Enbridge Inc. stated it’s making new capital investments according to its Permian export technique and gasoline transmission plans.

Enbridge President and CEO Greg Ebel stated in an announcement Wednesday, “As we speak we’re saying accretive new capital investments targeted on our U.S. Gulf Coast technique. These embrace further export docks and storage tanks at Enbridge Ingleside Power Heart (EIEC) and connecting egress for Shell’s Sparta property offshore of Louisiana’s shoreline”.

“These accretive investments present near-term development within the U.S. Gulf Coast and set the stage for the long run enlargement by means of prime quality partnerships and embedded natural alternatives. Together with immediately’s bulletins, our secured development backlog sits at $25 billion and is made up of greater than 20 extremely executable initiatives”, Ebel famous.

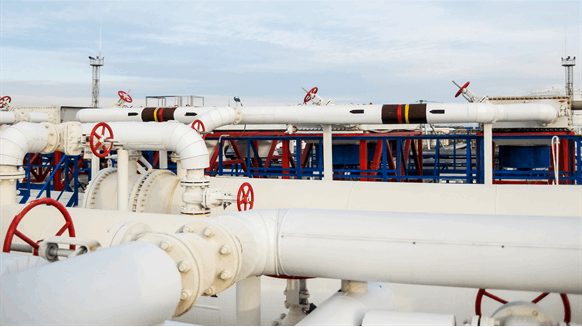

The brand new capital investments embrace the enlargement of the Planning Grey Oak Pipeline of roughly 120,000 barrels per day (bpd), pending a profitable open season. The enlargement will improve crude capability all through Enbridge’s complete built-in Permian tremendous system.

Enbridge sanctioned 2.5 million barrels of further storage at EIEC (Section VII), which can carry general storage capability to roughly 20 million barrels by 2025. The well timed addition of storage tanks at Ingleside helps greater crude throughput by making certain clients have on-demand entry to their export-ready crude provide, the corporate stated.

The corporate additionally plans to accumulate two marine docks and land from Flint Hills Sources adjoining to the EIEC terminal for round $0.2 billion. The transaction is predicted to shut within the third quarter, topic to receipt of customary regulatory approvals and shutting situations. Enbridge plans to completely combine the waterfront between EIEC and the newly acquired docks, which can add quick crude oil export capability and streamline current Ingleside operations by growing very giant crude service (VLCC) home windows on the first facility docks.

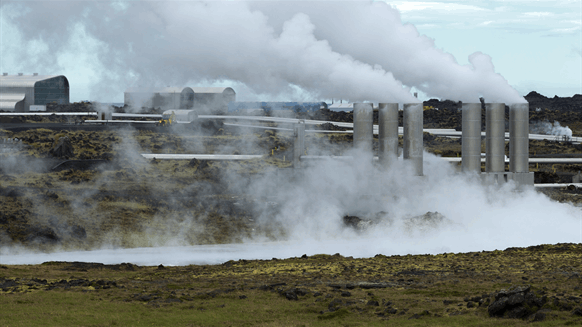

Additional, the corporate has sanctioned round $0.2 billion of offshore pipelines to service Shell and Equinor’s sanctioned Sparta improvement. Enbridge and Shell Pipeline have prolonged their relationship by means of further funding in rising Gulf of Mexico offshore performs with a newly shaped three way partnership, Oceanus Pipeline Firm, LLC.

“International demand for inexpensive, dependable and sustainable vitality continues to rise and North America has a essential position to play”, Ebel stated. “Considerable, cost-competitive and sustainable typical and decrease carbon vitality sources present folks with the vitality they want whereas supporting nations and communities in assembly international emission targets. At Enbridge, we’re constructing out our built-in infrastructure tremendous methods, to allow the continued supply of vitality in a planet-friendly method, in all places folks want it”.

“Disciplined capital allocation stays a prime precedence and we’re laser targeted on defending the steadiness sheet. We plan to speculate $6-$7 billion yearly on secured initiatives and keep inside our goal leverage vary of 4.5x to five.0x. With regards to deploying further funding capability, we’ll reside inside our means and guarantee all investments are accretive on per share metrics, improve our development profile and keep our steadiness sheet flexibility”, he added.

Concerning its deliberate acquisition of three U.S. gasoline utilities, Enbridge stated it’s investing roughly $3 billion yearly “in low-risk pure gasoline utility infrastructure, inclusive of the assumed capital for the acquisitions”.

In September 2023, Enbridge entered into three separate definitive agreements with Dominion Power Inc. to accumulate pure gasoline distribution firms East Ohio Fuel Co. (EOG), Public Service Co. of North Carolina Inc. (PSNC), and Questar Fuel Co. for an combination buy value of $14 billion (CAD 19 billion), composed of $9.4 billion of money consideration and $4.6 billion of assumed debt.

To contact the writer, e-mail rocky.teodoro@rigzone.com