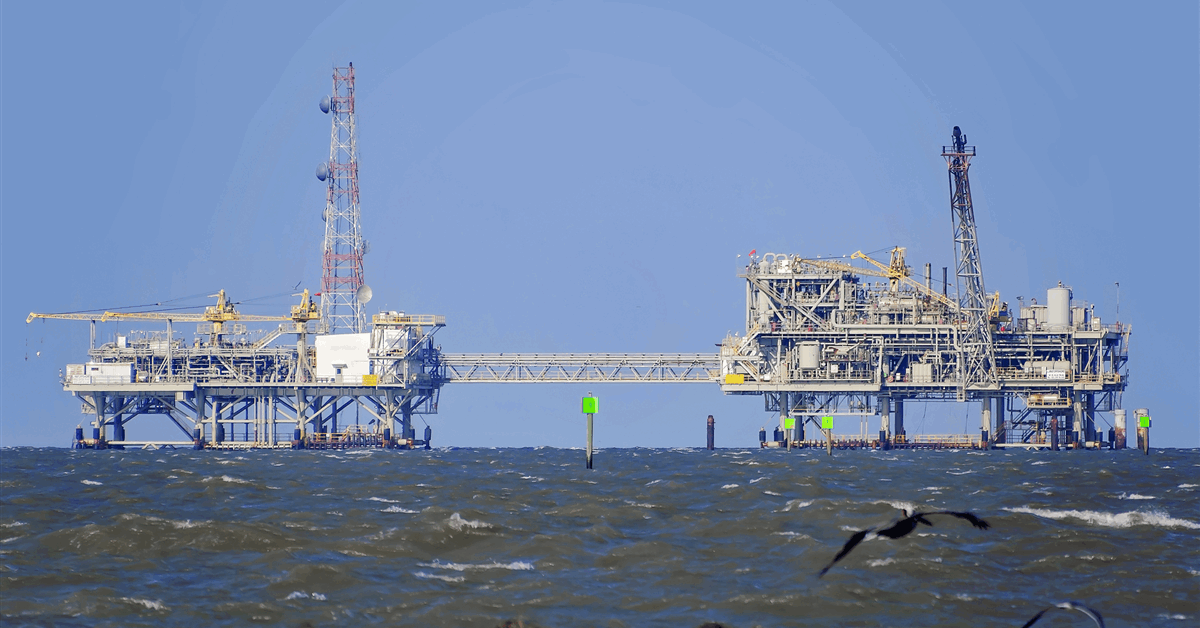

Enterprise Merchandise Companions LP has sealed its buy of a pure fuel gathering affiliate of Occidental Petroleum Corp. working within the Midland Basin for $580 million in money.

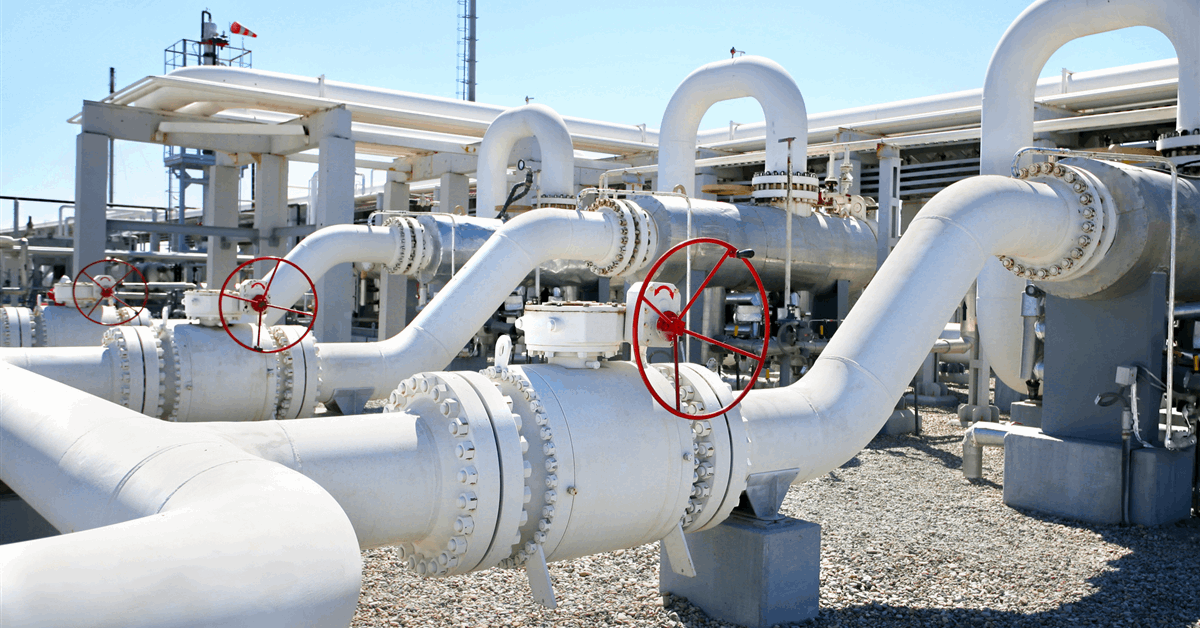

“The acquired belongings embrace sure pure fuel gathering methods within the Midland Basin, in addition to roughly 200 miles of pure fuel gathering pipelines that help Occidental’s manufacturing actions within the Midland Basin”, Houston, Texas-based Enterprise stated in an announcement on-line.

“With entry to greater than 1,000 drillable places, these methods will instantly broaden Enterprise’s pure fuel gathering footprint within the Midland Basin and supply long-term growth visibility”.

The sale, signed July and accomplished August, is a part of Occidental’s divestment program geared toward holding debt manageable following its acquisition of CrownRock LP in a $12.4 billion transaction accomplished final 12 months.

“Since July 2024, Occidental has repaid $7.5 billion of debt, together with proceeds from non-core Delaware Basin transactions that closed in April and July, and expects to use an extra $580 million to debt discount upon closing of the Midland Basin fuel gathering divestiture”, the Warren Buffett-backed producer stated August 6 asserting the take care of Enterprise.

“These transactions deliver the whole divestitures because the December 2023 announcement of the CrownRock acquisition to roughly $4 billion”, Occidental stated.

Occidental launched a $4.5-$6 billion asset sale program when it introduced its merger with CrownRock December 2023. Occidental stated in its annual report for 2024 it had achieved its near-term debt reimbursement purpose of $4.5 billion in 4Q that 12 months.

On the finish of 2Q 2025 it owed $433 million in present maturities from long-term debt. Occidental accrued complete present liabilities of $8.56 billion as of June, in line with a regulatory submitting.

In the meantime it had present belongings of $8.98 billion together with $2.33 billion in money and money equivalents.

Occidental reported $396 million in adjusted web revenue attributable to frequent shareholders for 2Q 2025, down from $860 million for the prior three-month interval on account of weaker realized oil and fuel costs. Gross sales volumes of 1.4 million barrels of oil equal remained largely flat in comparison with the prior quarter, consisting of over 700,000 barrels of oil, greater than 300,000 barrels of pure fuel liquids and a pair of.2 billion cubic toes of pure fuel.

Adjusted web earnings per share was $0.39 assuming dilution, beating the Zacks Consensus Estimate of 28 cents.

Oil and fuel pre-tax earnings was $934 million for 2Q 2025, in comparison with $1.7 billion for 1Q 2025. “Excluding gadgets affecting comparability, the lower in second quarter oil and fuel earnings, in comparison with the primary quarter of 2025, was on account of decrease commodity costs, partially offset by increased crude oil volumes and decrease lease working expense”, Occidental stated.

Occidental’s chemical compounds section contributed $213 million in pre-tax earnings for 2Q 2025, in comparison with $185 million for 1Q 2025. “Excluding gadgets affecting comparability, second quarter OxyChem earnings was comparatively unchanged in comparison with the primary quarter of 2025 and mirrored damaging stock changes, offset by improved export demand for caustic soda and polyvinyl chloride”, it stated.

Midstream and advertising and marketing generated $49 million in pre-tax earnings for 2Q 2025, in comparison with a $77 million pre-tax loss for 1Q 2025. “In comparison with the primary quarter of 2025, the rise in second quarter midstream and advertising and marketing outcomes mirrored increased fuel advertising and marketing margins from transportation capability optimization within the Permian and better sulfur costs at Al Hosn”, it stated.

Occidental registered $3 billion in working money circulate for 2Q 2025, which turns into $2.6 billion earlier than working capital.

It declared a dividend of $0.24 per share, payable October 15 to stockholders of document as of the shut of enterprise on September 10.

To contact the writer, e-mail jov.onsat@rigzone.com