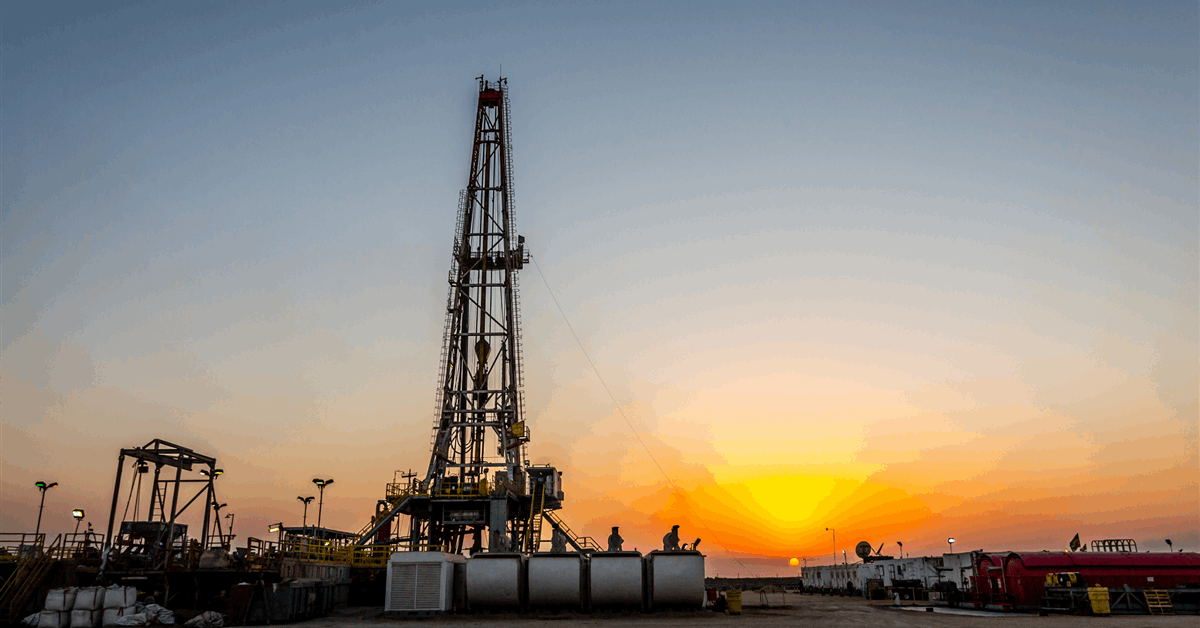

Kuwait Petroleum Corp. is contemplating leasing a part of its pipeline community to assist fund a $65 billion funding plan that covers all the things from upstream to petrochemicals, in response to folks acquainted with the matter.

Centerview Companions LLC is advising the state-backed agency on the deal, one of many folks mentioned, asking to not be recognized discussing private info. The transaction would possible be just like these carried out by neighboring Gulf states like Saudi Arabia and the United Arab Emirates which have sought to monetize authorities belongings to draw overseas funding.

KPC is aiming to lift $5 billion to $7 billion via the deal, two of the folks mentioned. As a part of the transaction, the agency is weighing leasing 13 pipelines over 25 years, the folks mentioned.

Deliberations are ongoing and no remaining selections have been made, the folks mentioned. The plan would additionally nonetheless require the ultimate approval of the federal government of Kuwait, which is OPEC’s fifth-biggest producer.

Representatives for KPC and Centerview declined to remark.

International Funding

KPC’s funding program, which started in April 2024, consists of plans to spend about $33 billion on boosting oil manufacturing capability towards a 4 million barrel-a-day goal by 2035.

Chief Government Officer Sheikh Nawaf Al-Sabah instructed Bloomberg Information in November that the agency is contemplating a number of funding sources for future initiatives, together with attainable pipeline offers.

“I am taking a look at the place the most affordable cash goes to return from,” Sheikh Nawaf mentioned in an interview. “If it comes from a pipeline monetization deal, which might be open to home and overseas traders, like what Adnoc and Aramco did just lately, I will pursue that.”

Any such settlement would possible be carried out via “lease and leasebacks,” he mentioned on the time.

The most recent deliberations come simply weeks after BlackRock Inc.’s World Infrastructure Companions signed a $11 billion deal to lease the infrastructure serving the Jafurah fuel venture after which hire it again to Aramco for 20 years.

Abu Dhabi Nationwide Oil Co. bought a 40 p.c stake in its oil pipeline community to BlackRock Inc. and KKR & Co. in 2019, although an entity based mostly within the emirate purchased again that stake. Adnoc additionally bought a stake in its fuel pipeline unit to an investor group led by GIP, whereas an investor group led by BlackRock acquired 49 p.c of Aramco Fuel Pipelines Co. some years in the past.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share information, join with friends and trade insiders and have interaction in an expert neighborhood that can empower your profession in vitality.