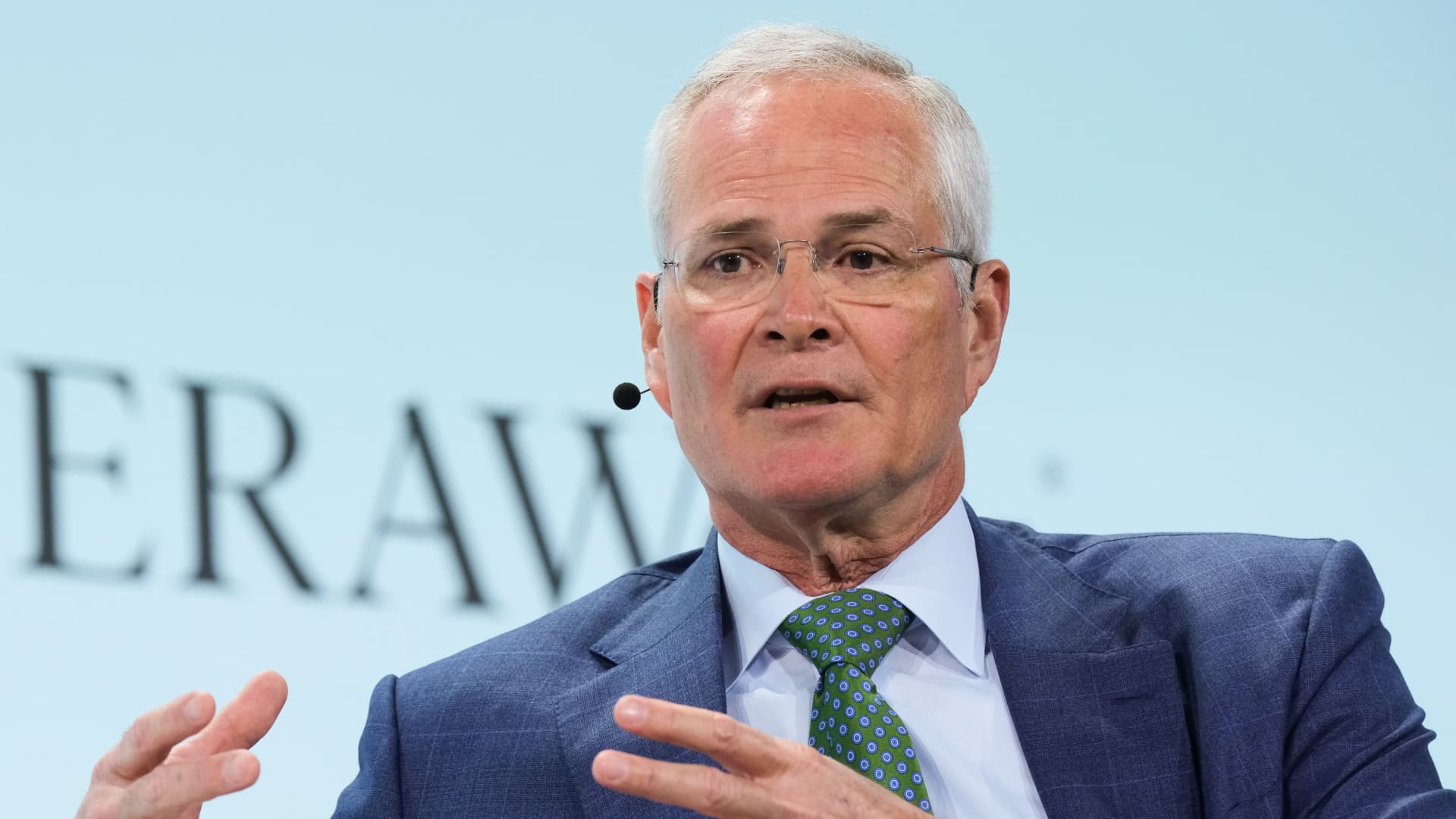

Exxon CEO Darren Woods mentioned Monday that the dispute with Chevron over Hess Company‘s oil belongings in Guyana doubtless is not going to be resolved till 2025.

“My view is it is going to go into 2025,” Woods informed CNBC’s David Faber on the Milken Institute’s International Convention in Los Angeles. Hess had beforehand indicated that the case might drag into subsequent yr.

“This is a crucial arbitration clearly not just for Exxon Mobil however for Chevron and Hess,” Woods mentioned. “What we have to do is take our time to do what’s proper to be sure that we do all of the due diligence and we get to the reply — the fitting reply.”

Exxon is claiming a proper of first refusal on Hess’ belongings in Guyana underneath a joint working settlement that governs a consortium that’s growing the South American nation’s prolific oil assets. The oil main filed for arbitration in March on the Worldwide Chamber of Commerce in Paris.

Woods mentioned the panel of arbitrators continues to be being chosen after which the method will go into discovery. The CEO has repeatedly expressed confidence that Exxon will prevail within the dispute, saying the corporate wrote the settlement that governs the consortium.

Chevron has rejected Exxon’s claims that the settlement applies to its pending all-stock deal to amass Hess, valued at $53 billion.

The arbitration court docket will finally determine the timeline of the proceedings, however Hess has requested the panel to listen to the deserves of the case within the third quarter with an consequence within the following quarter. Chevron CEO Mike Wirth informed analysts through the firm’s first-quarter earnings name in April that this timeline ought to permit the events “to shut the transaction shortly thereafter.”

“We see no legit purpose to delay that timeline,” Wirth mentioned.

If Exxon prevails within the case, Chevron’s take care of Hess would break up. Woods has mentioned Exxon is just not making a play to purchase Hess, however desires to defend its proper within the curiosity of shareholders and discover out what worth is being positioned on Hess’ Guyana belongings.

Hess has a 30% stake in an oil patch known as the Stabroek block off the coast of Guyana. Exxon leads the mission with a forty five% stake whereas China Nationwide Offshore Oil Corp. maintains 25% stake.