KKR & Co. Inc. has accomplished the acquisition of a 25 p.c stake in Eni SpA’s biofuels firm, to be raised to 30 p.c after the conclusion of a later deal.

“The general proceeds for Eni group, after accounting for money changes and different objects, quantity to 2.967 billion euros [$3.2 billion], together with a capital improve in Enilive of 500 million euros to assist the corporate’s progress plan”, Italy’s state-backed Eni mentioned in a web-based assertion.

“Enilive, with its built-in enterprise mannequin, represents a primary instance of the progress of the enterprise satellite tv for pc mannequin, additional confirmed by a post-money valuation of 11.75 billion euros of Fairness Worth for 100% of Enilive’s share capital and KKR’s dedication to strengthen its function as a key associate by way of an settlement, introduced to the market on 18 February, to extend its stake in Enilive by an extra 5 p.c”.

Eni’s satellite tv for pc mannequin includes “creating centered and lean firms capable of entice new capital to create worth by way of working and monetary synergies and the acceleration of progress”, within the firm’s phrases.

Final yr Eni introduced monetary and operational restructuring for Enilive and its chemical arm Versalis SpA that includes new capital for each items.

World funding agency KKR and Eni have been to inject into Enilive new capital of EUR 500 million every underneath the farm-in settlement, in keeping with Eni’s announcement October 24, 2024.

On February 18, 2025, New York Metropolis-based KKR mentioned it has entered into one other settlement to accumulate an extra 5 p.c in Enilive for EUR 587.5 million.

“Having first signed our funding in Enilive in October final yr, this transaction reiterates our confidence within the enterprise’ capacity to offer progressive and efficient emission-reducing expertise options, in step with our technique to assist transformative power tasks throughout Europe”, KKR managing director for European infrastructure Marco Fontana mentioned in a press release. “We’re excited to proceed working alongside Eni to additional set up Enilive as a market chief”.

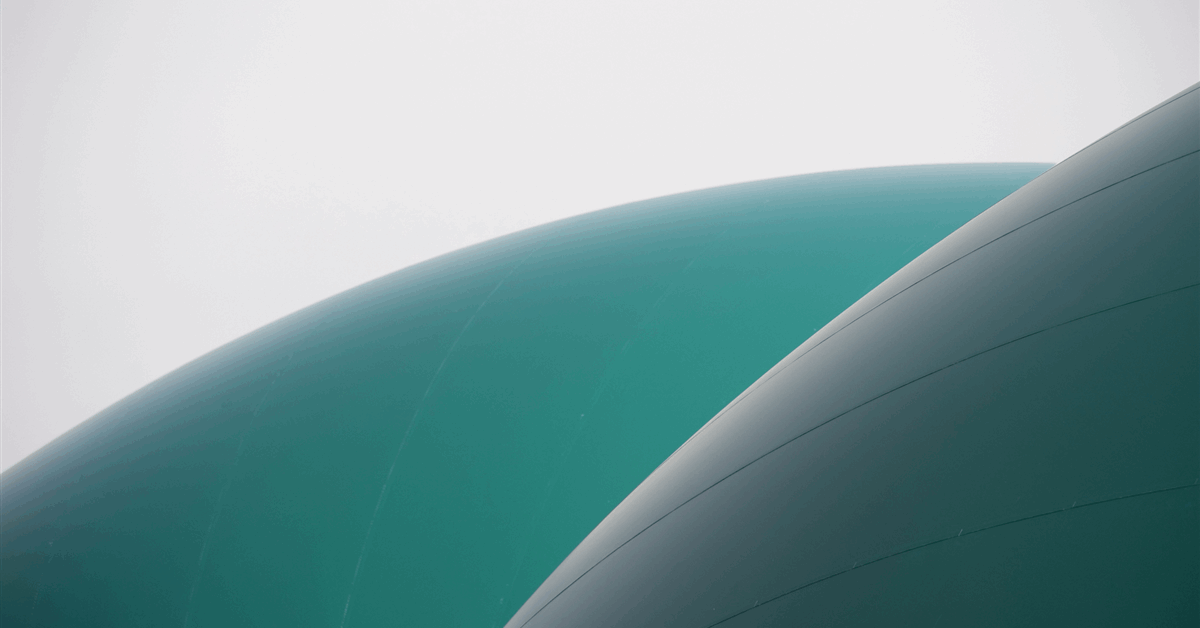

Enilive produces biomethane, sustainable aviation gasoline and different biofuels, in addition to affords electrical automobile charging and automotive sharing.

For Versalis, which makes fundamental chemical substances, chemical merchandise together with plastics and biochemical merchandise comparable to biolubricants, Eni has finalized a plan involving an funding of about EUR 2 billion. The plan “goals to cut back emissions by roughly 1 million tonnes of CO2 [carbon dioxide], presently about 40 p.c of Versalis’ emissions in Italy”, Eni mentioned final yr.

“It contains the set-up of latest industrial crops in line with the power transition and decarbonization of commercial websites throughout sustainable chemistry, in addition to biorefining and power storage”, Eni added. “To allow the development of the brand new crops, exercise on the cracking crops in Brindisi and Priolo, and the polyethylene plant in Ragusa, will likely be phased out”.

“Eni goals to considerably cut back Versalis’ publicity to fundamental chemical substances, a sector that’s going through structural and irreversible decline in Europe, and which has led to financial losses which have been near 7 billion in money phrases during the last 15 years, 3 billion of which was within the final 5 years”, the corporate mentioned.

Eni expects to finish the plan by 2029.

To contact the writer, electronic mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in an expert group that can empower your profession in power.