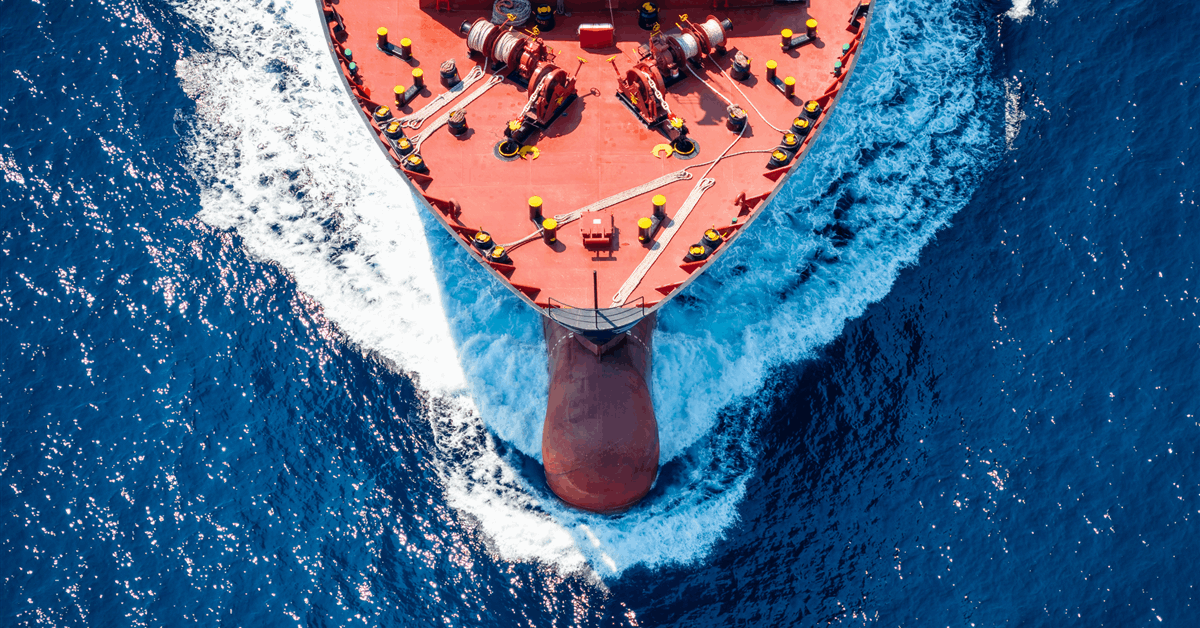

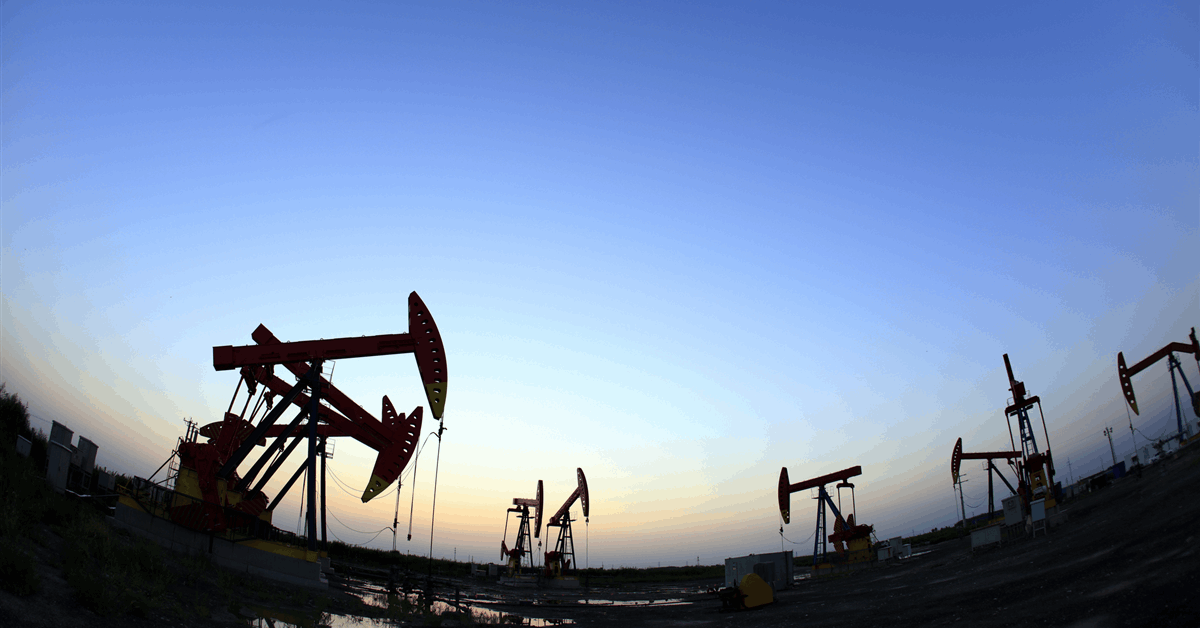

Kimbell Royalty Companions LP has signed a deal to amass Boren Minerals’ oil and pure gasoline mineral and royalty pursuits within the Permian Basin for about $231 million.

“Kimbell estimates that, as of September 30, 2024, the Acquired Belongings produced 1,842 Boe/d (1,125 Bbl/d of oil, 410 Bbl/d of NGLs, and 1,842 Mcf/d of pure gasoline) (on a 6:1 foundation), which is predicted to extend Kimbell’s common each day web manufacturing as of September 30, 2024 by roughly eight p.c and additional steadiness Kimbell’s commodity combine”, Fort Price, Texas-based Kimbell mentioned in a regulatory submitting. In 2025 it expects the acquisition to keep up the identical degree of whole manufacturing.

The acquisition entails roughly 6,953 web royalty acres within the Mabee Ranch of the Midland sub-basin. Upon completion, Kimbell expects to have about 158,350 web royalty acres, 130,238 gross wells and 92 lively rigs, which might comprise about 16 p.c of the entire lively land rigs within the continental United States, the corporate mentioned.

“Kimbell estimates that the Acquired Belongings will cut back Kimbell’s basic and administrative expense, web of non-cash unit-based compensation, by roughly seven p.c per Boe [barrel of oil equivalent]”, Kimbell informed the U.S. Securities and Alternate Fee (SEC).

“As of September 30, 2024, there have been two lively rigs drilling on the acquired property’ acreage.

“Moreover, Kimbell estimates that, as of September 30, 2024, the acquired property consisted of 1.22 web drilled however uncompleted wells and web permitted areas, which is [sic] anticipated to extend Kimbell’s whole web drilled however uncompleted wells and permitted location stock by roughly 16 p.c to a complete of 9.06 web wells.

“The acquired property consisted of 6.06 web (513 gross) upside areas, which is [sic] anticipated to extend Kimbell’s main web drilling stock by 19 p.c within the Permian Basin”.

Bob Ravnaas, chair and chief govt of Kimbell’s basic accomplice, mentioned in a press launch, “The acquired property are situated on one of many largest family-owned tracts within the coronary heart of the Midland Basin, and improve Kimbell’s Permian footprint with glorious reservoir high quality, near-term money movement and long-term manufacturing development”.

“Headlined by PDP manufacturing from roughly 875 gross producing wells, glorious rig exercise and line of sight wells, premier E&P [exploration and production] operators, and substantial undeveloped drilling stock, the acquisition is predicted to be instantly accretive to distributable money movement per unit, with accelerated accretion anticipated in future years”, Ravnaas added.

Kimbell could pay Boren totally in money or a mix of $207 million in money and the issuance of over 1.43 million widespread models representing restricted partnership pursuits in Kimbell.

Topic to customary closing circumstances, the transaction is predicted to shut this quarter.

Concurrently it introduced an settlement to concern 10 million widespread models, with an possibility for a further 1.15 million widespread models, to a bunch of underwriters to settle excellent borrowings underneath a revolving credit score facility. Kimbell plans to attract from the ability, which is supplied by the identical underwriters, to fund the money portion of the acquisition from Boren.

The underwriters are Citigroup World Markets Inc., JP Morgan Securities LLC, BofA Securities Inc., Mizuho Securities USA LLC, PNC Capital Markets LLC, Keybanc Capital Markets Inc. and Capital One Securities Inc., in keeping with a separate SEC submitting.

The general public providing worth is $14.9 per widespread unit. Kimbell expects $149 million in gross proceeds, which it intends to switch to its working firm, Kimbell Royalty Working LLC, in trade for 10 million widespread models within the working firm. The working firm has agreed to make use of the proceeds to settle dues underneath the revolving credit score facility.

Citigroup, JP Morgan, RBC Capital Markets, BofA Securities and Mizuho are joint bookrunning managers within the providing. PNC Capital Markets, KeyBanc Capital Markets, Capital One Securities and TCBI Securities are co-managers.

To contact the writer, e-mail jov.onsat@rigzone.com