Hafnia Ltd has consummated the acquisition of almost 14 p.c of TORM PLC from Oaktree Capital Administration LP for $311.43 million.

The acquisition concerned round 14.1 million TORM shares, priced $22 per share, based on the announcement of the deal earlier.

“The acquired TORM A-shares symbolize roughly 13.97 p.c of TORM’s issued share capital as per the date hereof”, Hafnia mentioned in a press release this week confirming completion.

TORM mentioned individually, “Following completion of the acquisition, TORM PLC understands that Oaktree holds 26,425,059 A shares, and Hafnia holds 14,156,061 A shares, out of a complete of 101,332,707 A shares of USD 0.01 every”.

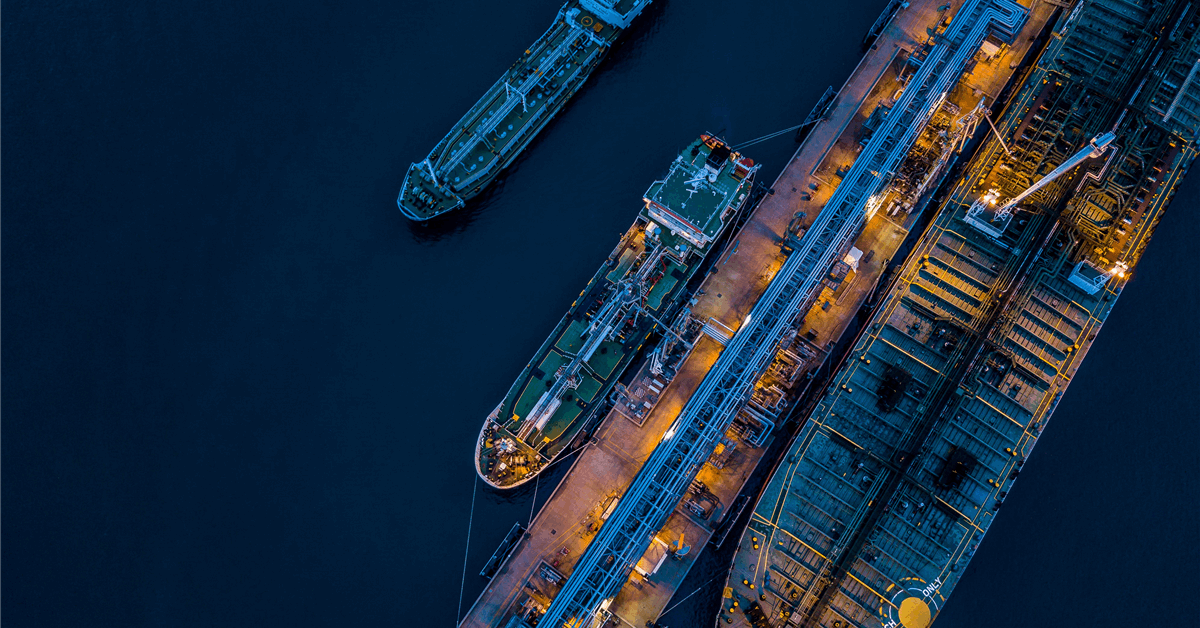

Hafnia and TORM personal fleets that ship crude, oil merchandise or chemical compounds. Hafnia says it owns about 200 vessels. TORM says it owns about 90 vessels.

Hafnia trades on the Oslo Inventory Change and the New York Inventory Change whereas TORM is listed on Nasdaq in Copenhagen and New York.

Oaktree Capital in the meantime is a Los Angeles-based investor.

Robust Demand

Hafnia has maintained an outlook for sturdy demand within the tanker sector. This yr it reported a constant quarter-on-quarter enhance in working income.

“The product tanker market started the yr with modest exercise however gained momentum within the third quarter, supported by elevated buying and selling volumes and robust refinery margins”, Hafnia mentioned in its third quarter report December 1. “This enchancment was largely pushed by increased export exercise from the Center East and Asia, with clear petroleum merchandise (CPP) volumes on the water persevering with to develop all through the quarter.

“Day by day loaded volumes additionally rose, indicating that the rise in oil-on-water was fueled primarily by stronger export demand quite than longer voyage distances.

“Russian CPP exports declined in Q3 following Ukrainian drone assaults on a number of refineries, tightening Russian provide and stimulating elevated commerce exercise within the Atlantic Basin.

“Substitute barrels for South America had been sourced from the US Gulf Coast, including tonne-miles to the unsanctioned fleet and pushing total utilization.

“Underlying fundamentals stay sturdy. The continued closure of refineries in Europe and the US is anticipated to assist increased tonne-miles. Sanctions on Russian molecules and vessels buying and selling with Russia will doubtless proceed tightening efficient provide by means of the rest of 2025 and into 2026.

“World oil demand additionally stays resilient, with the IEA forecasting a rise of 0.8 million barrels per day in 2025, to a complete of 103.9 million barrels per day.

“On the provision aspect, stronger crude manufacturing and OPEC+ plans for elevated output ought to assist the product tanker market by driving increased refinery throughput”.

Hafnia added, “The availability outlook stays constructive. Fleet development in Q3 was minimal regardless of ongoing newbuild deliveries, with the orderbook-to-fleet ratio declining to about 18 p.c as of November 2025. Restricted development was pushed by continued vessel sanctions and the shift of LR2s into soiled buying and selling, which tightened provide within the clear product phase. Ship provide crossing over from the crude sector has additionally fallen sharply in This fall, supported by a sturdy crude market, additional limiting accessible tonnage”.

To contact the creator, e mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share information, join with friends and trade insiders and interact in an expert group that can empower your profession in vitality.