Exxon Mobil Corp. will elevate capital spending subsequent yr because it provides the $60 billion buy of Pioneer Pure Sources Co. to oil-production plans, threatening to worsen subsequent yr’s anticipated crude glut.

Exxon plans to spend between $27 billion and $29 billion of money in 2025, North America’s largest power explorer mentioned in an announcement Wednesday. Annual outlays will rise to about $30.5 billion within the following 5 years in contrast with roughly $24.5 billion earlier than the Pioneer deal.

Exxon’s outlook is in direct distinction to different oil-industry gamers. The OPEC+ alliance prolonged plans to withhold crude from the market into subsequent yr as costs wrestle amid a looming surplus. In the meantime, Chevron Corp. final week introduced the primary lower to annual expenditures since 2021 because it prioritizes earnings over manufacturing.

Exxon expects to pump the equal of 5.4 million barrels a day by 2030, probably the most within the firm’s trendy historical past. Price financial savings from the Pioneer deal that closed in Could had been raised by 50% to greater than $3 billion.

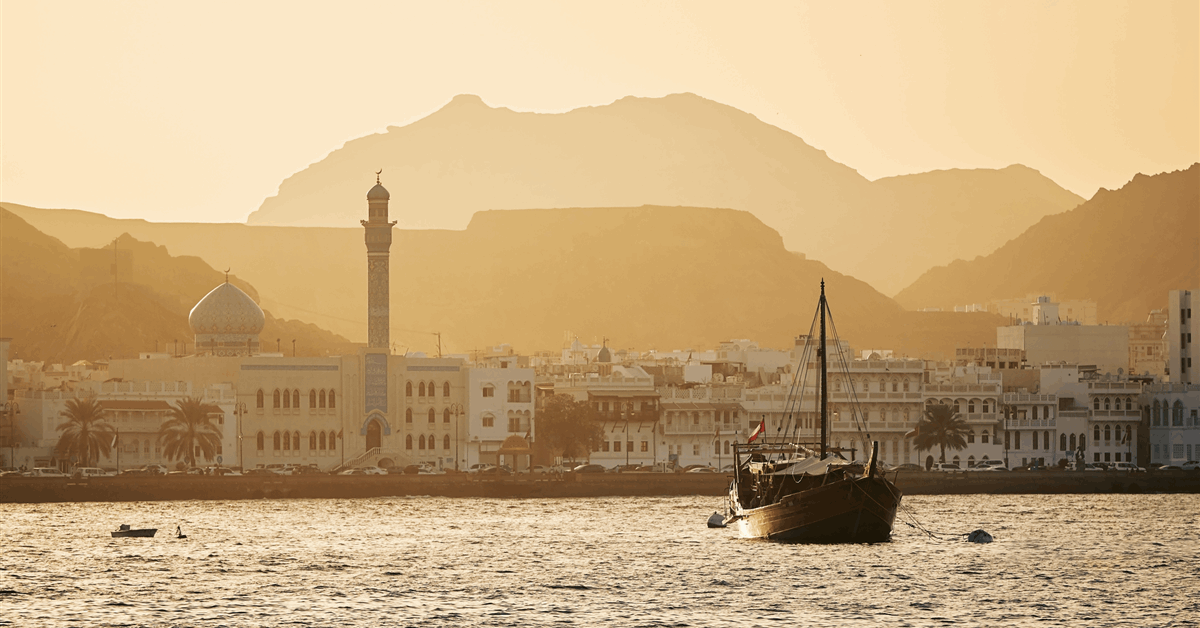

Exxon Chief Government Officer Darren Woods is investing in what he calls “advantaged” tasks that may produce oil and pure fuel for the equal of lower than $40 a barrel over the long run. Decrease-cost ventures resembling oil drilling within the US Permian Basin and Guyana, and liquefied pure fuel output are seen remaining worthwhile nicely into the longer term even when main economies transition away from fossil fuels, denting costs.

Exxon introduced two new growth plans in Guyana, nearly tripling every day manufacturing capability to 1.7 million barrels from the present degree. Firm-wide, low-carbon investments had been raised to $30 billion by 2030, up from $20 billion by 2027.

“The portfolio of advantaged belongings we’ve constructed is the envy of the {industry},” Woods mentioned in November.

Woods’ technique might make sense for shareholders in the long run, however analysts concern Exxon’s growing oil manufacturing might add to a world oversupply forecast for subsequent yr. That, in flip, would complicate efforts by the Group of Petroleum Exporting International locations and its allies to include the surfeit and buoy crude costs.

“It’s Exxon very straight that’s consuming the oil market’s lunch, and notably the Saudi’s lunch,” Paul Sankey, a veteran oil analyst and founding father of Sankey Analysis LLC, mentioned earlier than the announcement. Weak Chinese language consumption and increasing provides from locations just like the US and Brazil are resulting in a “fairly pressured oil worth.”

Woods’ refusal to depart from Exxon’s core oil and fuel enterprise has served the corporate nicely since 2021, when power demand roared again from pandemic-era lows. The inventory’s complete return of greater than 100% over the previous three years is greater than double these of the S&P 500 Index and Chevron.

However analysts are beginning to query the knowledge of specializing in oil-production progress at a time when the worldwide crude benchmark is on observe for a second straight annual decline, Chinese language power demand stays weak, and OPEC+ is sitting on thousands and thousands of barrels of untouched output capability, based on Citigroup Inc.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback might be eliminated.

MORE FROM THIS AUTHOR

Bloomberg