Oil slid as risk-averse sentiment pervaded world markets and buyers digested contemporary developments in US-Iran tensions that proceed to cloud the availability outlook.

West Texas Intermediate fell 2.8% to finish the day beneath $63 a barrel, as equities weakened amid issues over expertise earnings. US President Donald Trump stated negotiations with Iran over its nuclear program might stretch for so long as a month, however it could be “very traumatic” for Tehran if it failed to achieve an settlement. Merchants stay involved concerning the potential for army strikes and dangers to provide from the Center East.

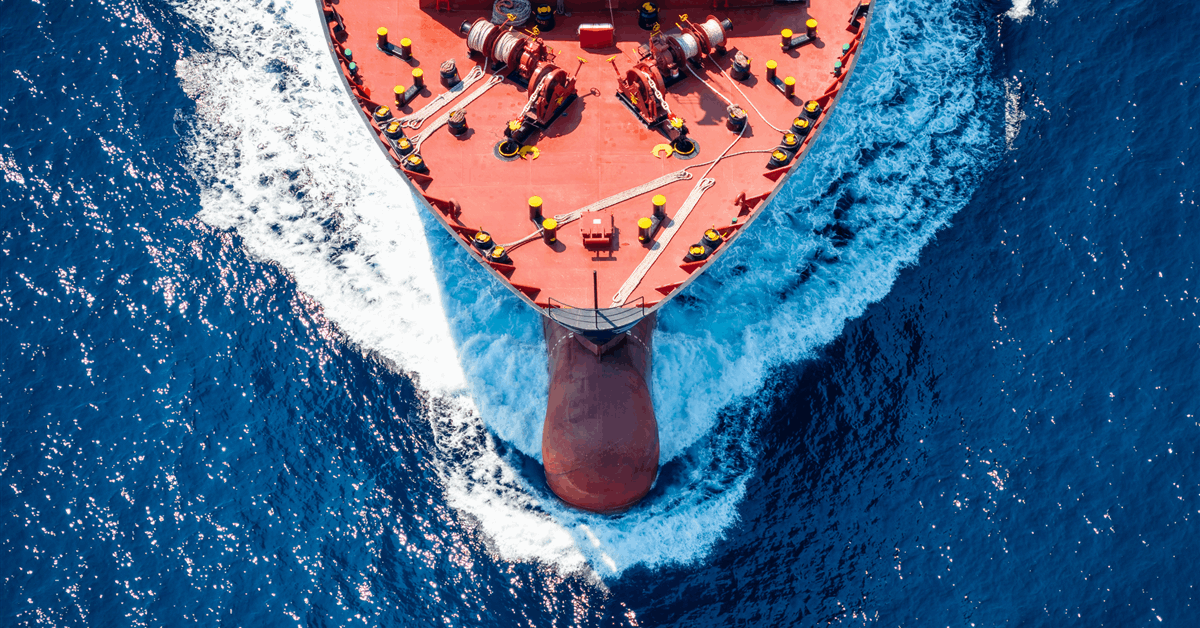

Crude has gained each week this 12 months, with a single exception, as geopolitical dangers and provide disruptions drove futures larger. The US intervened in Venezuela in January, then pivoted to Iran after a wave of protests challenged the Islamic Republic’s management. An unlimited hoard of sanctioned oil at sea can also be protecting a flooring beneath costs as consumers compete for different barrels.

Nonetheless, banks preserve that there’s plentiful provide, with Goldman Sachs Group Inc. saying that the excess was showing, however primarily in places which might be much less important for price-setting. The Worldwide Power Company stated on Thursday that world oil stockpiles grew on the strongest tempo since 2020 final 12 months, underscoring the view {that a} interval of oversupply has arrived, even when it isn’t being felt evenly throughout the globe.

Because the US-Iranian tensions play out, the Pentagon has positioned a naval drive within the area. Israeli President Benjamin Netanyahu met with Trump on Wednesday, with the US chief saying his “choice” is to achieve a take care of Tehran on its nuclear ambitions. Netanyahu visited Washington in a bid to warn Trump towards such a transfer, as an alternative hoping to press him to endorse a extra sweeping rollback of Iran’s army affect within the area.

Costs are more likely to keep vary sure, with pullback from diplomatic progress to be restricted given the key political hurdles to any sturdy deal, stated Vandana Hari, founding father of Vanda Insights.

“Further adversarial rhetoric or army posturing could add incremental threat premium, however features are more likely to be capped except US strikes on Iran seem imminent,” Hari stated.

Flows from Venezuela are additionally in focus. China has purchased some Venezuelan oil that was bought earlier by the US, Power Secretary Chris Wright stated at a roundtable with the media in Caracas, with out giving particulars. The Latin American nation’s so-called “oil quarantine” was primarily over, he added.

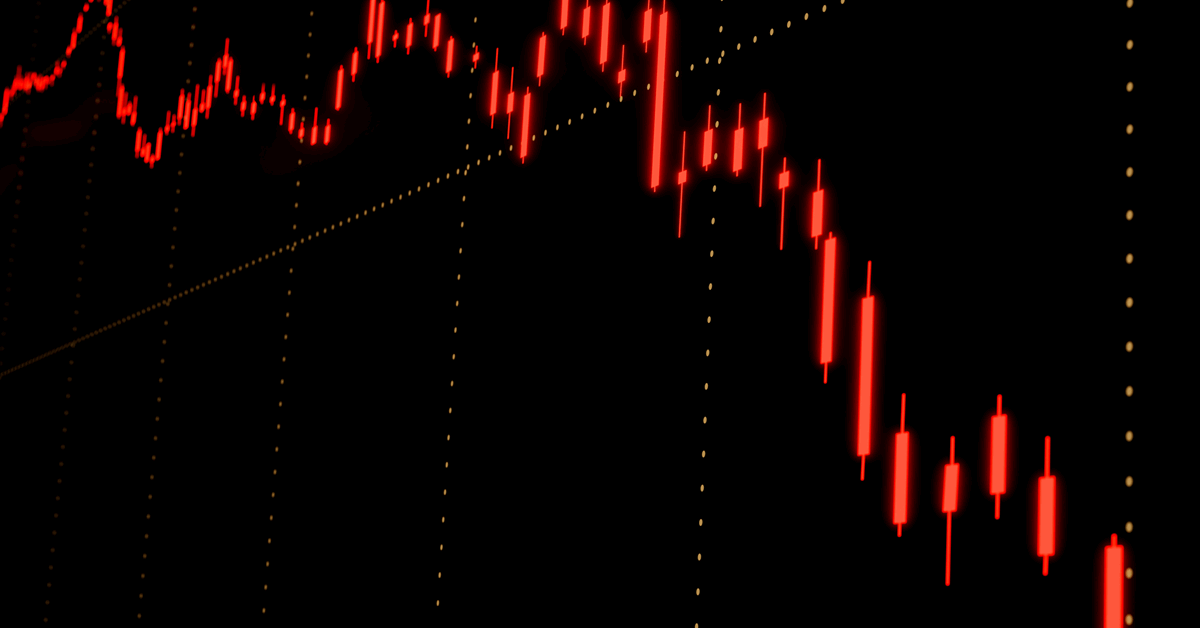

Oil Costs

- WTI for March supply slipped 2.8% to settle at $62.84 a barrel in New York.

- Brent for April settlement dipped 2.7% to settle at $67.52 a barrel.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share information, join with friends and business insiders and have interaction in knowledgeable neighborhood that may empower your profession in power.