The U.S. Vitality Data Administration’s (EIA) newest gasoline gas replace, which was launched on February 10, confirmed an growing development for the U.S. common gasoline worth.

In keeping with the replace, the U.S. common gasoline worth averaged $2.853 per gallon on January 26, $2.867 per gallon on February 2, and $2.902 per gallon on February 9. Though the February 9 worth was up $0.035 from the week in the past worth, it was down $0.226 from the 12 months in the past worth, the replace outlined.

Of the 5 Petroleum Administration for Protection District (PADD) areas highlighted within the EIA’s newest gas replace, the West Coast was proven to have the very best U.S. common gasoline worth as of February 9, at $3.938 per gallon. The Gulf Coast was proven within the replace to have the bottom U.S. common gasoline worth as of February 9, at $2.476 per gallon.

A glossary part of the EIA web site notes that the 50 U.S. states and the District of Columbia are divided into 5 districts, with PADD 1 additional cut up into three subdistricts. PADDs 6 and seven embody U.S. territories, the positioning provides.

In a weblog posted on its web site on February 9, GasBuddy famous that, in line with its knowledge, the U.S. common worth of gasoline “has risen 1.2 cents during the last week and stands at $2.84 per gallon”.

“The nationwide common is up 5.4 cents from a month in the past and is 24.9 cents per gallon decrease than a 12 months in the past,” it added.

In that weblog, Patrick De Haan, head of petroleum evaluation at GasBuddy, mentioned, “the nationwide common worth of gasoline solely edged barely larger final week, however 9 of the ten largest weekly worth actions had been will increase, led by West Coast states as California begins the transition to summer season gasoline”.

“Most states noticed comparatively minor fluctuations, however we’re now beginning to see seasonal tendencies take maintain on the West Coast, with these pressures anticipated to regularly push eastward within the weeks forward,” he added.

“Though oil costs slipped barely final week amid decreased geopolitical threat, strengthening seasonal elements are more likely to intensify, probably driving the nationwide common again above the $3 per gallon mark, the place costs may stay for at the least a part of the spring,” he continued.

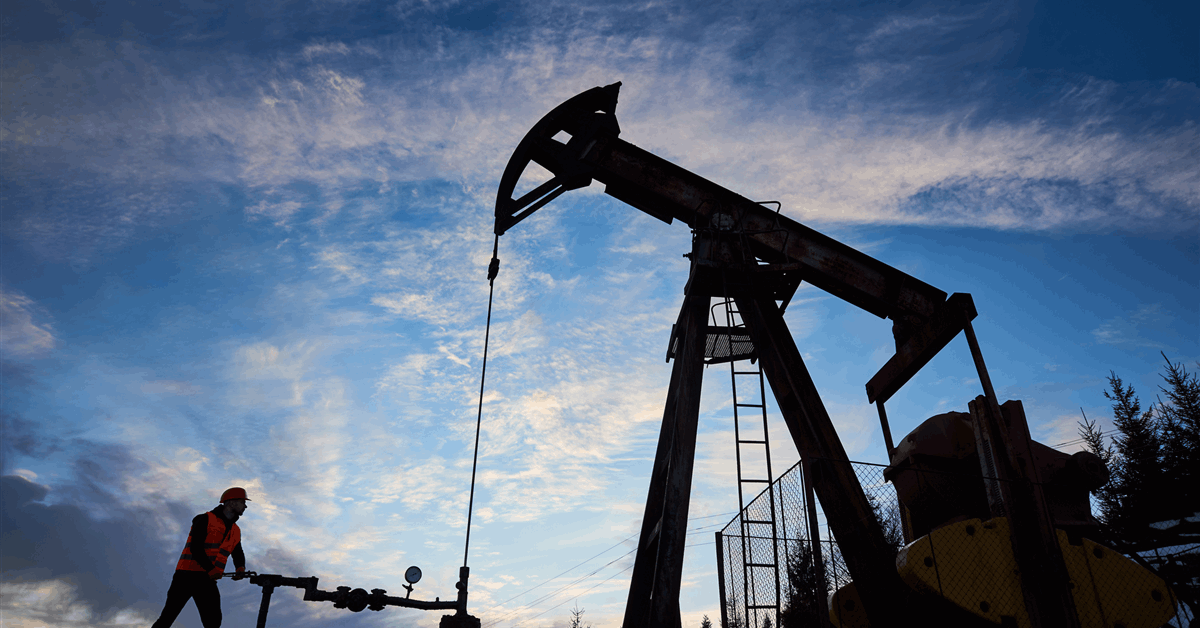

In its newest quick time period vitality outlook (STEO), which was launched on February 10, the U.S. Vitality Data Administration (EIA) projected that the U.S. common gasoline retail worth will common $2.91 per gallon in 2026 and $2.93 per gallon in 2027.

A quarterly breakdown included in that STEO projected that the U.S. common gasoline retail worth will are available at $2.88 per gallon within the first quarter of this 12 months, $3.04 per gallon within the second quarter, $2.97 per gallon within the third quarter, $2.76 per gallon within the fourth quarter, $2.79 per gallon within the first quarter of 2027, $3.05 per gallon within the second quarter, $3.04 per gallon within the third quarter, and $2.82 per gallon within the fourth quarter of subsequent 12 months.

“Consumption of motor gasoline is the one one of many three main transportation fuels that we anticipate will decline over the following two years,” the EIA mentioned in its February STEO.

“Gas effectivity good points within the automobile fleet have usually outpaced development in driving since 2019, permitting drivers to journey extra miles utilizing much less gasoline. We forecast U.S. motor gasoline consumption to say no about one % in 2026 as gas effectivity good points surpass elevated driving exercise, measured by automobile miles traveled,” it added.

“We forecast gasoline consumption to additional lower in 2027, though we anticipate a slowing tempo of decline due to extra development in driving exercise as employment development improves. In contrast with 2019, we forecast about 5 % much less U.S. motor gasoline consumption in 2026 and 2027, regardless of extra miles pushed in each years than in 2019,” it continued.

To contact the creator, e mail andreas.exarheas@rigzone.com