EOG Sources, Inc. reported whole income of $6.36 billion for the fourth quarter of 2023, in comparison with $6.72 billion in the identical interval in 2022.

The corporate’s adjusted web earnings for the quarter was $1.78 billion, or $3.07 per share, in comparison with $1.94 billion, or $3.30 per share, within the fourth quarter of 2022. EOG missed the Zacks Consensus Estimate of $3.14 per share.

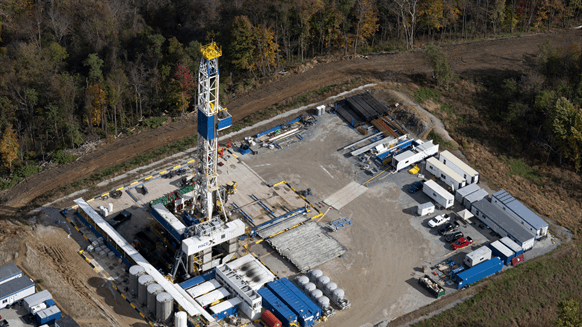

EOG stated in its current earnings launch that its whole fourth-quarter 2023 equal manufacturing elevated three p.c quarter over quarter. The corporate’s oil manufacturing of 485,200 barrels of oil per day (bopd) was above the steering midpoint and up from the earlier quarter. Pure fuel liquid (NGL) manufacturing was above the steering midpoint and up 2 p.c sequentially, whereas pure fuel manufacturing was above the excessive finish of the steering vary and up 7 p.c quarter over quarter.

“EOG continues to ship on its worth proposition as demonstrated by our sturdy execution in 2023”, EOG Chairman and CEO Ezra Yacob stated. “Oil and whole volumes had been on the right track, capital expenditures on price range, and we additional lowered working prices. Every of the groups working throughout our multi-basin portfolio championed the EOG tradition and performed an necessary position in delivering one other profitable 12 months”.

“The flexibility to handle funding and tempo of exercise on the acceptable stage for every of our performs was important to our success in 2023”, Yacob continued. “We lowered the general value foundation of the corporate by balancing exercise between foundational property and rising performs. Progress throughout our portfolio, together with continued enchancment in Delaware Basin productiveness, profitable delineation ends in the Utica play, and developments throughout a number of exploration areas, offers alternative for additional enchancment going ahead”.

For the complete 12 months of 2023, EOG stated its whole firm equal manufacturing elevated eight p.c in comparison with 2022. Crude oil manufacturing rose three p.c to 475,800 bopd, NGL manufacturing jumped 13 p.c, and pure fuel manufacturing elevated 14 p.c, the corporate stated.

“EOG’s working outcomes drove our monetary efficiency. EOG earned [a] sturdy return on capital, whereas producing $5.1 billion of free money move”, Yacob famous. “Money return to shareholders of $4.4 billion was properly above our prior minimal 60 p.c dedication and continues to be anchored by our sustainable, rising common dividend. The monetary power of the corporate, together with our money move era capability and our industry-leading steadiness sheet, allowed us to extend our common dividend [by] 10 p.c and go-forward money return dedication to a minimal [of] 70 p.c of annual free money move”.

For 2024, EOG estimates whole expenditures to vary from $6.0 billion to $6.4 billion, together with exploration and improvement drilling, amenities, leasehold acquisitions, capitalized curiosity, dry gap prices, and different property, plant and tools, and excluding property acquisitions, asset retirement prices and non-cash exchanges and transactions. The capital program additionally excludes sure exploration prices incurred as working bills.

The corporate’s capital program allocates roughly $4.3 billion to drill and full 600 web wells in EOG’s home premium areas. Robust capital effectivity will ship three p.c oil quantity development and 7 p.c whole quantity development, it stated. The plan is anchored by regular year-over-year exercise ranges throughout most of EOG’s premium performs, with a step up in exercise within the Ohio Utica play, it added.

The capital program additionally funds funding in environmental and infrastructure initiatives, together with roughly $400 million in strategic infrastructure initiatives related to EOG’s Delaware Basin and Dorado property. The initiatives are anticipated to supply a number of long-term advantages to the corporate, together with margin enchancment by way of larger value realizations and decrease working prices, based on the discharge.

“EOG’s enterprise has by no means been higher, and our monetary place has by no means been stronger”, Yacob concluded. “Our 2024 plan demonstrates our constant give attention to bettering the price construction of our firm. The depth of useful resource throughout our multi-basin portfolio of premium property offers long-term visibility for top returns and robust free money move era. Our confidence in EOG’s skill to compete throughout sectors, create worth for our shareholders, and be a part of the long-term vitality answer has by no means been larger”.

To contact the writer, e mail rocky.teodoro@rigzone.com