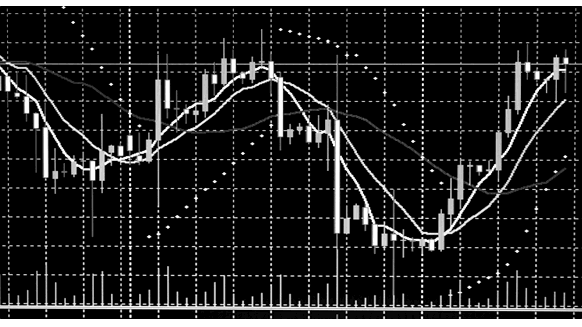

Oil held close to November lows, settling close to $68 a barrel, as more and more bearish fundamentals capped the session’s achieve.

Within the bodily market, a key provide gauge suggests a glut is coming ahead of anticipated, whereas timespreads within the futures market are flashing indicators of oversupply. Additionally weighing on oil: OPEC minimize its demand progress forecasts for a fourth consecutive month and the greenback hit a one-year excessive, making commodities priced within the foreign money much less enticing.

Nonetheless, a spate of exercise within the bodily market that units the Dated Brent benchmark stored oil futures jumpy. London-based Petroineos has up to now this month bought eight crude cargoes, supporting costs on the European shut. Brent ended the session under $72 a barrel.

“It’ll be a uneven commerce within the mid-60s to mid-70s till the market will get extra readability on the driving narratives,” mentioned Jon Byrne, analyst at Strategas Securities.

Merchants proceed to trace tensions within the Center East, the prospects of a second Trump presidency and OPEC+ choices on output. The outlook stays weak, with international provide anticipated to outpace demand subsequent 12 months. China’s newest measures to kick-start its economic system stopped wanting direct stimulus, and inflation stays weak.

In a single vivid spot for bulls, President-elect Donald Trump is anticipated to call Marco Rubio as secretary of state, an individual aware of the matter mentioned. The Florida senator has beforehand supported a maximum-pressure marketing campaign in opposition to Iran and an emboldened Israeli response to threats from OPEC’s largest producer.

Oil Costs:

- WTI for December supply gained 0.1% to settle at $68.12 a barrel.

- Brent for January settlement was little modified at $71.89 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share information, join with friends and trade insiders and interact in an expert neighborhood that may empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg