Imperial Oil Ltd stated it expects CAD 2-2.2 billion ($1.6 billion) in capital and exploration expenditure for subsequent 12 months, in comparison with CAD 1.9-2.1 billion for this 12 months.

The Canadian oil sands-focused producer, majority-owned by Exxon Mobil Corp, earlier introduced a cost-saving restructuring plan.

“The corporate’s technique stays targeted on maximizing the worth of its current property and progressing advantaged high-value development alternatives whereas delivering industry-leading returns to shareholders”, Imperial stated in a steering assertion.

Imperial expects a gross manufacturing of 441,000-460,000 gross oil equal barrels per day (boed) in 2026.

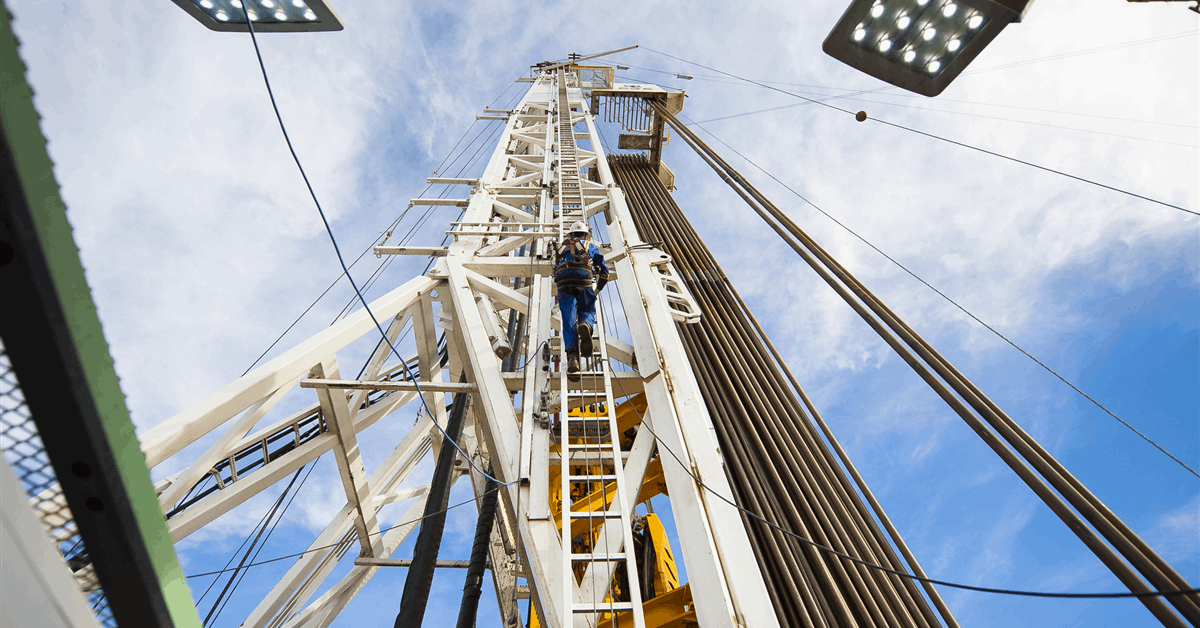

Within the first 9 months of 2025, Imperial averaged 436,000 boed gross, in line with its third quarter report October 31. Whereas that fell wanting the higher finish of its 2025 projection of 433,000-456,000 boed, the third quarter determine was 462,000 boed, the corporate’s highest quarterly output in over 30 years with Kearl recording its highest-ever quarterly gross manufacturing at 316,000 barrels per day (bpd).

“Larger volumes replicate reliability enhancements and continued development at Kearl and Chilly Lake, progressing in direction of targets of 300,000 and 165,000 barrels per day respectively”, Imperial stated of its manufacturing forecast for 2026. “Turnarounds are deliberate at Chilly Lake, Syncrude and at Kearl, the place deliberate work on the K1 plant will prolong the turnaround interval from two years to 4 years”.

Subsequent 12 months Imperial “will progress secondary bitumen restoration initiatives at Kearl, high-value infill drilling and Mahihkan SA-SAGD at Chilly Lake and mine development at each Kearl and Syncrude”, the corporate stated.

Downstream, Imperial expects to course of 395,000-405,000 bpd with a utilization charge of 91-93 %.

“The corporate is planning to finish turnarounds at Strathcona and Sarnia”, Imperial stated. “At Strathcona, the work will concentrate on the crude unit, after attaining its longest-ever run size of 10 years.

“Imperial continues to concentrate on additional bettering and maximizing profitability of its downstream enterprise by leveraging its coast-to-coast community of advantaged logistics and robust model loyalty packages to maneuver merchandise, together with renewable diesel, to high-value markets”.

Chair, president and chief government John Whelan stated, “Our 2026 plan builds on Imperial’s sturdy basis and positions the corporate to structurally enhance money circulate, by progressing in direction of quantity and unit money value targets at Kearl and Chilly Lake”.

On September 29 Imperial introduced a restructuring plan that it expects would minimize annual bills by CAD 150 million by 2028 and cut back its workforce by about 20 % by 2027.

“As a part of this alteration, Imperial will additional consolidate actions to its working websites, enhancing collaboration, operational focus and execution excellence”, Imperial stated.

“The restructuring is in line with Imperial’s technique to maximise worth, utilizing expertise and leveraging the corporate’s relationship with ExxonMobil”, it stated.

“With information availability and processing capabilities rising at an accelerating tempo, the adjustments are designed to completely leverage globally obtainable experience to maximise the advantages of present expertise and speed up the cost-effective deployment of latest applied sciences that drive worth and improve monetary resilience”, Imperial added.

To contact the creator, electronic mail jov.onsat@rigzone.com