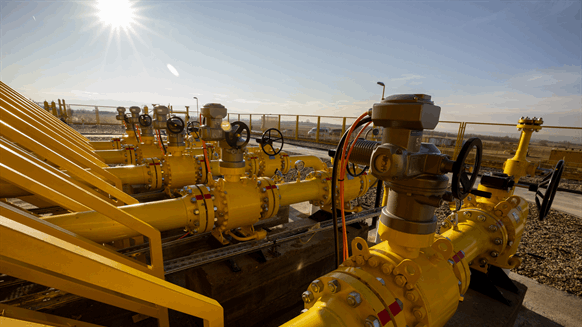

ONEOK Inc. agreed to promote three pure gasoline pipelines with an combination capability of three.7 billion cubic toes a day (Bcfd) to DT Midstream Inc. for $1.2 billion, the businesses stated Tuesday.

Anticipated to shut by yearend or early 2025, the transaction entails 1,300 miles of pipelines straddling seven states “within the enticing Midwest market area which is predicted to expertise continued progress in energy demand”, Detroit, Michigan-based DT Midstream stated in an announcement on-line.

DT Midstream launched an underwritten public providing of $300 million shares and stated it plans to difficulty as much as $650 million in senior secured notes to assist fund the acquisition. It additionally expects to faucet on its revolving credit score facility, with debt accounting for a complete of about $900 million of the funding sources. Barclays, which served as monetary advisor to the client, dedicated financing. DT Midstream stated it might additionally use money readily available.

The money transaction, which entails no assumed debt, consists of Guardian Pipeline LLC, Midwestern Fuel Transmission Co. and Viking Fuel Transmission Co. — all regulated by the Federal Vitality Regulatory Fee.

Guardian Pipeline, which stretches round 260 miles, is an interstate pipeline interconnected with DT Midstream’s Vector Pipeline and the Chicago Hub. Guardian Pipeline serves Wisconsin.

Interconnected with Guardian Pipeline, Midwestern Fuel Transmission is a bi-directional interstate pipeline measuring roughly 400 miles. It brings Appalachia gasoline to the Midwest market between Tennessee and the Chicago Hub.

Viking Fuel Transmission, about 675 miles, can also be an interstate pipeline that delivers Canadian provide from Emerson, Manitoba, to utility clients in Minnesota, Wisconsin and North Dakota.

As a part of the acquisition, employees on the pipelines will switch to the brand new proprietor.

The transaction is topic to anti-trust evaluations by the Justice Division or the Federal Commerce Fee.

“Increasing our scale by means of this bolt-on pure gasoline pipeline acquisition totally aligns with our pure play pure gasoline technique”, DT Midstream president and chief govt David Slater stated. “This transaction additionally will increase the income contribution from our pipeline phase, supported by take-or-pay contracts with sturdy credit score high quality utility clients”.

DT Midstream expects the brand new property to develop the share of its pipeline phase within the firm’s EBITDA to about 70 p.c in 2025, assuming changes for non-recurring or extraordinary gadgets. “Total, the acquired portfolio has an roughly 90 p.c demand-pull buyer base with roughly 85 p.c of revenues from investment-grade clients”, it added.

For Tulsa, Oklahoma-based ONEOK, the divestment is “anticipated to boost ONEOK’s monetary flexibility and ONEOK’s deleveraging development towards its beforehand introduced goal of three.5 instances throughout 2026”, the vendor stated individually.

“Based mostly on Federal Vitality Regulatory Fee filings, the acquisition value represents 10.8 instances earlier 12 months EBITDA as of June 30, 2024”, ONEOK stated.

ONEOK president and chief govt Pierce H. Norton II stated, “This transaction will align and improve our capital allocation priorities inside our built-in working footprint”.

The divestment comes on the heels of ONEOK’s $3.3 billion acquisition of International Infrastructure Companions’ (GIP) stake in EnLink Midstream LLC and $2.6 billion takeover of Medallion Midstream LLC, additionally from GIP.

The EnLink acquisition, which has given ONEOK a 43 p.c share in EnLink’s frequent shares, provides 1.7 Bcfd of Permian gasoline processing capability and 1.6 million barrels per day (bpd) of Permian crude oil gathering capability to ONEOK’s portfolio.

Medallion’s property included over 1,200 miles of petroleum gathering pipelines that present about 1.3 million bpd of capability and about 1.5 million barrels of crude oil storage within the Permian Basin.

“With the acquisition of Medallion, the biggest privately held crude gathering and transportation system within the Permian’s Midland Basin, we proceed our demonstrated monitor document of intentional and disciplined progress”, Norton II stated in an organization assertion October 31 saying the completion of the transaction. “This acquisition additional diversifies ONEOK’s asset portfolio and provides an expansive and well-connected crude oil gathering system to our Permian Basin platform.

“We anticipate to drive significant industrial synergies from these complementary property, which already join with ONEOK’s long-haul crude oil pipelines out of the basin”.

To contact the creator, electronic mail jov.onsat@rigzone.com