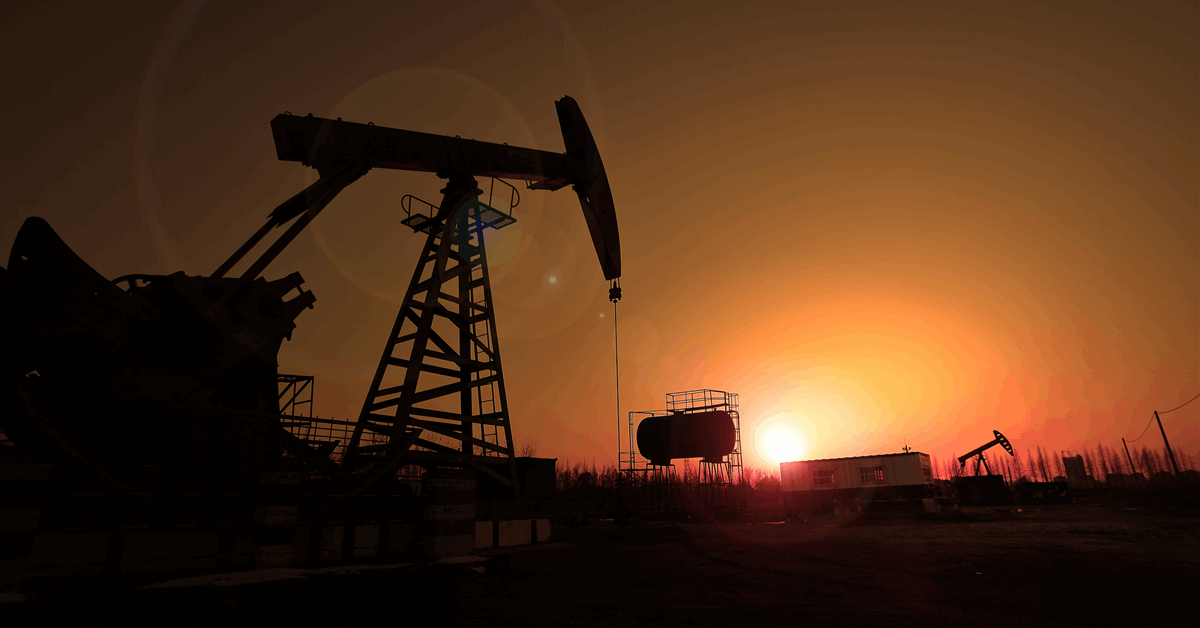

Mentor Capital Inc. has expanded its stake within the West Texas Permian Basin, snapping up eight new royalty curiosity tons in an all-cash deal.

The corporate stated in a media launch that the royalty streams it bought pay out a portion of income from the oil and fuel manufacturing “off the highest”. The corporate has no obligation to pay the bills of the underlying manufacturing.

With the acquisition, Mentor will increase its total possession of property within the sector of oil and fuel, coal, and uranium by 27.5 p.c on a value foundation.

“The three main Permian Basin pooled oil and fuel initiatives that Mentor at the moment participates in signify in complete roughly 131 producing wells plus various improvement alternatives”, Mentor stated. “This massive mixed oil and fuel footprint is anticipated to have appreciable life.

“As is now frequent in Permian oil fields, some present and attainable wells are projected to make the most of multi-leg horizontal and directional drilling with parallel lateral lengths reaching out 2 to three miles”.

On a value foundation, the most recent follow-on buy will increase Mentor’s portfolio of basic vitality property owned to 10.92 cents per Mentor frequent share, with 21,686,105 shares excellent, the corporate stated.

The acquisition follows Mentor’s buy of a 25.127 internet royalty acre portion of a producing 71-well pooled venture within the West Texas Permian Basin in one other all-cash transaction. Mentor stated on the time its bought royalty stream was the equal of 12.5 p.c “off the highest” of oil and fuel revenues for its acreage, with no accountability to pay any bills.

To contact the creator, electronic mail andreson.n.paul@gmail.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback might be eliminated.