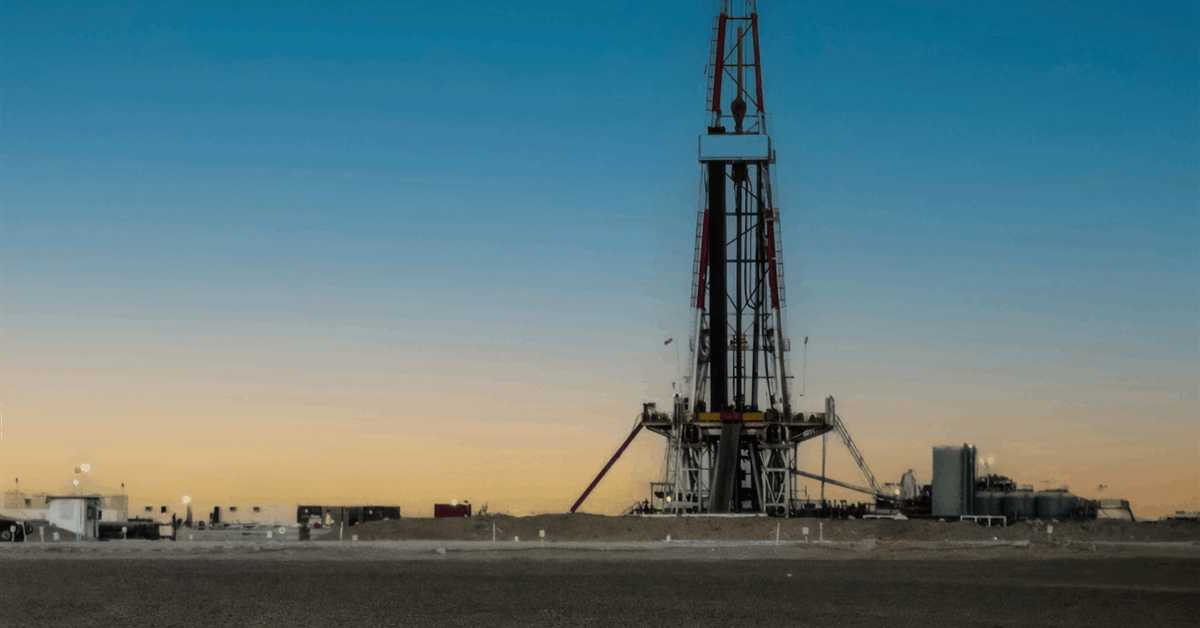

IOG Sources has acquired non-operating working pursuits within the Utica shale, elevating its web manufacturing within the Appalachian Basin by about 26 million cubic toes of pure fuel equal a day (MMcfed).

The acquisition consisted of round 175 developed wellbores and roughly 4,500 web acres of leasehold in Ohio, one of many three major gas-producing states within the Appalachian Basin alongside Pennsylvania and West Virginia in accordance with the Power Data Administration.

The Dallas, Texas-based vitality funding platform didn’t disclose the vendor or the acquisition value.

IOG Sources, which made the acquisition by means of IOG Sources II LLC (IOGR II), mentioned in a web based assertion manufacturing from the property is “beneath top-tier operators together with Antero, Encino, EOG, EQT, Broaden and Gulfport”.

“The acquisition represents the fifth funding made by IOGR II, which was raised in 2022, and the seventeenth funding for the IOG Sources platform”, it added. IOG Sources has two platforms, the opposite being IOG Sources LLC (IOGR I).

IOG Sources has made 5 “important” acquisition transactions involving non-operated stakes at a median buy value of about $90 million since 2021, it says on its web site. IOG Sources targets onshore property within the Decrease 48, or the contiguous United States.

It had about 24,000 barrels of oil equal per day (boed) of manufacturing and about 1,800 wells – unfold within the Permian, Utica, Marcellus, DJ, Mid-Continent and Eagle Ford – as of January 2025.

Final 12 months IOGR II obtained working and royalty stakes within the DJ Basin from Civitas Sources Inc. The property comprised about 1,480 developed and undeveloped wellbores primarily in Weld County, Colorado.

“Present web manufacturing is roughly 4.7 mboe/d beneath top-tier operators together with Occidental Petroleum and Chevron Company”, IOG Sources mentioned in a press launch Might 6, 2024.

On March 30, 2023, IOG Sources introduced a take care of an unnamed firm to purchase non-operated Appalachian property with a web manufacturing of about 24 MMcfed. The acquisition included 66 producing wellbores and seven,000 web acres primarily in Carroll County, Ohio, and Butler County, Pennsylvania.

In 2022 it acquired stakes within the Marcellus shale, a part of the Appalachian Basin, and the Delaware Basin, a Permian sub-basin.

The Marcellus acquisition from Seneca Sources Co. LLC, a part of Nationwide Gas Fuel Co., consisted of non-operated wellbores primarily within the counties of Clearfield, Elk and McKean in Pennsylvania. The property had a web manufacturing of about 17 MMcfd.

“The acquisition represents the preliminary funding for IOGR II, the successor platform to IOG Sources, LLC”, IOG Sources mentioned November 22, 2022.

The Delaware Basin acquisition from Tier 1 Merced Holdings LLC consisted of non-operated wellbores, primarily within the New Mexico counties of Eddy and Lea.

“With this acquisition, IOGR provides web manufacturing of roughly 3,800 boe/d beneath top-tier operators together with Devon, Conoco, and Marathon”, IOG Sources mentioned March 3, 2022.

In 2021 it acquired non-operating stakes in 77 producing horizontal wells from Sequel Power Group LLC. The property, operated by Southwestern Power Co. and Ascent Sources, had a web manufacturing of about 75 MMcfed, as introduced March 3, 2021.

IOG Sources, shaped 2014, says it has been “sponsored” by First Reserve Corp. since 2017.

Stamford, Connecticut-based First Reserve, which lists IOG Sources as a portfolio firm, says on its web site, “IOG Sources, LLC [IOGR I] and IOG Sources II, LLC are non-operated exploration and manufacturing corporations targeted on partnering with operators to supply drilling capital to accumulate working pursuits in oil and pure fuel property throughout a number of core hydrocarbon basins in North America (every distinct asset funding a Growth JV or PDP acquisition)”.

To contact the creator, e mail jov.onsat@rigzone.com