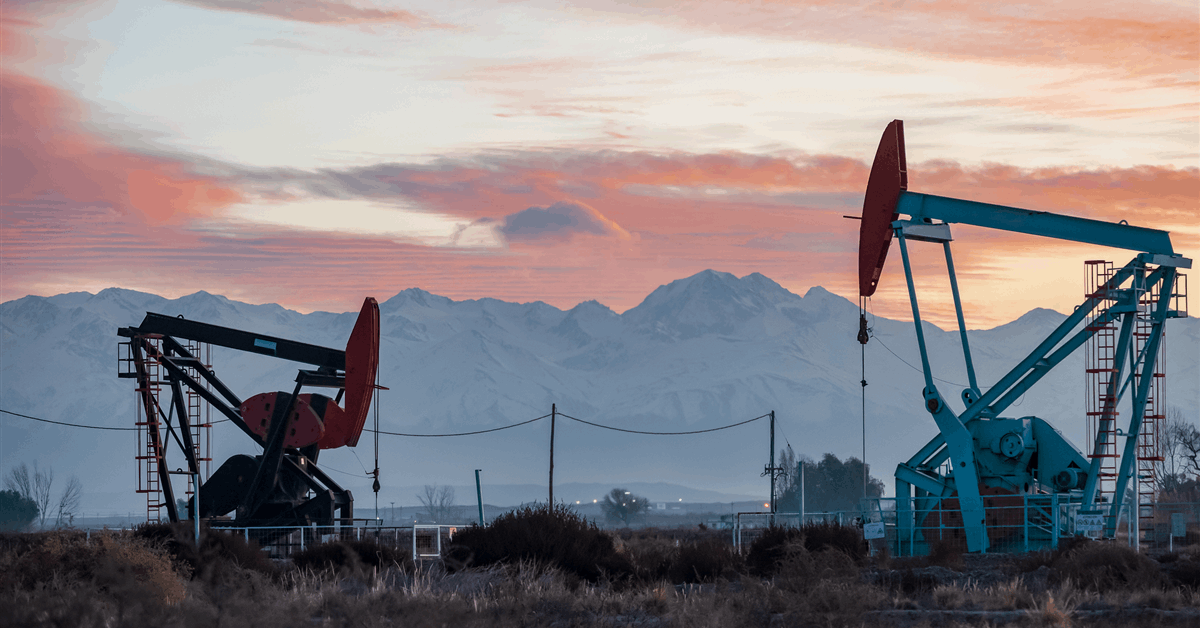

Evolution Petroleum Company mentioned it’s buying non-operated oil and pure gasoline belongings in New Mexico, Texas, and Louisiana for a complete buy worth of $9 million, topic to customary closing changes.

The acquisition is anticipated to shut by the top of Evolution’s third quarter of fiscal 2025 with an efficient date of February 1, 2025, the corporate mentioned in a information launch.

Evolution mentioned the acquisition expands its asset portfolio with roughly 440 barrels of oil equal per day (boepd) of web manufacturing, consisting of a balanced commodity mixture of 60 % oil and 40 % pure gasoline with the acquired belongings primarily being low-decline.

The portfolio consists of roughly 254 gross producing wells throughout all areas, and the belongings shall be managed by a top-tier non-public operator, “making certain operational effectivity and the flexibility to maximise worth,” Evolution mentioned.

The corporate mentioned it intends to finance the acquisition via a mix of money readily available and borrowings beneath its current credit score facility.

Evolution President and CEO Kelly Loyd mentioned, “This acquisition marks our seventh such transaction within the final 6 years and is one other step ahead in strengthening our manufacturing base – aligns with our disciplined development technique by including high-quality, low-decline manufacturing at a sexy valuation, estimated at ~2.8x NTM2 Adjusted EBITDA which doesn’t embody any incremental money flows for upside alternatives. These belongings complement our current portfolio and improve our capability to generate secure free money stream, which helps our long-standing dedication to returning capital to shareholders. We see extra upside via reactivations of current waterfloods and thru operational efficiencies, which can additional improve long-term worth”.

“We stay dedicated to executing our technique of buying high-quality, long-life belongings that improve our manufacturing base whereas sustaining monetary self-discipline,” Loyd mentioned. “This transaction additional reinforces our robust stability sheet and skill to ship constant shareholder worth via sustainable manufacturing and money stream technology”.

Within the firm’s second fiscal quarter, whole revenues decreased 4 % to $20.3 million in contrast with $21.0 million within the year-ago quarter. The decline was pushed primarily by a 12 % lower in common realized commodity costs which offset a rise in manufacturing volumes, it mentioned in its most up-to-date earnings launch.

Manufacturing for the quarter elevated 10 % year-over-year to six,935 common boepd, with oil rising 13 %, pure gasoline rising 9 %, and pure gasoline liquids (NGLs) rising 9 %.

The rise in manufacturing volumes was largely as a result of firm’s SCOOP/STACK acquisitions in February 2024 and subsequent drilling and completion actions, in addition to new wells at Chaveroo that got here on-line on the identical time, Evolution mentioned.

“Regardless of operational points and downtime at Chaveroo and Williston, which resulted in roughly 90 boepd decrease manufacturing for the quarter, our balanced portfolio delivered robust year-over-year manufacturing development of 10 %. These points have been resolved, and charges have been restored earlier than the top of January. Decrease commodity pricing, significantly for pure gasoline, was the primary contributor to a modest income decline and web adjusted loss. Nonetheless, in direction of the top of the quarter and past, we’ve seen a robust restoration all through the pure gasoline futures curve and considerably improved pure gasoline worth realizations up to now, whereas oil and pure gasoline liquids pricing has remained comparatively secure to barely improved,” Loyd mentioned.

To contact the creator, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback shall be eliminated.