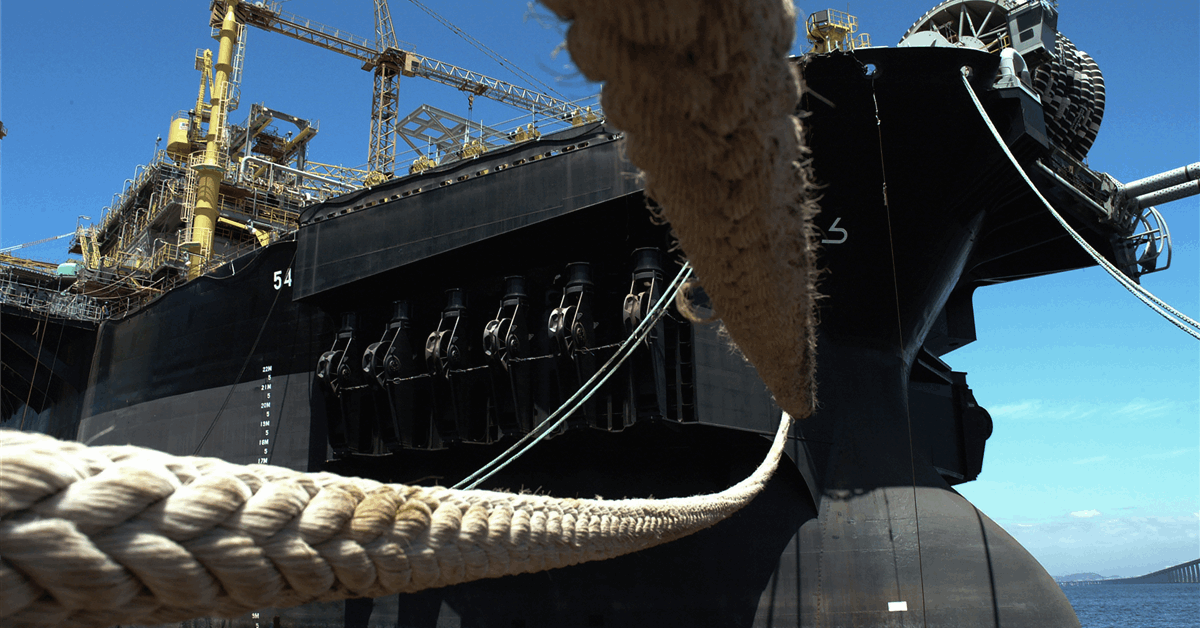

Karoon Vitality Ltd is buying the Cidade de Itajaí floating manufacturing, storage and offloading facility (FPSO), the manufacturing facility for Karoon’s 100% owned Baúna Undertaking within the southern Santos Basin, Brazil, from Altera & Ocyan (A&O).

The gross sales and buy settlement, signed by Karoon’s Brazilian subsidiary Karoon Petróleo & Gás Ltda. (KPG), is for consideration of $115 million plus roughly $8 million in transaction prices.

The settlement is topic to customary approvals. Karoon expects to shut the transaction by April 30 and change into the vessel’s proprietor, it mentioned in a information launch.

The acquisition is anticipated to be funded from present money readily available, topic to the timing of closing and near-term cashflow, the corporate mentioned. A deposit of $30 million has been paid into an escrow account and the steadiness is payable at closing, it added.

Karoon mentioned it intends to contract a brand new operations and administration contractor to function and preserve the FPSO, whereas KPG will take over the possession and strategic optimization plans for the vessel. Karoon mentioned it expects to award a contract to the profitable tenderer by mid-2025.

A&O will proceed to function the FPSO till KPG has absolutely absorbed FPSO administration and the brand new contractor is able to assume built-in operations and upkeep providers for the vessel, in response to the discharge. The period of the transition interval is anticipated to be six to 9 months and stays topic to additional planning and regulatory approvals, Karoon mentioned.

The Cidade de Itajaí FPSO has been working on the Baúna Undertaking manufacturing because the subject got here onstream in 2013. It has a nameplate fluid dealing with capability of roughly 80,000 barrels of liquid per day and a nameplate storage capability of roughly 631,000 barrels of oil, in response to the discharge.

Karoon Managing Director and CEO Julian Fowles mentioned, “We’re delighted to have reached settlement with A&O on the acquisition of the Cidade de Itajaí FPSO. The FPSO is vital to our operations at Baúna, and possession will present us with direct strategic management over the power, permitting us to boost operational efficiencies in response to a timetable decided by Karoon. We will even be capable of implement Karoon’s security requirements and processes to additional reinforce the already sturdy security tradition. The transaction aligns with the Firm’s long-term strategic aims, to broaden the reserves base of present property and enhance operational effectivity”.

“The acquisition is economically enticing, producing important worth for shareholders with an anticipated charge of return comfortably above our mid-teens put up tax hurdle charge and doubtlessly greater than 20 %. Most significantly, it gives certainty on the provision of the FPSO for the Baúna Undertaking by to the top of subject life,” Fowles continued.

“The anticipated lower in working prices and certainty on the long-term availability of the vessel ought to enable the sphere to function profitably properly into the 2030s. This might allow us to entry a portion of the [8.7 million to 16.4 million barrels] of Baúna Undertaking Contingent Useful resource (1C to 3C), topic to additional technical and industrial analysis. Shifting these sources into the reserves class would cut back unit depreciation prices in addition to defer subject abandonment and vessel decommissioning liabilities,” he mentioned.

To contact the writer, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback can be eliminated.