Twenty p.c or 12.7 billion cubic meters (448.5 billion cubic toes) of pure gasoline imported into the European Union within the third quarter got here from Russia, up two share factors from the earlier quarter and 5 share factors towards the third quarter of 2023, the European Fee has reported.

The rise comes because the EU prepares for the anticipated finish this month of the transit settlement permitting the export of Russian gasoline to the EU through Ukraine.

Nevertheless, in comparison with the primary quarter of 2021, earlier than the Russia-Ukraine conflict broke out, the determine marks a 64 p.c fall within the Russian share of EU gasoline imports, based on the Fee’s quarterly gasoline market report.

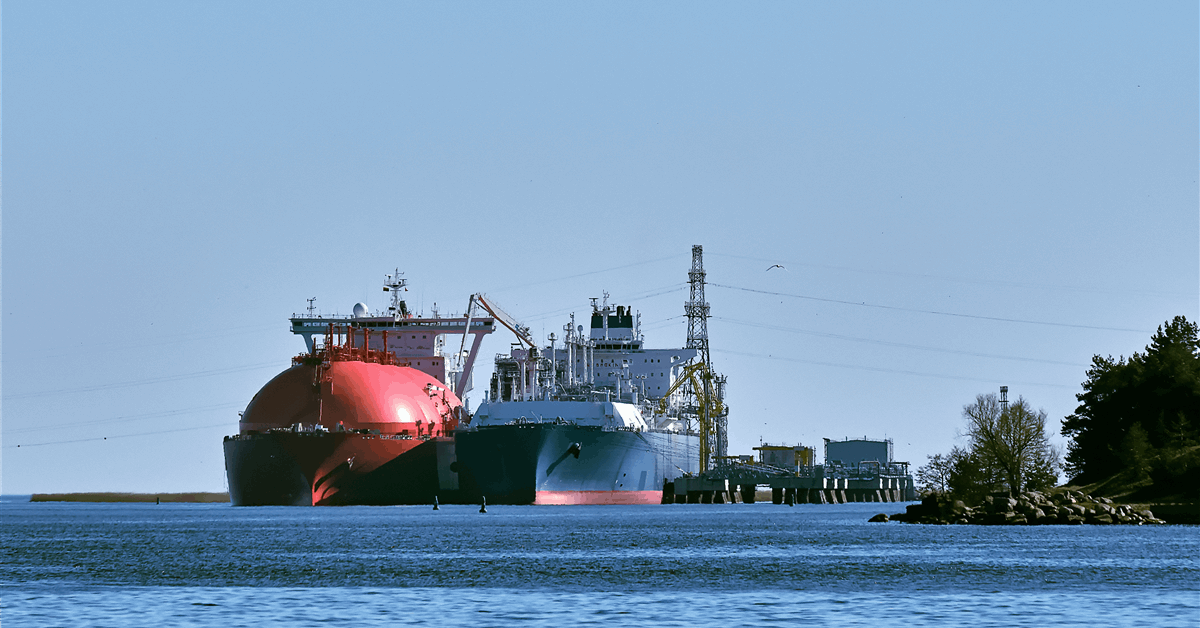

The 27-member EU imported 64 billion cubic meters of gasoline in July–September 2024, down eight p.c quarter-on-quarter and 6 p.c year-on-year. Of the overall, pipeline gasoline accounted for 67 p.c and liquefied pure gasoline (LNG) declined to 33 p.c, stated the report on the Fee’s web site.

Russia accounted for 20 p.c of gasoline imported by the EU through pipeline within the third quarter. Norway continued to be the EU’s high pipeline gasoline provider with a share of 47 p.c, adopted by North Africa (16 p.c). The UK was the EU’s fourth-biggest pipeline gasoline supply accounting for 11 p.c, whereas Azerbaijan got here fifth with six p.c.

In comparison with the second quarter, the pipeline figures confirmed Russia’s share rose from 17 p.c whereas the share of the others within the high 4 sources within the second quarter — Norway, North Africa and Azerbaijan — declined within the third quarter. Moreover the rise in Russia’s share when it comes to share, this lower within the others’ share was absorbed by the UK, which displaced Azerbaijan because the EU’s fourth-biggest provider.

For LNG, Russia additionally accounted for 20 p.c, whereas the US remained the EU’s greatest supply accounting for 40 p.c. Qatar got here third accounting for 12 p.c.

European gasoline spot costs — based mostly on the digital buying and selling platform Title Switch Facility — averaged EUR 35.4 ($37) per megawatt hour (mWh) within the third quarter. That’s seven p.c greater than the identical quarter in 2023 and 11 p.c greater than the prior quarter in 2024. Nevertheless, in comparison with historic peaks within the third quarter of 2022, the typical spot worth within the third quarter of 2024 represents an 82 p.c lower.

“Within the third quarter, costs continued to rise all through July and August persevering with the rising development noticed already within the second quarter”, the report famous. “The common month-to-month worth was 32.2 EUR/MWh in July and 37.8 EUR/MWh in August, after they peaked at 39.3 EUR/MWh on 8 August following Ukraine incursion into Russian territory within the Kursk area on 6 August and threatening to chop gasoline flows by way of the one remaining entry level of Russian gasoline into Ukraine on the Sudzha interconnection.

“As gasoline flows continued on the common price regardless of the continuation of the battle, European gasoline markets calmed down and costs declined to a month-to-month common of 36.2 EUR/MWh in September”.

To contact the creator, electronic mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in an expert group that can empower your profession in vitality.