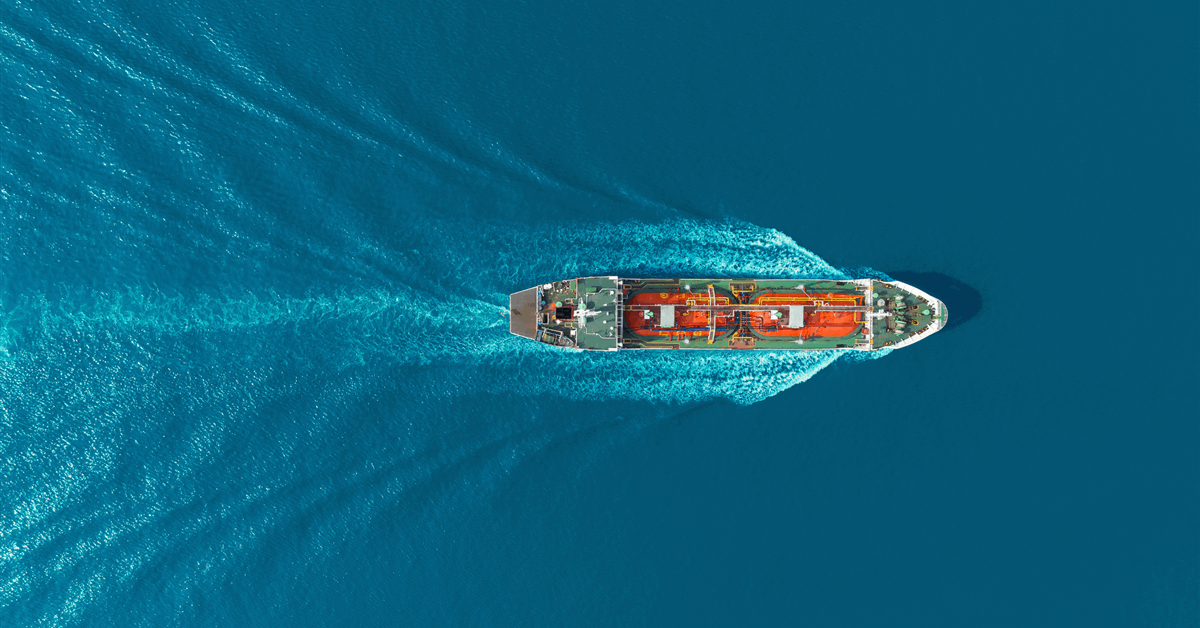

It seems that Iran was not very near attempting to dam transport by way of the Strait of Hormuz.

That’s what Edward L. Morse, Senior Advisor and Commodities Strategist at Hartree Companions LP, and beforehand the World Head of Commodity Analysis at Citi Group, instructed Rigzone in an unique interview not too long ago.

“Iran’s place within the Center East and within the international market has deteriorated considerably for the reason that October 7 Hamas assaults in Southern Israel, which Iran with no query helped to orchestrate,” Morse mentioned.

“It has misplaced efficient utility of all of its exterior proxies. It has misplaced its place in plenty of international locations virtually fully … It has misplaced its air protection fully. And it … [has] seen its vulnerability to its management over the home financial system, together with the supply of pure gasoline for energy technology and business as summer season demand was beginning to surge,” he added.

“On prime of that the mixture of Israeli and notably U.S. assaults have lowered the potential for vital help from the 2 exterior powers tha[t]… have been their important international backers – Russia and China,” he continued.

“The previous has restricted capability to offer arms given its scenario vis-à-vis Ukraine whereas the later has completely little interest in seeing a disruption of important provides by way of the Strait of Hormuz,” Morse went on to state.

“In brief, a shutting of flows by way of the Strait would truly be an existential menace to Iran, and a menace to try this shouldn’t be solely not a important ingredient of its nationwide safety, it’s a direct hazard to its existence,” he highlighted.

When requested how excessive oil costs would have climbed if Iran had shut the Strait, Morse instructed Rigzone that it’s near unimaginable to see how a lot oil costs would have elevated had Iran shut the Strait or if Iran succeeded in shutting the Strait within the close to future.

“Relying on the extent of mining of the Strait required (which might be noticed and interrupted in all probability by the U.S. and with the help of others who want the Strait to stay open), it could possibly be an as much as three month operation within the worst case,” Morse warned.

“Of the ~21 million barrels per day of crude and product commonly flowing by way of the Strait, different utilization of pipes from the East to West Coasts of Saudi Arabia and thru Fujairah within the UAE may divert as much as eight million barrels per day of flows,” he added.

“You may add one other ~500,000 barrels per day if the Iraqi pipeline by way of Turkey to the Med had been re-opened. Nearly all of that capability is seemingly out there, however that may nonetheless depart a niche of 12 million barrels per day, nicely above the flexibility of the market to stability with out excessive costs wanted to destroy demand,” Morse continued.

It’s truthful to say a surge in costs would in all probability be nicely above $100 per barrel, Morse instructed Rigzone.

“Would it not be $120 or $130 initially? No matter it could be, that quantity would in all probability be greater than what could be required – as was the case in July 2008 when Brent hit ~$147 a barrel,” he famous.

“However that was when international inventories had been exceptionally excessive. Inevitably [the] Worldwide Vitality Company and different strategic shares could be launched, together with these of China, that are the best on this planet provided that the federal government controls each its personal and all business shares,” he added.

“However that incremental ~4 million barrels per day nonetheless would go away an eight million barrel per day hole. How lengthy would excessive costs final? Maybe shorter than the three months estimated to clear the Strait of sunk ships and current mines,” he continued.

Morse instructed Rigzone that Iran wouldn’t have the facility to impede the re-opening of the Strait.

“Russia wouldn’t be on Iran’s aspect given its relations with the Gulf Cooperation Council (GCC) international locations and its personal need to have the ability to promote crude and merchandise as wanted into the area,” he famous.

“China would additionally regard the re-opening as a excessive precedence safety matter and would probably be engaged with the U.S., UK and different NATO international locations, in addition to the GCC in a re-opening,” he added.

Morse went on to inform Rigzone that it’s extremely unlikely that Tehran would have an curiosity in shutting the Strait at any time in 2025.

Rigzone has contacted the Iranian Ministry of International Affairs, Israel’s Ministry of International Affairs Spokesperson, Oren Marmorstein, the Division of Data and Press of the Russian Ministry of International Affairs, the UK International, Commonwealth & Improvement Workplace, the White Home, the State Council of the Individuals’s Republic of China, the Worldwide Vitality Company, the Gulf Cooperation Council Basic Secretariat, and NATO for touch upon Morse’s statements. On the time of writing, not one of the above have responded to Rigzone.

American Enterprise Institute, Baker Institute View

In a separate unique interview, Michael Rubin, a Senior Fellow on the American Enterprise Institute (AEI), instructed Rigzone that Iran doesn’t have the capability to shut the Strait of Hormuz for greater than a day or so.

“Not solely may any Iranian property concerned be eradicated comparatively simply, however Iran additionally will depend on the Strait to export its personal oil and import gasoline,” he mentioned.

When requested how excessive oil costs would have climbed if Iran had shut the Strait, Rubin instructed Rigzone that the world isn’t as dependent upon the Persian Gulf because it was a long time in the past.

“There are different fields – in North and South America, Europe, and Africa that may decide up some slack,” he identified.

“Possibly costs would have spiked $10 or $15, however they might have simply as shortly come down. However, Iranian closure of the Strait is extra a hypothetical than a practical occasion,” he added.

When requested if Iran is prone to shut the Strait within the second half of the yr, Rubin instructed Rigzone that is “unlikely”.

“The aim of Iranian motion is to not truly fulfill the bluster however fairly stress the West by elevating the price of insurance coverage,” he added.

One other Senior Fellow on the AEI, Ben Zycher, instructed Rigzone that Iran closing the Strait “was by no means going to occur”.

When requested how excessive oil costs would have climbed if Iran had shut the Strait, Zycher mentioned, “in all probability on the order of $100, however very briefly”. He believes Iran shouldn’t be prone to shut the Strait within the second half of the yr.

Kristian Coates Ulrichsen, a fellow for the Center East at Rice College’s Baker Institute for Public Coverage, and co-director of the Center East Vitality Roundtable, instructed Rigzone in a separate unique interview that he doesn’t assume Iran ever critically thought of closing the Strait of Hormuz.

“For a begin, it could have impacted their very own vitality exports from Kharg. As well as, for the reason that waterway is shared with Oman, and the transport lane by way of Hormuz is usually in Omani water, it was not Iran’s resolution alone and would have concerned hostile motion in opposition to a pleasant and, critically, a impartial neighbor,” he added.

“Iranian officers and politicians have threatened to shut the Strait for many years, ever for the reason that Nineteen Eighties, however to my data the management has by no means acted on these threats, which I believe are extra for public and political consumption domestically,” he continued.

“In fact, Iran can attempt to harass and disrupt transport wanting closing the Strait, and we did see an increase in freight charges and insurance coverage prices in the course of the battle, which is one thing that does should be borne in thoughts,” Ulrichsen went on to notice.

Maritime Intelligence Firm View

Corey Ranslem, the CEO of Dryad World, a maritime intelligence firm, instructed Rigzone in one other unique interview that the corporate doesn’t consider that Iran got here near shutting down the Strait not too long ago.

“Their parliament voted to shut the Straits, however that was extra probably a ‘ceremonial’ vote,” Ranslem mentioned.

“Shutting down the Straits would trigger financial points for Iran in addition to the remainder of the Center East and would have probably expanded the battle into the maritime realm,” he added.

“In the course of the U.S. assaults there have been quite a few navy vessels inside this area that may most definitely have prevented Iran from absolutely closing the Straits as nicely,” he continued.

“We do count on Iran to proceed the satellite tv for pc navigation system interference together with their regular harassment of vessels by way of radio and suspicious approaches by their Revolutionary Guard,” Ranslem warned.

The Dryad CEO went on to inform Rigzone that, proper now, it isn’t probably they may shut down the Strait underneath the present geopolitics. Ranslem identified, nevertheless, that geopolitics are quickly altering globally, “so something is feasible”.

Rigzone has contacted the Iranian Ministry of International Affairs for touch upon Rubin, Zycher, Ulrichsen, and Ranslem’s statements. Rigzone has additionally contacted the International Ministry of Oman for touch upon Ulrichsen’s statements and the White Home for touch upon Ranslem’s statements. On the time of writing, not one of the above have responded to Rigzone.

To contact the writer, e-mail andreas.exarheas@rigzone.com