Greater than 2,500 enterprise figures have referred to as for an “fast finish” to the UK authorities’s Vitality Income Levy (EPL) in an open letter, which was posted on the Aberdeen & Grampian Chamber of Commerce (AGCC) web site.

“Pricey Prime Minister, it’s virtually precisely a yr because you publicly insisted that your social gathering’s plans for the North Sea wouldn’t value jobs,” the letter, signed by a number of chairs, administrators, and chief executives, together with AGCC Chief Government Russel Borthwick, reads.

“On seventh Could, the most important impartial operator within the UK Continental Shelf, Harbour Vitality, introduced plans to chop its workforce by 25 p.c with 250 roles in Aberdeen being positioned in danger,” it states.

“It is a devastating blow for the financial system throughout the area, and the federal government ought to be involved that with continued job losses within the North Sea the UK’s long-term vitality safety is threatened,” it provides.

“Harbour Vitality has been clear that they’ve come to the choice as a direct results of the punitive Vitality Income Levy. For years oil and gasoline firms have argued that it’s hemorrhaging funding within the sector, a coverage that OEUK evaluation exhibits has, up to now, value 10,000 jobs since its inception, while in the identical interval the value of Brent Crude oil has practically halved,” the letter continues.

“This, together with the truth that within the final 10 days an extra 300 jobs have been misplaced throughout our area at subsea engineering provide chain companies, serves as an essential reminder that our vitality sector is very built-in,” it notes.

“Briefly, we’re at grave threat of shedding the world-class firm and expertise base that will probably be required to ship offshore wind, inexperienced hydrogen, and carbon seize tasks at tempo at such time they’re out there commercially at scale,” the letter warns.

The letter goes on to state that “we discover ourselves within the economically and environmentally incoherent place whereby authorities coverage is bringing a untimely finish to the oil and gasoline sector while the UK concurrently depends on rising quantities of carbon heavy and dear imports from abroad to satisfy its vitality wants”.

It provides that “the state of affairs is absurd” and urges the UK Prime Minister “to behave now earlier than it’s too late”.

“Please verify a right away finish to the Windfall Tax and unlock the funding required to guard jobs, generate financial development, and better vitality and nationwide safety for the UK”.

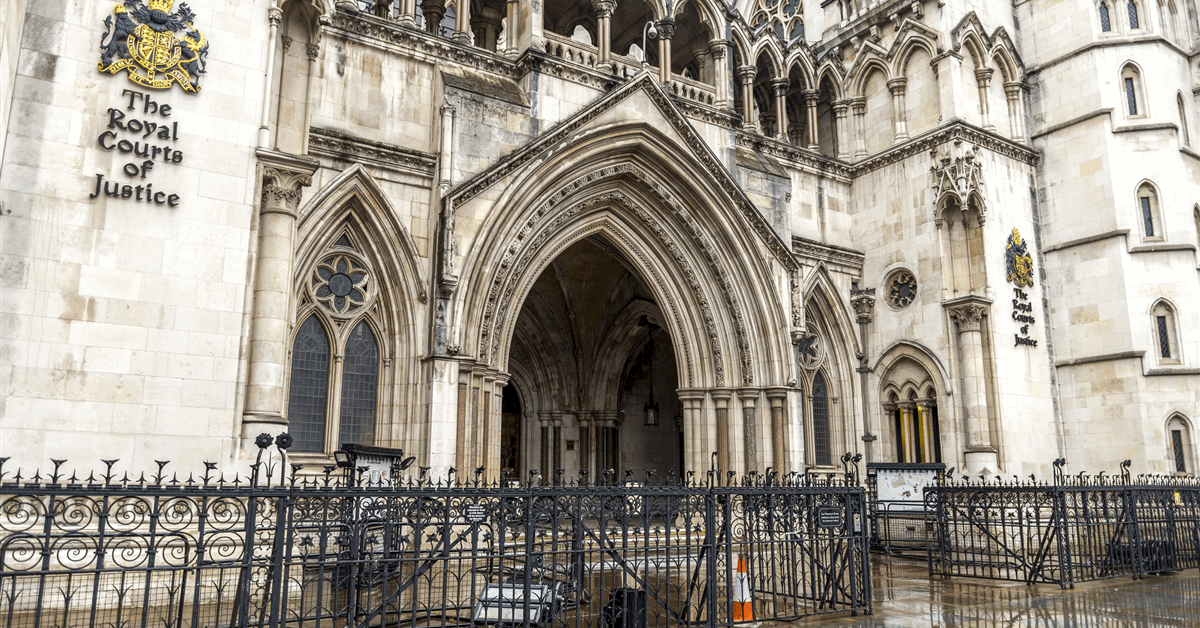

Rigzone contacted HM Treasury (HMT), the UK Division for Vitality Safety and Web Zero (DESNZ), the Cupboard Workplace (CO), and OEUK for touch upon the open letter.

In response, a Treasury spokesperson instructed Rigzone, “the federal government has given the oil and gasoline sector certainty by confirming the windfall tax on the business will finish in 2030 – or sooner if costs drop sufficient to set off its removing”.

“The federal government acknowledges oil and gasoline manufacturing within the North Sea will probably be with us for many years to come back and is dedicated to managing the vitality transition in a approach that helps jobs in current and future industries,” the spokesperson added.

OEUK CEO David Whitehouse instructed Rigzone, “it is a tough time for the folks, their households, and the communities affected by these job losses”.

“There may be one other path – one the place authorities insurance policies take advantage of home oil and gasoline quite than imports as we construct out renewables. That is the trail on which we encourage firms to spend money on homegrown vitality, help jobs, develop the financial system and assist the nation on its journey to internet zero,” he added.

“Because the Prime Minister has stated, the UK will proceed to make use of oil and gasoline for many years to come back. Our selection is whether or not we produce that oil and gasoline right here or more and more depend on imports,” he continued.

“We should help our personal workforce, with measures together with issuing new oil and gasoline licenses, enabling renewable tasks, and ending the Vitality Income Levy,” he stated.

“The federal government is presently participating on the way forward for the North Sea by main consultations. The choices made will form our business and financial system for many years to come back. These choices are pressing. We should get them proper,” Whitehouse went on to state.

The CO directed Rigzone to DESNZ for touch upon the open letter. DESNZ has not responded to Rigzone’s request for touch upon the open letter on the time of writing. Rigzone additionally contacted HMT, DESNZ, and the CO for touch upon Whitehouse’s assertion. The CO directed Rigzone to DESNZ for touch upon this assertion. DESNZ and HMT haven’t responded to this request on the time of writing.

Earlier this month, Harbour Vitality instructed Rigzone that it expects to chop round 250 jobs.

“Harbour is launching a overview of its UK operations, which we count on to end in a discount of round 250 onshore roles in our Aberdeen-based enterprise unit,” Scott Barr, the managing director for Harbour Vitality’s UK enterprise unit, stated in an announcement despatched to Rigzone on Could 7.

“The overview is sadly essential to align staffing ranges with decrease ranges of funding, due primarily to the federal government’s ongoing punitive fiscal place and a difficult regulatory surroundings,” he added.

Rigzone requested HMT and DESNZ for touch upon Barr’s assertion on the time. Responses from HMT and DESNZ to that assertion could be seen right here.

In an announcement made on March 5, which was posted on the UK parliament web site, James Murray, the Exchequer Secretary to the Treasury, famous that the EPL was launched in 2022 “in response to extraordinary earnings made by oil and gasoline firms pushed by world occasions, together with resurgent demand for vitality post-Covid 19 and the invasion of Ukraine by Russia”.

“The EPL will finish in 2030, or earlier if the EPL’s worth flooring, the Vitality Safety Funding Mechanism, is triggered,” the assertion added.

In that assertion, Murray highlighted that HMT and HM Income and Customs had printed a session on how the oil and gasoline fiscal regime “will reply to future oil and gasoline worth shocks as soon as the EPL ends”. The session closes on Could 28.

“The federal government is dedicated to making sure that there’s a new everlasting mechanism in place to reply to future oil and gasoline worth shocks,” Murray stated within the assertion.

“This new mechanism will type an integral a part of the fiscal regime, responding solely when there are unusually excessive costs. This will even make sure that the oil and gasoline business has the knowledge it wants on the long run fiscal panorama serving to to guard companies and jobs now and for the long run,” he added.

“The session units out the federal government’s policymaking aims and design choices for a brand new mechanism inviting stakeholder suggestions. The federal government will work along with the sector and others to make sure we take account of as vast a spread of views as doable throughout this session,” Murray continued.

To contact the writer, electronic mail andreas.exarheas@rigzone.com