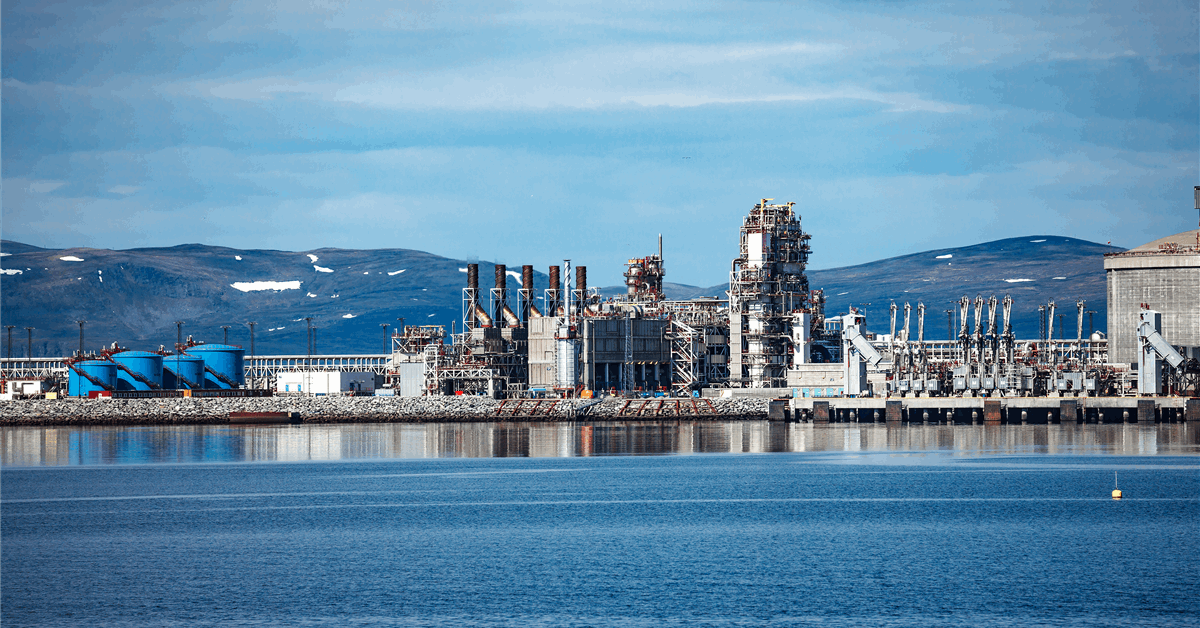

Nigerian Nationwide Petroleum Co Ltd (NNPC) averaged 1.37 million barrels per day (MMbpd) in crude manufacturing within the first three quarters, in response to provisional figures revealed by the state-owned firm on Tuesday.

September’s oil output of 1.37 MMbpd represented the third consecutive month of decline, in response to NNPC’s month-to-month report.

Oil and condensate manufacturing totaled 1.61 MMbpd final month, with condensate accounting for 240,000 bpd. NNPC’s peak oil and condensate manufacturing in 2025 to date was 1.77 MMbpd.

NNPC offered 17.81 million barrels of crude September, down for the second consecutive month.

Its pure gasoline manufacturing and gross sales stood at 6.28 billion normal cubic toes a day (Bscfd) and three.44 Bscfd in September respectively, each down for the second consecutive month.

“Manufacturing ranges in the course of the interval had been quickly moderated because of deliberate upkeep actions together with these at NLNG alongside the phased restoration of beforehand shut-in belongings and delays within the graduation of operations at OMLs 71 and 72”, the report mentioned.

NNPC reported a 77 % petrol availability at its stations. NNPC’s upstream pipeline availability was 96 %.

NNPC logged NGN 4.27 trillion ($2.91 billion) in income for September. Revenue after tax was NGN 216 billion. The corporate reported “statutory funds” of NGN 10.07 trillion.

On the Ajaokuta-Kaduna-Kano Fuel Pipeline undertaking, the report mentioned, “Sustained focus is being directed in direction of completion of the mainline works with substantial progress being recorded”. NNPC mentioned in a press launch July 1 the undertaking was on monitor for completion by yearend.

On the Obiafu-Obrikom-Oben (OB3) Fuel Pipeline undertaking, the report mentioned the execution plan was being revised “to make sure supply inside goal timelines”.

“113km portion of OB3 Fuel Pipeline has been commissioned and flowing circa 300 MMscfd of gasoline”, the report added.

In different developments, Shell PLC earlier this month introduced a ultimate funding resolution (FID) to develop the HI subject to produce as much as 350 MMscfd to Nigeria LNG.

The undertaking is a part of a three way partnership by which Shell owns 40 % and Sunlink Energies and Assets Ltd holds 60 %. At Nigeria LNG, which has a declared capability of twenty-two million metric tons of liquefied pure gasoline a 12 months, Shell owns 25.6 %.

HI is estimated to carry about 285 million barrels of oil equal, in response to the British power large. The sphere, found 1985, lies 50 kilometers (31.07 miles) from shore in waters 100 meters (328.08 toes) deep, in response to Shell.

“Following latest funding selections associated to the Bonga deepwater improvement, right now’s announcement demonstrates our continued dedication to Nigeria’s power sector, with a deal with deepwater and built-in gasoline,” Shell upstream president Peter Costello mentioned in an organization assertion October 14. “This upstream undertaking will assist Shell develop our main built-in gasoline portfolio, whereas supporting Nigeria’s plans to turn into a extra vital participant within the world LNG market”.

To contact the writer, e mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our business, share data, join with friends and business insiders and interact in knowledgeable group that can empower your profession in power.