Egypt is “cautiously optimistic” a ceasefire between Israel and Hamas will finally translate right into a restoration in Suez Canal income, which fell no less than 60% because of the struggle, the nation’s minister for international commerce and funding stated.

“It’s not going to be a direct switchback to the Suez Canal as we envisage,” stated Egypt’s Hassan El Khatib in an interview with Bloomberg Tv on the World Financial Discussion board in Davos, Switzerland on Thursday. “We’ll examine it and we are going to speak to shipowners.”

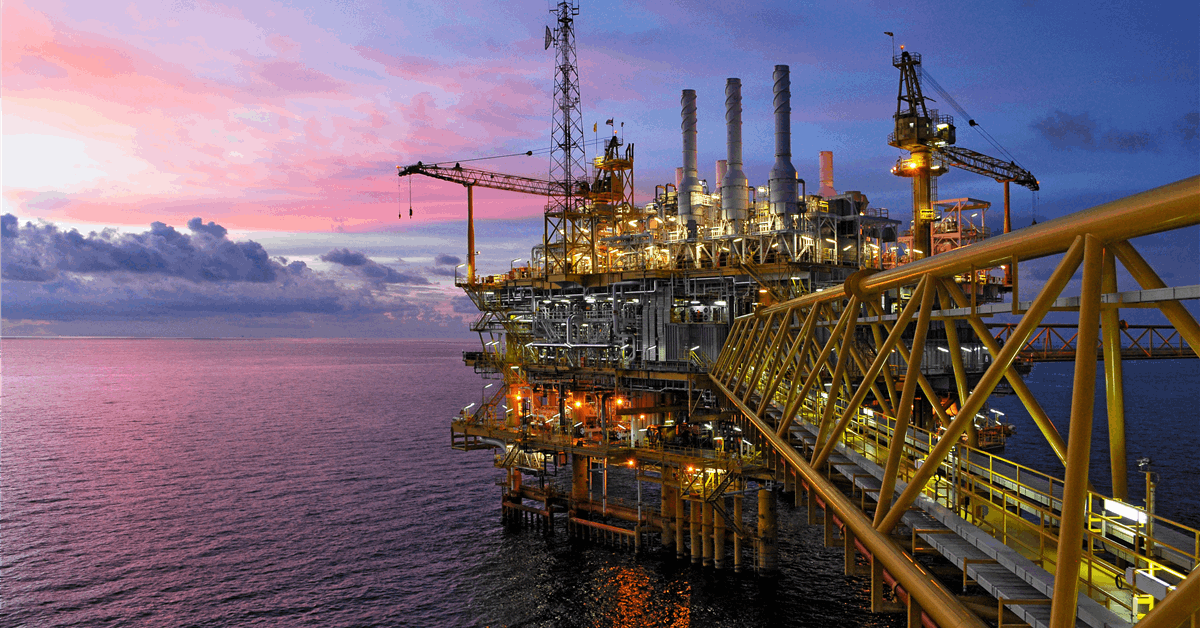

Site visitors by the Egyptian waterway, one of many world’s main commerce routes, dwindled since Yemen’s Houthi rebels in late 2023 started concentrating on Purple Sea transport in solidarity with Palestinian militant group Hamas, hobbling an vital supply of international foreign money. A six-week truce that started Sunday in Gaza raised the prospect the assaults will ease, though a full revival of crossings isn’t anticipated to shortly materialize.

A return to normality for the Suez Canal could be welcome information for Egypt because it seems to emerge from its worst financial disaster in a long time. Authorities allowed the foreign money to weaken about 40% final March, securing contemporary help from the Worldwide Financial Fund and others as a part of a $57 billion international bailout.

For the reason that ceasefire, the Houthis stated they’d cease concentrating on US and UK ships in response to the pause in combating between Israel and Hamas. Nonetheless, transport companies reminiscent of A.P. Moller-Maersk A/S indicated it’s too early to plan a return. Egypt has stated Purple Sea disruptions price it no less than $7 billion final yr.

El Khatib was appointed to Egypt’s cupboard in July, a part of an intensive reboot, because the Center East’s most populous nation seems to draw large-scale international direct funding. Promoting stakes in a spread of state belongings to strategic traders or through the inventory market is a significant IMF-backed purpose.

Egypt’s investor-friendly financial coverage will probably be key to that, in keeping with the funding minister. “The central financial institution narrative at present may be very clear,” El Khatib stated. “It’s one thing we will put ahead to traders and they’ll truly like, as a result of merely it’s inflation concentrating on and a versatile alternate fee.”

The federal government expects to see no less than three or 4 asset gross sales within the first half of 2025, Finance Minister Ahmed Kouchouk advised a Davos panel on Wednesday. Authorities say they’re revising the record of choices and have beforehand introduced they search to lift as a lot as $2.5 billion through the offers by the top of June.

Earlier than becoming a member of the federal government, El Khatib labored at monetary establishments together with the European Financial institution for Reconstruction and Improvement, the place he oversaw direct investments and fairness funds.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will probably be eliminated.

MORE FROM THIS AUTHOR

Bloomberg