Eni S.p.A.’s company enterprise capital firm, Eni Subsequent, has signed a collaboration settlement with Azimut Group. Below the settlement, Azimut will launch a brand new European Lengthy Time period Funding Fund (ELTIF) of enterprise capital, leveraging Eni Subsequent’s consulting and experience on technological developments within the vitality sector.

Eni stated in a media launch the ELTIF’s launch is anticipated in September 2025, and the fund will assist investments within the vitality tech sector.

With a EUR 100 million ($118 million) fundraising goal, the Luxembourg-based fund, which is presently awaiting authorization from the related authorities, shall be open to a broad vary of traders, each institutional and personal, in keeping with the brand new ELTIF 2.0 Regulation’s standards.

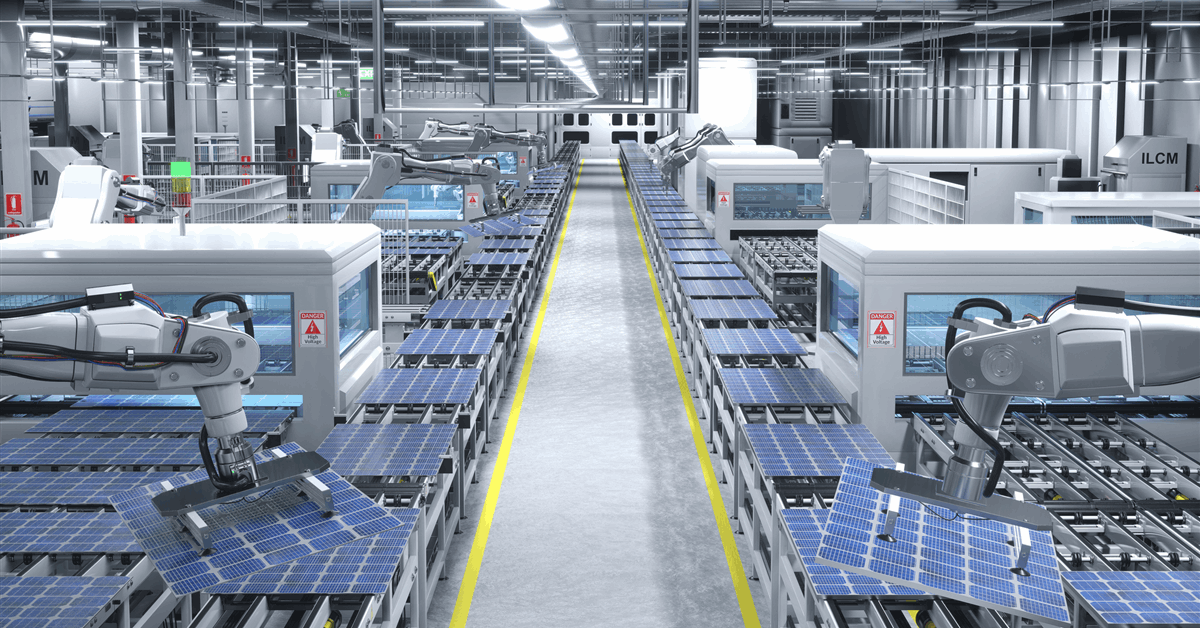

The portfolio will comprise U.S.-based startups and scale-ups within the clear tech sector, specializing in decarbonization, vitality effectivity, sustainable mobility, and the round economic system. The fund can also put money into European and worldwide firms, Eni stated.

“This strategic collaboration initiated with Azimut supplies Eni Subsequent with a further lever to assist modern firms within the vitality sector. By combining our specialised experience with Azimut’s fundraising capabilities, the partnership will additional speed up and improve the expansion of the Eni Subsequent portfolio”, Clara Andreoletti, CEO of Eni Subsequent, stated. “The vitality sector, like many different industrial sectors, is present process a profound transformation pushed by technological innovation. To assist this transition and guarantee its financial sustainability, non-public capital performs an important position in enabling new technological options to emerge and scale quickly”.

“As new applied sciences reshape the vitality sector, driving a generational shift towards more and more environment friendly options, this fund goals to present traders entry to probably the most promising and high-potential alternatives”, Giorgio Medda, CEO of Azimut Holding, commented. “It will assist carry the Group’s whole investments since 2022, devoted to international vitality transition and environmental sustainability, to not less than EUR 470 million ($554.5 million). Following the settlement signed with our Vehicle Heritage Enhancement fund and Ferrari, this new alliance with one other Italian champion marks an extra step in our development journey as a world funding companion to the nation’s main innovators”.

To contact the writer, e mail andreson.n.paul@gmail.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in an expert neighborhood that may empower your profession in vitality.