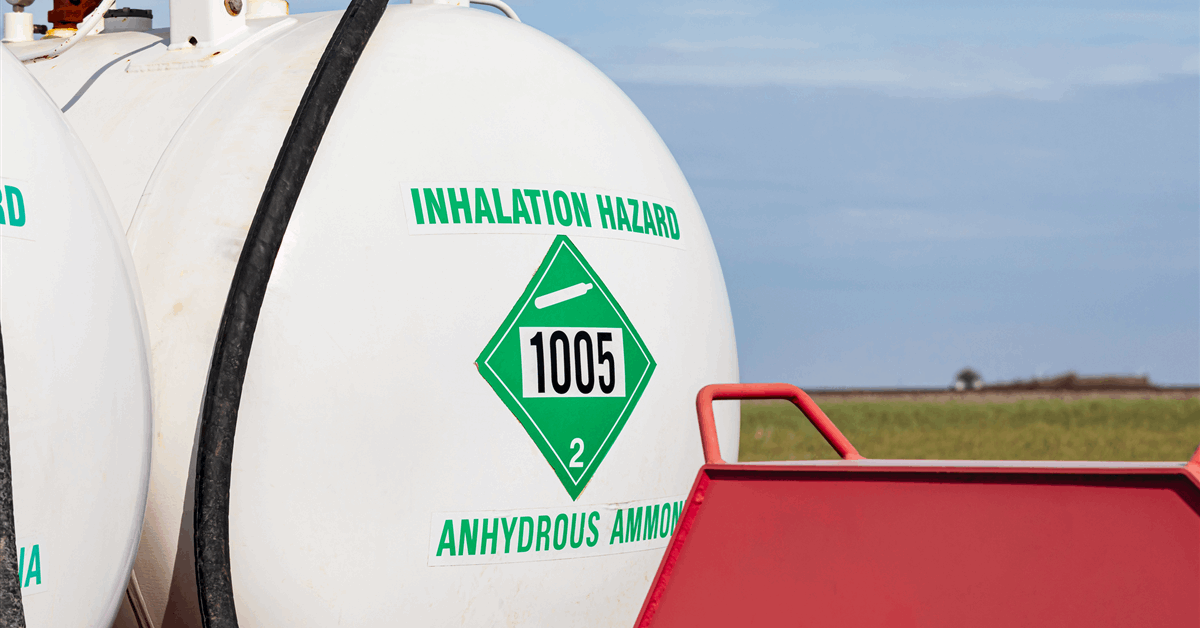

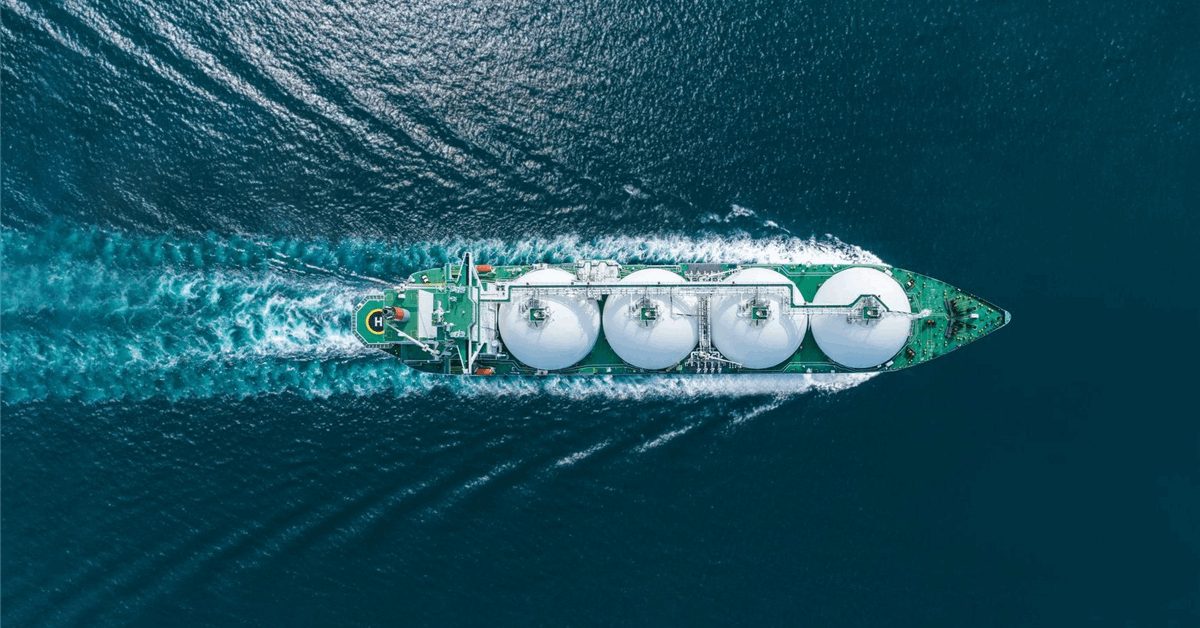

Egypt agreed to purchase liquefied pure fuel cargoes from Saudi Aramco, Trafigura Group, Vitol Group and others, placing the nation on track to be a long-term importer as native manufacturing slows.

Egyptian Pure Fuel Holding Co. additionally made agreements with Hartree Companions LP, BGN and Shell, in response to individuals with data of the matter who requested to not be recognized.

The transfer to safe cargoes is geared toward slicing Egypt’s reliance on unstable spot markets, but in addition exemplifies the sharp turnaround in a rustic that till only a 12 months in the past was exporting LNG. Declining fuel output from native fields at a time when an rising inhabitants and rising temperatures are boosting demand have made Egypt a significant importer and helped tighten world markets.

The transfer comes because the North African nation tries to reboot its economic system after rising from a foreign-currency disaster, and a shift to medium-term LNG offers leaves it much less uncovered to the volatility of the spot LNG market.

Nonetheless, greater fuel necessities means Egypt’s vitality invoice is more likely to rise to about $3 billion a month over the summer season from July, in contrast with about $2 billion final 12 months, an individual aware of the matter mentioned final month. Bloomberg has beforehand reported Egypt might purchase greater than 160 shipments for the interval by June 2026.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in an expert neighborhood that may empower your profession in vitality.