverage maker might argue {that a} credible risk to Hormuz transits succeeded in deterring vital assaults on its export infrastructure, whereas a U.S. coverage maker might argue that the risk to Hormuz was not credible due to the projection of U.S. naval and air energy,” the analysts famous within the report.

“In different phrases, the shortage of disruption within the Hormuz Strait is prone to be seen by either side as a vindication of their technique, which might counsel that little could be assessed from the previous week when it comes to the true nature of Hormuz transit dangers,” they went on to state.

The Commonplace Chartered Financial institution analysts highlighted within the report that front-month Brent “spiked as excessive as $81.40 per barrel at open within the wake of the 22 June U.S. bombing of nuclear targets in Iran”. Additionally they identified that at time of writing their report, the value had fallen $13.50 per barrel.

“Volatility has additionally spiked, with 10-day Brent realized annualized volatility at 66.0 p.c at settlement on 23 June, per week on week enhance of 23.6 share factors and the best volatility since mid-July 2022,” the analysts said within the report.

“30-day Brent realized annualized volatility was 45.0 p.c at settlement on 23 June, 11.7 share factors greater week on week,” they added.

The analysts went on to warn within the report that tail dangers nonetheless abound within the oil market.

“One upside threat is that the latest historical past of Center East ceasefires is at greatest checkered; most ceasefires have, to various levels, proved fragile,” they famous.

“The second threat that we expect is underpriced is key: the market stays extraordinarily tight, with U.S. inventories particularly properly beneath regular ranges … as well as, the absence of the big surpluses that consensus has been anticipating for properly over 12 months (even after OPEC+ manufacturing will increase) means that consensus supply-demand fashions are doubtless mis-calibrated,” they added.

Additionally they warned within the report that there are draw back tail dangers.

“Most notably now we have but to see a big change within the output figures of a few of the key underperformers when it comes to the guarantees made to OPEC+ companions; this means to us that OPEC+ shouldn’t be but in an equilibrium when it comes to sharing of the load,” they highlighted.

“The general macroeconomic backdrop represents one other draw back threat; whereas now we have to but to see any vital falling away of oil demand progress, the uncertainty brought on by U.S. commerce and financial insurance policies is protecting sentiment biased in direction of the bearish,” they added.

“Investor positioning additionally stays bearish; terribly within the run-up to an escalation of Center East battle our NYMEX WTI money-manager positioning index has remained firmly unfavourable, gaining solely 9.6 week on week to -22.8 within the newest positioning knowledge,” they continued.

“The ICE Brent positioning index is no less than optimistic, gaining 18.8 week on week to +20.1, however such low readings at a time of heightened geopolitical threat seem to point that buyers are extraordinarily cautious about being lengthy crude oil,” they went on to state.

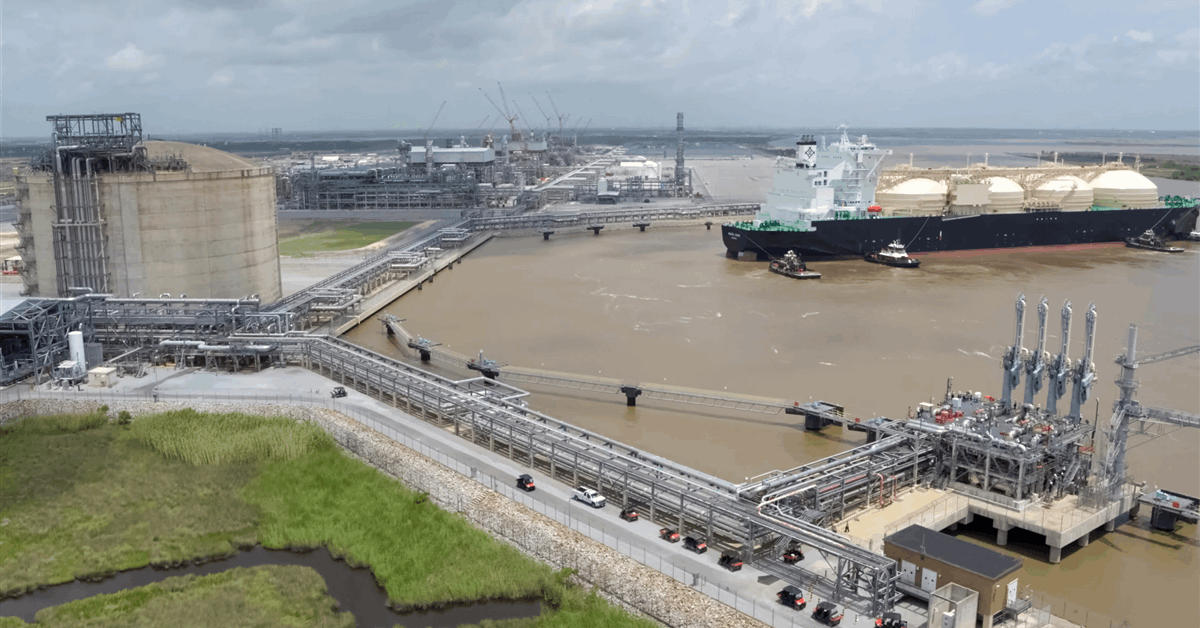

In an oil market replace despatched to Rigzone on Tuesday by the Rystad Power staff, Rystad Power World Head of Commodity Markets – Oil, Mukesh Sahdev, famous that “the in a single day ceasefire between Israel and Iran got here sooner than many anticipated, pushing Brent crude costs again beneath $70 per barrel”.

“Assuming the ceasefire holds, it reinforces our view that de-escalation was extra doubtless than a full blockade of the Strait of Hormuz – a transfer that might have triggered a pointy spike in oil costs,” Sahdev added.

“With this in thoughts, we anticipate oil costs to carry close to the $70 per barrel stage whereas readability on a U.S.-Iran deal emerges, assuming the ceasefire holds,” Sahdev continued.

“The prospect of extreme financial fallout from a possible blockade doubtless motivated either side to comply with the ceasefire whether it is certainly real,” the Rystad consultant went on to state.

Sahdev additionally famous within the replace that Rystad’s understanding of oil market fundamentals factors to a good oil stability heading into summer time.

“This encourages OPEC+ to stay opportunistic in steadily unwinding cuts, whereas intently monitoring the product market to keep up backwardation in crude futures and stability in value actions,” Sahdev highlighted within the replace.

In an oil and gasoline report despatched to Rigzone on June 16 by the Macquarie staff, Macquarie strategists warned that, “ought to Iran efficiently block the Strait of Hormuz for any time frame, the influence on oil costs might be unbounded”.

“To roughly quantify it, we use $1.60 per 100,000 barrels per day. Utilizing the complete 15 million barrels per day of provide in danger, the upside (as a perform of length) could be $240 per barrel, a theoretical upside provided that the Strait of Hormuz was shut for a big time frame,” they added.

“Though we don’t consider the state of affairs is real looking, it highlights how small and even minute possibilities of a blockage can introduce extraordinarily massive threat premiums,” they continued.

In that report, the strategists revealed that they anticipated oil costs “to stay unstable with an upward pattern for the following few weeks as each Iran and Israel preserve their army depth”.

“No matter army or diplomatic progress, we anticipate Brent to rally in direction of the low $80 stage earlier than hitting a plateau because the perceived threat of precise oil provide disruption turns into largely discounted,” they added in that report.

Rigzone has contacted the White Home, the Iranian Ministry of Overseas Affairs, and Israel’s Ministry of Overseas Affairs Spokesperson, Oren Marmorstein, for touch upon Commonplace Chartered’s report, Rystad’s oil market replace, and Macquarie’s report. Rigzone has additionally contacted OPEC for touch upon Commonplace Chartered’s report and Rystad’s replace. On the time of writing, not one of the above have responded to Rigzone.

To contact the writer, e mail andreas.exarheas@rigzone.com