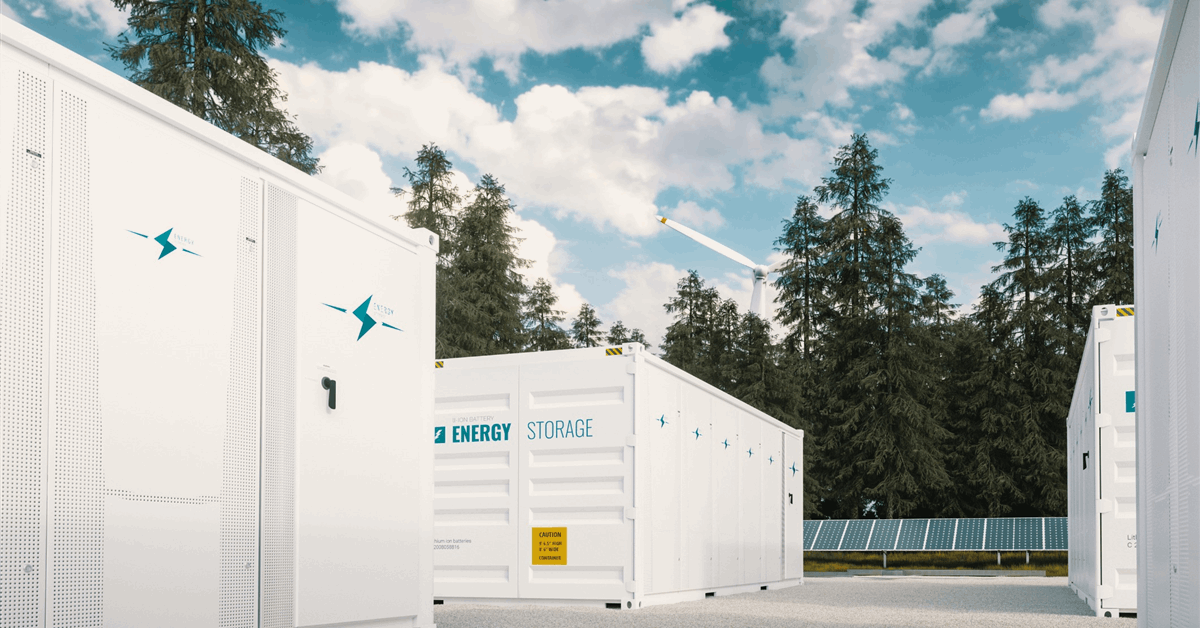

The European Fee rolled out Wednesday a mechanism for coordinated purchases of hydrogen, the primary mechanism below the EU Power and Uncooked Supplies Platform.

The net platform permits EU consumers to supply demand for biomethane, pure fuel, hydrogen and uncooked supplies. It seeks to offer EU corporations a cheap and environment friendly entry to such commodities by enabling negotiations with competing suppliers. The Fee’s Directorate-Basic for Power mentioned extra merchandise could also be coated sooner or later.

The Hydrogen Mechanism is “designed to assist the market improvement of renewable and low-carbon hydrogen and its derivatives (ammonia, methanol, electro-sustainable aviation gasoline)”, the Directorate mentioned in a web based assertion.

“The primary spherical of matching demand and provide is deliberate for September 2025”, it added.

The Hydrogen Mechanism will function till 2029 below the European Hydrogen Financial institution, as specified below the European Union’s “Regulation on the Inside Markets for Renewable Fuel, Pure Fuel and Hydrogen”. The Hydrogen Financial institution is an EU Innovation Fund financing platform to scale up the renewable hydrogen worth chain within the 27-nation bloc and accomplice nations.

Power and Housing Commissioner Dan Jorgensen mentioned, “With the Hydrogen Mechanism launched right now, we empower the European business to grab aggressive alternatives whereas advancing in direction of larger safety of provide and decarbonization”.

A Fee data web page in regards to the platform says, “The EU Power and Uncooked Supplies Platform allows the gathering and change of market information, details about demand and provide, demand aggregation, and joint buying of energy-related merchandise and uncooked supplies. The Platform fosters collaboration, effectivity, and transparency to find counterparts”.

“It doesn’t instantly present financing or assist negotiations which can happen, outdoors of the Platform, between Contributors following their connections via the Platform”, the web page says.

Nonetheless, monetary establishments could take part within the platform to publish details about their financing presents, the web page says.

The 2 different mechanisms below the platform – the Fuel Mechanism and the Uncooked Supplies Mechanism – will launch “within the coming months”, the Directorate’s assertion mentioned.

The Fuel Mechanism is anticipated to interchange AggregateEU, a mechanism wherein fuel suppliers compete to e book demand positioned by corporations within the EU and its Power Group accomplice nations. AggregateEU has been prolonged, having initially been meant just for the 2023-24 winter.

In March 2025 the Directorate mentioned a second midterm spherical for AggregateEU matched practically 20 billion cubic meters (706.29 billion cubic toes). Midterm rounds supply six-month contracts for potential suppliers throughout a buyer-seller partnership of as much as 5 years.

The Directorate mentioned February 1, 2024, saying the primary midterm tender, “In early 2024, with the results of the vitality disaster nonetheless not over, AggregateEU is introducing a special idea of mid-term tenders so as to deal with the rising demand for stability and predictability from consumers and sellers of pure fuel”.

“Underneath such tenders, consumers will be capable of submit their demand for seasonal 6-month durations (for a minimal 1,800,000 MWh for LNG and 30,000 for NBP per interval), going from April 2024 to October 2029″, the Directorate mentioned then. “That is meant to assist sellers in figuring out consumers who may be considering an extended buying and selling partnership – i.e. as much as 5 years”.

NBP fuel, or Nationwide Balancing Level fuel, refers to fuel from the nationwide transmission techniques of EU states.

A complete of seven rounds have been carried out below AggregateEU, pooling over 119 Bcm of demand and attracting 191 Bcm of presents. Practically 100 Bcm have been matched, based on the most recent outcomes announcement March 26, 2025.

“In keeping with the Hydrogen and Decarbonized gases bundle, the Fee is now engaged on establishing a everlasting instrument for the joint buying of fuel and of different related mechanisms for the demand aggregation of essential commodities comparable to hydrogen and demanding uncooked supplies”, the announcement mentioned.

To contact the creator, e mail jov.onsat@rigzone.com