The market is underestimating the possibility of disruption to Russian gasoline flows.

That’s what analysts at Commonplace Chartered Financial institution, together with the corporate’s commodities analysis head Paul Horsnell, suppose, a report despatched to Rigzone by the Commonplace Chartered Financial institution workforce late Tuesday revealed.

“The ‘Sanctioning Russia Act of 2025’, launched by U.S. senators Lindsey Graham (Republican) and Richard Blumenthal (Democrat), has 85 co-sponsors within the Senate (out of 100 senators),” the analysts acknowledged within the report.

“In a joint assertion on 14 July the 2 senators famous President Trump’s choice to implement 100% secondary tariffs on nations that purchase Russian oil and gasoline if a peace settlement just isn’t reached inside 50 days however pledged that they are going to proceed to work on ‘bipartisan Russia sanctions laws that may implement as much as 500 p.c tariffs on nations that purchase Russian oil and gasoline’,” they added.

“Market response to President Trump’s announcement was muted, maybe as a part of common dealer fatigue in relation to proposed actions towards Russia that had been subsequently delayed or considerably watered down,” they continued.

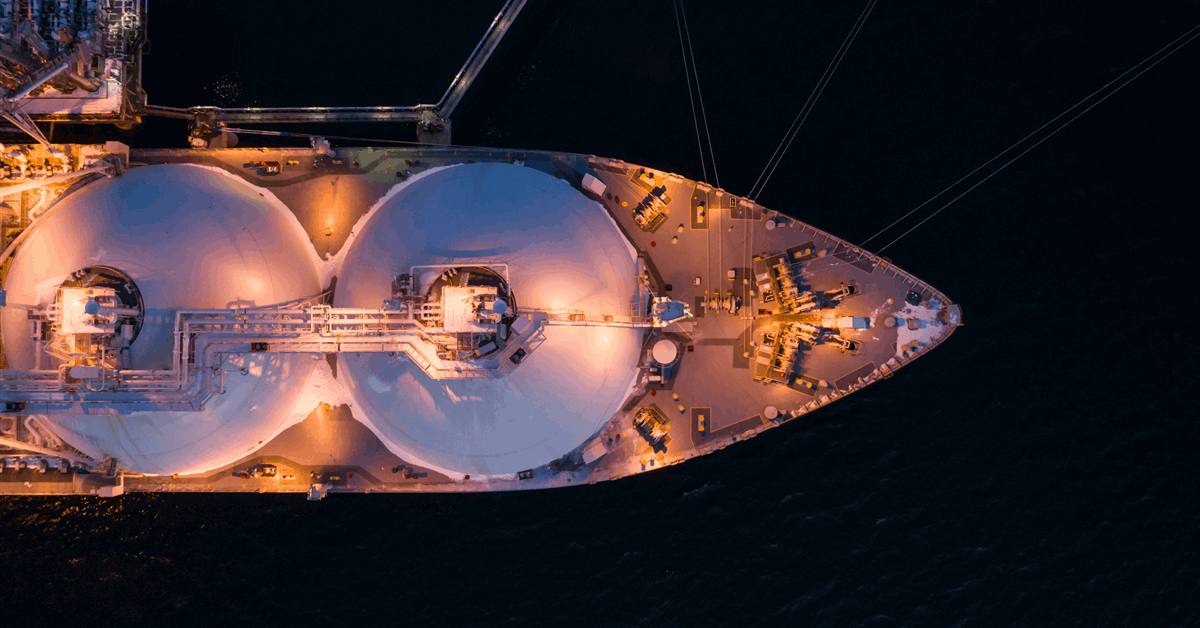

“There stays skepticism that the U.S. will take actions which may drive oil costs larger; nevertheless, we expect it’s a lot simpler for the U.S. to place stress on Russian gasoline flows as this is able to seemingly lead to larger U.S. LNG exports at larger costs,” they stated.

“With a robust head of bipartisan steam behind measures within the Senate, we expect the market is underestimating the possibility of disruption to Russian gasoline flows,” the Commonplace Chartered Financial institution analysts famous.

Within the report, the analysts went on to state that they estimate that the EU’s internet imports of Russian pipeline gasoline averaged 79.8 million cubic meters per day (mcmpd) within the first 14 days of July, primarily based on European Community of Transmission System Operators for Gasoline (ENTSOG) knowledge.

“All non-transit flows into the EU got here into Bulgaria by way of the Turkstream pipeline, with Hungary and Slovakia additionally receiving Turkstream gasoline,” they stated within the report.

“There was additionally a circulation of about 65 mcmpd of Russian LNG within the first half of July; in whole, Russia supplied 18.6 p.c of the EU’s internet imports, decrease yr on yr by 1.7 proportion factors however 6.8 proportion factors larger than March 2025’s low,” they added.

“Whereas EU inventories are constructing strongly within the face of weak demand and powerful LNG flows, we expect costs are usually not absolutely reflecting the potential of an additional constriction in Russian gasoline flows,” the analysts highlighted.

Rigzone has contacted the White Home, the Division of Info and Press of the Russian Ministry of International Affairs, and the European Fee Chief Spokesperson for touch upon the Commonplace Chartered Financial institution report. On the time of writing, not one of the above have responded to Rigzone.

A joint assertion from Graham and Blumenthal was posted on Graham’s web site on July 14. The Sanctioning Russia Act of 2025 invoice additionally goes by H.R.2548, the Congress.gov web site reveals. The invoice must cross the home and the senate earlier than going to the president and changing into legislation, the location outlines. It was launched on January 4, 2025, and is sponsored by Republican congressman Brian Fitzpatrick, the location highlights.

A “newest motion” subhead, associated to the invoice, on the Congress web site factors out that, on January 4, the Home “referred [the bill] to the Committee on International Affairs, and along with the Committees on the Judiciary, Monetary Companies, Methods and Means, and Oversight and Authorities Reform, for a interval to be subsequently decided by the Speaker, in every case for consideration of such provisions as fall inside the jurisdiction of the committee involved”.

To contact the writer, e-mail andreas.exarheas@rigzone.com