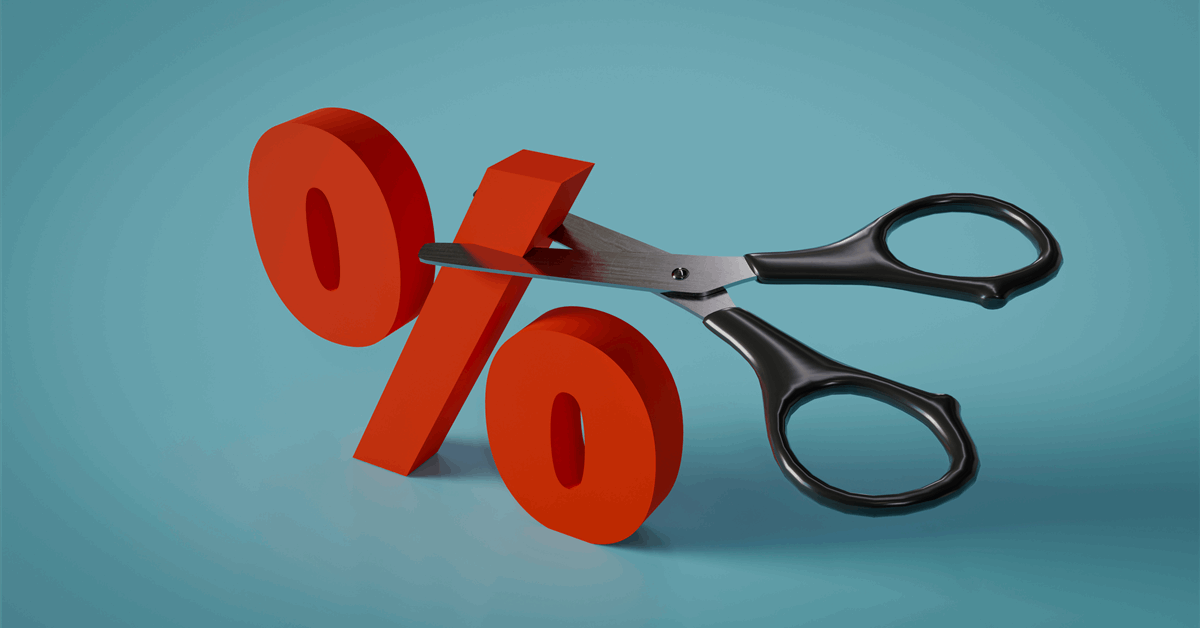

Enterprise World Inc. slashed the marketed vary for its preliminary public providing, decreasing the market worth it might fetch.

The liquefied pure fuel exporter is advertising and marketing 70 million shares within the providing for $23 to $27 every, a greater than 40% drop from the $40 to $46 per share vary it had focused earlier, based on an earlier submitting with the US Securities and Trade Fee.

On the high of the brand new vary, the corporate would now have a market worth of about $65 billion, down from the $110 billion mark on the high of the earlier vary, primarily based on the excellent shares.

Traders approached through the advertising and marketing of the deal needed a decrease valuation vary, based on individuals accustomed to the matter, who requested to not be recognized as the knowledge isn’t public. A consultant for Enterprise World didn’t instantly reply to requests for remark.

The decrease pricing would come as a setback for potential IPO candidates within the US vitality sector, which have been trying to Enterprise World’s providing to assist revive sentiment round first-time share gross sales within the sector. Simply six vitality IPOs priced on US exchanges in 2024, elevating $667 million to mark the bottom quantity for the sector in 21 years, information compiled by Bloomberg present.

Nonetheless, Enterprise World is focusing on a lofty valuation relative to opponents. Cheniere Vitality Inc., the biggest LNG exporter within the US, has a market worth of $56 billion after leaping greater than 50% over the previous yr.

Enterprise World, based exterior of Washington, DC, was seen as a startup in comparison with the established vitality corporations and climbed to rapidly construct two export amenities in Louisiana.

The corporate is locked in arbitration battles with a number of the world’s largest vitality gamers, that are additionally its prospects. BP Plc and Shell Plc are in a dispute with Enterprise World over its first plant, Calcasieu Cross, as a consequence of a chronic begin to their contracts nearly three years because the facility first started loading cargoes.

Enterprise World had web earnings of $756 million within the 9 months ended Sept. 30 on income of $3.4 billion, versus web earnings of $3.6 billion on income of $6.3 billion in the identical interval in 2023, based on the submitting.

LNG is predicted to play an more and more central function in international vitality markets within the years forward, as nations search a cleaner-burning various to grease and coal. The US’s place because the world’s largest provider of the gas is poised to develop even stronger, as Donald Trump’s return to the White Home was accompanied by a sweeping overhaul of US vitality coverage to return the emphasis to fossil-fuel manufacturing.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback shall be eliminated.

MORE FROM THIS AUTHOR

Bloomberg