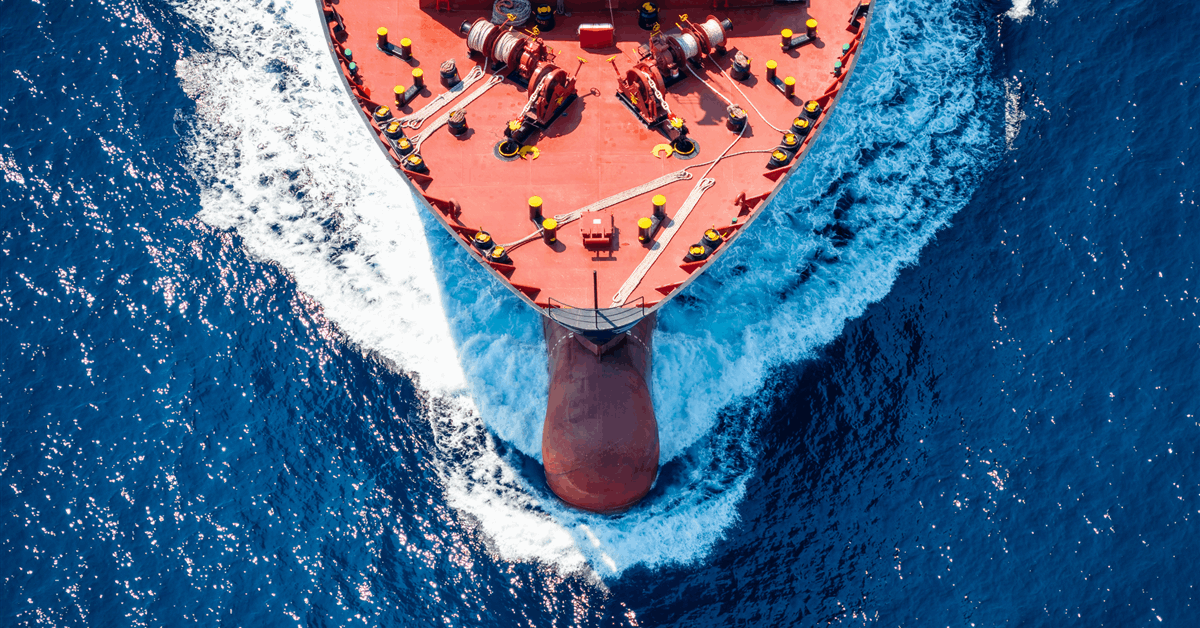

An unlimited hoard of sanctioned oil that’s stranded at sea is driving up international costs as consumers compete for different barrels, a number of of the world’s prime merchants mentioned.

Refineries that may sometimes purchase Russian and Iranian crude are more and more turning elsewhere, Russell Hardy, the chief government officer of Vitol Group, the world’s largest impartial oil dealer, mentioned at an occasion in London on Thursday. His views are extensively echoed by merchants from around the globe, together with at Gunvor Group and Pacific Funding Administration Co.

A ramp-up of sanctions strain on Russia and Iran has tightened the screws on flows from the 2 nations over the previous few months, forcing consumers in nations like India to hunt options. The shift marks a possible turning level after years of sanctioned oil flowing with little restriction, and is supporting costs at the same time as analysts warn of a mounting extra of provide.

“The standard consumers of these two provide sources are reaching for extra Western or Saudi provide sources, which is in flip tightening the actual market,” Hardy mentioned on the Worldwide Power Week convention in London. “The worldwide provide demand steadiness must consider a few of these troublesome conditions — as a result of that’s roughly one million barrels a day that’s not reaching a refinery — it’s simply sitting on the excessive seas.”

The US and European nations have stepped up strikes to grab tankers from the shadow fleet that helps preserve sanctioned barrels flowing, whereas restrictions on Russia’s largest producers, and American political strain have pressured Indian refiners to look elsewhere for barrels.

The outcome has been a big quantity of oil build up at sea that’s not getting purchased.

Whereas a flotilla of oil tankers can typically be very bearish as a result of it factors to oversupply, this time it’s pressuring refiners to look elsewhere for cargoes. There are about 292 million barrels of Russian and Iranian crudes at the moment on the water, greater than 50% larger than a 12 months in the past, in line with ship-tracking agency Vortexa Ltd. Of that determine, 140.5 million barrels are Russian — near double the extent a 12 months in the past — whereas 151 million are Iranian, the info confirmed.

“There’s an terrible lot of oil that’s briefly at sea due to blockades, sanctions, and so on. around the globe,” mentioned Jason Prior, the pinnacle of oil buying and selling at Financial institution of America Corp. “That’s holding up molecules attending to the market.”

As merchants and analysts gathered within the bars and eating places of London’s Mayfair district for the Worldwide Power Week occasion, the influence of sanctions on costs was one of many primary speaking factors. The 12 months started with warnings of document oversupply from the Worldwide Power Company, however benchmark Brent futures are up about 14% up to now in 2026, paring a lot of their hunch from final 12 months.

“We’ve seen a difficult market the place you’ve gotten a bifurcation between these barrels you possibly can simply commerce and people barrels you possibly can’t,” Greg Sharenow, who helps handle practically $20 billion as head of Pimco’s commodity portfolio funding workforce, mentioned at a Bloomberg occasion throughout IE Week on Wednesday. “You may have a macro view on the oil market, we’re constructing 1.5 million barrels a day, and never even have a really sturdy translation of that into value formation.”

It’s not simply sanctioned oil resulting in a extra fragmented market.

The IEA mentioned on Thursday that international oil inventories grew on the quickest tempo since 2020 final 12 months. Nonetheless, a pointy improve in Chinese language crude stockpiles — which have risen by round 200 million barrels during the last 12 months, in line with analytics agency OilX — has fed into this. In contrast, US inventories, which have a far greater influence on crude futures costs, have fallen over the identical interval.

A key query for oil merchants now, is whether or not the present disruptions may be sustained. A US-brokered peace deal between Russia and Ukraine might rapidly open the floodgates, as might any settlement between Washington and Tehran. On the similar time, a slowdown in Indian shopping for of Western barrels might result in stockpiles rising at a quicker place in key pricing facilities.

“The purpose is, what’s subsequent?” mentioned Frederic Lasserre, international head of analysis and evaluation at commodity dealer Gunvor Group. “We really feel we could have virtually saturated what may be put at sea.”

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback will likely be eliminated.