A average enhance in demand and a fall in wind and hydro technology that offset a report first quarter (Q1) for photo voltaic led to a 17 p.c rise in fossil gasoline energy manufacturing within the European Union within the January-March interval, the European Fee has stated.

The 27-member bloc generated 681 terawatt hours (tWh) of electrical energy within the first quarter (Q1), up 9 tWh from the identical three-month interval final 12 months, in keeping with the Fee’s quarterly electrical energy market report.

The share of renewables dropped to 41 p.c or 282 tWh from 46 p.c in Q1 2024, whereas the share of fossil fuels rose to 33 p.c or 227 tWh from 28 p.c in Q1 2024. Nuclear accounted for 33 p.c of Q1 2025 technology.

Onshore wind remained the most important renewable energy supply within the EU, regardless of a 17 p.c or 22 tWh year-on-year decline to 107 tWh. Onshore wind accounted for 38 p.c of renewables technology within the EU in Q1 2025.

Offshore wind additionally decreased 22 p.c or 4 tWh to fifteen tWh. It accounted for five p.c of the full EU renewables technology.

Hydro technology declined 15 p.c or 16 tWh to 91 tWh, “albeit from excessive ranges in Q1 2024”, the report stated. Hydro had a 32 p.c share of the full renewables technology.

The declines offset a brand new record-high Q1 for photo voltaic. Photo voltaic technology grew 30 p.c or 10 tWh to 45 tWh.

Nevertheless, the Fee stated in a separate assertion, “A more in-depth take a look at the figures exhibits that, after atypically weak technology in January and February, renewable output began to choose up once more in March, indicating a constructive trajectory for the upcoming months”.

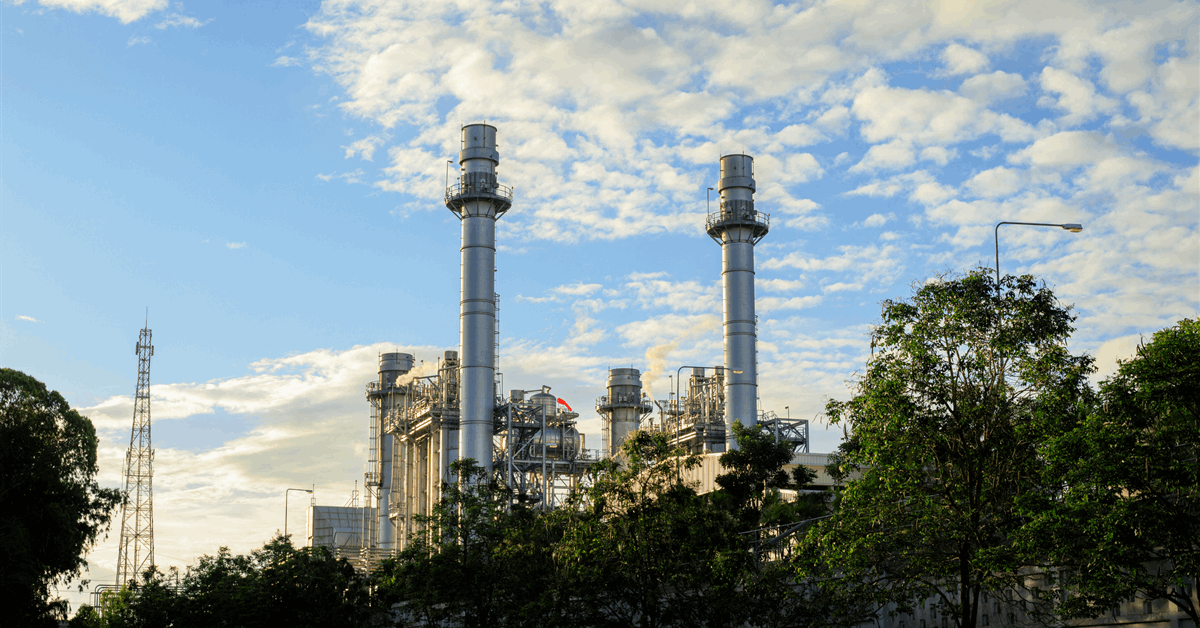

In the meantime fossil gasoline technology climbed 17 p.c or 33 tWh year-on-year. “In complete, coal-fired technology rose by 15 p.c (+11 TWh), whereas much less CO2-intensive fuel technology elevated even stronger by 23 p.c (+21 TWh)”, the report stated.

EU consumption barely elevated, by one p.c or 8 tWh, to 657 tWh in Q1 2025. “On the nationwide degree, eighteen Member States, noticed a rise in electrical energy consumption, whereas the remaining international locations have been stagnant or skilled a decline”, the report stated.

“Regardless of this modest enhance, demand ranges for Q1 2025 have been nonetheless under the pre-crisis common (-6 p.c, in comparison with the 2015-2019 vary)”.

The European Energy Benchmark rose 49 p.c year-on-year to EUR 100 per megawatt hour (mWh). Nationwide quarterly common costs ranged from EUR 49 per mWh in Finland to EUR 145 per mWh in Eire.

“The most important year-on-year worth will increase have been recorded in Portugal (+93 p.c) and Spain (+92 p.c), the place costs had been quite low in Q1 2024. Costs rose considerably additionally in Slovenia (+91 p.c)”, the report stated. “In distinction, worth drops have been registered solely in Finland (-32 p.c) and Sweden (-9 p.c)”.

“Retail electrical energy costs for households in EU capital cities rose marginally by 3 p.c in Q1 2025 (EUR 255/MWh)”, it added. “This enhance is pushed by an increase in power taxes and community prices, which offset a slight lower within the power part.

“Moreover, there was vital variation between Member States with a number of seeing double-digit share will increase (e.g. Austria, Luxembourg, Poland) and others seeing giant decreases in retail costs attributable to decrease power prices (e.g. Slovenia, Eire, Finland)”.

“The variety of hours with unfavorable wholesale costs in Q1 2025 (814) was 103 p.c greater than in Q1 2024”, the report famous. “This represented a rise of 0.6 pp within the share of buying and selling hours with unfavorable costs within the complete variety of buying and selling hours (1.1 p.c).

“March noticed the incidence of unfavorable costs booming, registering a report variety of 756 hours with unfavorable costs, regardless of a sluggish begin in January and February. Sweden led European international locations with the very best incidence of unfavorable costs in Q1 2025.

“The rising incidence of unfavorable costs alerts the necessity for short-term storage and adaptability, elevated interconnectivity, and incentives for demand-side response”.

To contact the creator, e-mail jov.onsat@rigzone.com