Oil vigilantes have been discovered wanting.

That’s what analysts at J.P. Morgan stated in a analysis word despatched to Rigzone on Thursday by Natasha Kaneva, Head of World Commodities Technique on the firm.

Within the analysis word, the J.P. Morgan analysts famous that the time period bond vigilantes has lengthy been a part of the market vernacular, “referring to the idea that if governments or central banks have interaction in extreme spending or insurance policies which may result in inflation or unsustainable debt ranges, bond buyers – by promoting bonds – will search to exert strain on governments or central banks to undertake insurance policies that they understand as fiscally accountable, typically by elevating borrowing prices”.

“Oil vigilantes, however, is an idea suggesting that when challenges come up and oil costs plummet, the OPEC alliance will intervene to stabilize the market and prop up costs,” the analysts added.

The J.P. Morgan analysts acknowledged within the analysis word that this angle was echoed throughout a Bloomberg panel on the Worldwide Power occasion in late February, “the place nearly 20 % of respondents recognized OPEC’s output choices as essentially the most influential issue for the oil market this 12 months, in comparison with simply three % who considered non-OPEC provide development as the first driver of worth formation”.

Within the analysis word, the J.P. Morgan analysts famous that, “because the Trump administration prepares to impose hefty tariffs on a variety of imports beginning April 2, affecting nearly all nations and growing the danger of a recession, oil costs have certainly tumbled”.

“With Brent crude buying and selling simply above $70 per barrel – except for a quick dip final September – costs are at their lowest since December 2021,” the analysts stated within the report, including that Brent and WTI immediate time spreads have additionally weakened.

“But, this hasn’t set off any alarms at OPEC,” the J.P. Morgan analysts stated within the analysis word.

“As an alternative, the alliance has demonstrated larger tolerance for the potential adversarial financial fallout from tariffs and has opted to proceed with its plan to regularly enhance crude oil output starting in April 2025,” they added.

“Those that have been ready on a ‘put’, anticipating OPEC to reverse its stance, are actually dealing with the chance that they might have misinterpret the market,” they continued.

The J.P. Morgan analysts acknowledged within the word that, for the alliance to vary its course, important market imbalances, akin to a sudden drop in demand or a big enhance in provide resulting in swelling inventories, would doubtless be wanted.

“Up to now, none of those situations have materialized – the downgrades in U.S. GDP have been nearly totally offset by upgrades in Europe’s and China’s development, conserving our demand projections unchanged,” the analysts highlighted.

“Whereas OECD inventories are 4 % above their 2000-2015 ranges, they continue to be three % under their five-year averages,” they added.

The analysts went on to warn within the analysis word that the short-term outlook can also be unclear.

“Our fair-value mannequin means that present Brent costs, that are hovering within the low $70s, are about $6 undervalued, however most of this underperformance is probably going attributable to a big three % decline within the U.S. trade-weighted greenback since mid-January,” they stated.

“Internet investor positioning stays quick. From a technical standpoint, Brent costs are trying to stabilize close to the July 2023 channel help at $69.96, however the lack of pattern-based purchase indicators and the uneven nature of the current bounce make it troublesome to confidently assert that the rebound over the previous week or so marks a sustainable transition to a rally section,” they added.

The J.P. Morgan analysts highlighted within the word that, “basically”, they “nonetheless anticipate Brent costs to get well into the mid-to-high $70s over the subsequent couple of months, earlier than dipping under $70 and ending the 12 months within the mid-$60s, averaging round $73”.

Additionally they warned that their outlook for 2026 “stays decidedly bearish, with substantial surpluses from 2025 extending into the next 12 months, pulling Brent costs all the way down to the excessive $50s by the tip of 2026”.

“Sooner or later between at times, we anticipate the oil vigilantes to emerge,” the J.P. Morgan analysts stated within the word.

Rigzone has contacted the Trump transition workforce, the White Home, and OPEC for touch upon J.P. Morgan’s analysis word. On the time of writing, not one of the above have responded to Rigzone.

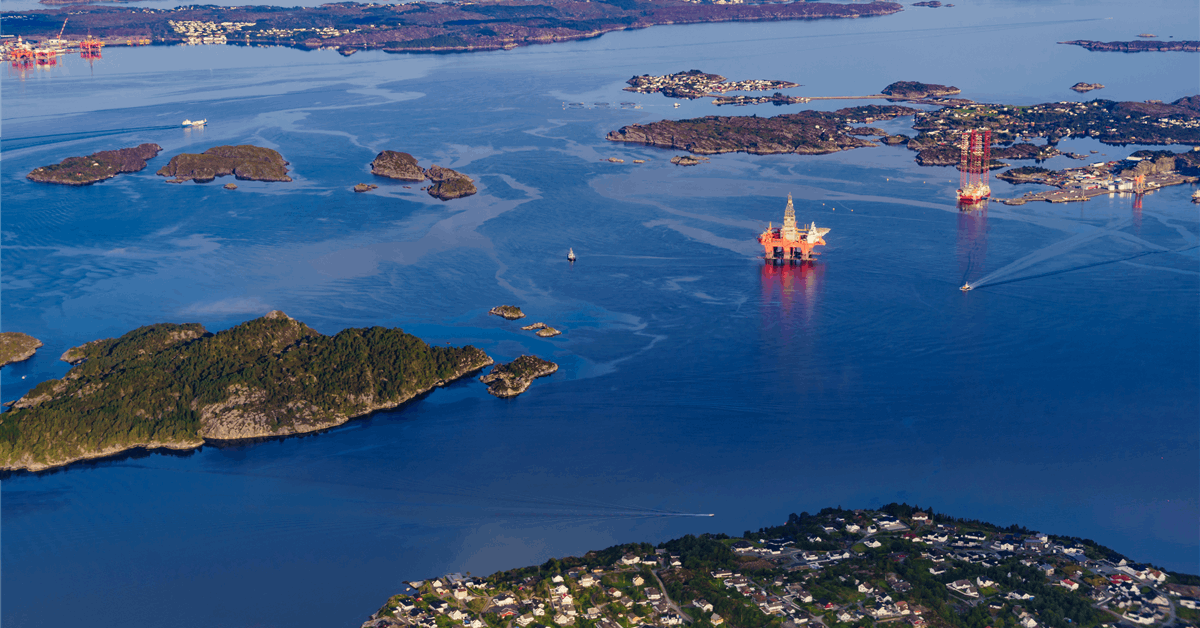

A press release posted on OPEC’s web site earlier this month revealed that Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman will begin unwinding a 2.2 million barrel per day reduce from subsequent month.

“The eight OPEC+ nations, which beforehand introduced further voluntary changes in April and November 2023, specifically Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman met nearly on March 3, 2025, to assessment international market situations and the longer term outlook,” this assertion famous.

“Considering the wholesome market fundamentals and the optimistic market outlook, they re-affirmed their resolution agreed upon on December 5, 2024, to proceed with a gradual and versatile return of the two.2 million barrel per day voluntary changes beginning on 1st April, 2025, whereas remaining adaptable to evolving situations,” it added.

“Accordingly, this gradual enhance could also be paused or reversed topic to market situations. This flexibility will enable the group to proceed to help oil market stability,” it continued.

To contact the creator, e mail andreas.exarheas@rigzone.com