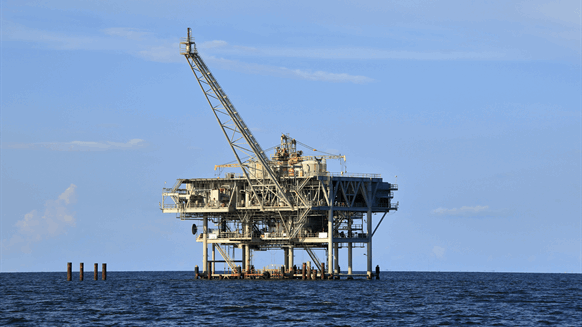

Crude oil futures fell to three-month lows on Friday and are heading to a weekly loss as summer time driving season will get underway with the Memorial Day vacation.

U.S. crude oil hit an intraday low of $76.15, the bottom stage since Feb. 26. International benchmark Brent fell to $80.65, the bottom stage since Feb. 8. The 2 benchmarks are on tempo for a weekly lack of about 4% and three%, respectively.

Listed below are immediately’s power costs:

- West Texas Intermediate July contract: $76.67 a barrel, down 19 cents, or 0.25%. Yr up to now, U.S. oil is up 7%.

- Brent July contract: $81.13 a barrel, down 23 cents, or 0.26%. Yr up to now, the worldwide benchmark is up 5.3%.

- RBOB Gasoline June contract: $2.45 a gallon, down 0.6%. Yr up to now, gasoline futures are up 16.7%.

- Pure Gasoline June contract: $2.63 per thousand cubic ft, down 0.87%. Yr up to now, gasoline is up 4.6%.

“Macroeconomic developments have been failing to supply significant help for oil, which has its personal issues to take care of,” stated Tamas Varga, analyst at oil dealer PVM, pointing to Russia overproducing in April regardless of commitments to slash manufacturing together with different OPEC+ members.

WTI v. Brent

OPEC and its allies, led by Russia, will maintain a digital assembly on June 2 to assessment manufacturing coverage. A coalition of OPEC+ members are voluntarily holding 2.2 million barrels per time without work the market to help costs.

“Subsequent week’s OPEC assembly is broadly anticipated to roll over the present manufacturing ceiling, particularly now that oil costs are in a relentless downtrend,” Varga stated.

“However it will in all probability not be sufficient to unambiguously brighten the temper, just because there may be practically 6 mbpd of provide cushion hooked up to the seemingly oversupplied market,” the analyst stated.