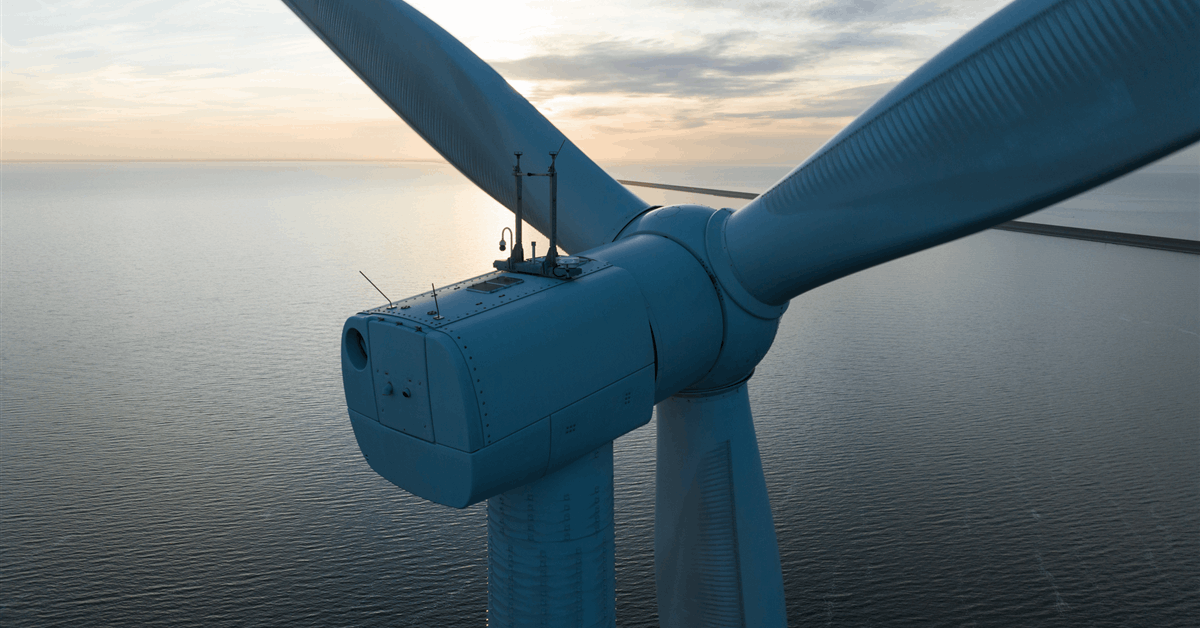

Britain stepped up help for offshore wind within the newest subsidy public sale, displaying the federal government remains to be decided to fulfill its bold 2030 clean-power objective at the same time as prices rise.

The 8.2 gigawatts of offshore wind beat analysts’ expectations and can enhance the probability of the federal government delivering on its promise to virtually completely exit fossil fuels in energy era. The UK now wants round 7 gigawatts of latest capability within the subsequent public sale, which is the final life like likelihood to get initiatives inbuilt time.

The federal government can pay builders extra for initiatives gained on this public sale in contrast with final yr, a value that’s in the end paid for by shoppers. It creates a troublesome balancing act for Prime Minister Keir Starmer, who has pledged to chop family payments throughout the present parliament.

“With these outcomes, Britain is taking again management of our power sovereignty,” mentioned Power Secretary Ed Miliband in an announcement. The outcomes ship the largest single procurement of offshore wind power in British and European historical past, in response to the assertion.

The public sale secured capability at a value of £65.45 ($88) per megawatt-hour in 2012 costs, a generally used benchmark, or £91.20 in 2024 phrases, accounting for some inflation. This value, increased than in final yr’s public sale, nonetheless represents a “internet profit to payments over the subsequent decade,” in response to evaluation from Aurora Power Analysis.

RWE AG was the foremost winner, concerned in all however one of many initiatives that gained. Individually, RWE mentioned it has agreed a take care of KKR & Co to develop, assemble and function the Norfolk Vanguard East and Norfolk Vanguard West initiatives, which have been awarded contracts within the public sale.

One other winner, RWE’s Dogger Financial institution South, doesn’t but have planning permission, which implies it is probably not inbuilt time to fulfill the 2030 objective. RWE’s shares rose as a lot as 3.5%, to the best stage in virtually 15 years.

The federal government says investing in renewables and transferring away from a gas-based energy system will in the end decrease electrical energy prices, however it does imply that the excessive upfront expense of constructing wind farms is handed on to shoppers within the brief time period.

Prices are more likely to be increased than anticipated as a result of the federal government overspent on its unique £900m funds for fixed-bottom offshore wind. This system was elevated to virtually £1.8 billion beneath new guidelines that permit the federal government to decide on additional initiatives if they’re deemed good worth for shoppers.

For the reason that early 2000s, the price of constructing offshore wind has fallen because the know-how matured and generators grew to become extra highly effective. Lately, nevertheless, supply-chain disruptions, rising raw-material prices and better financing bills have pushed costs up for some initiatives. Consequently, governments round Europe have struggled to draw bids for offshore wind developments over the previous yr, with increased prices making builders extra cautious.

Excessive Costs

Britain continues to have among the highest electrical energy costs in Europe, placing stress on households, slowing the uptake of applied sciences similar to electrical autos and warmth pumps, and threatening the nation’s competitiveness in attracting rising sectors like information facilities.

Energy demand is about to rise and governments are getting ready their power methods for this enhance by quickly scaling up wind and photo voltaic era capability. Alongside constructing out renewable power capability, grids should even be upgraded to carry the ability from the place it’s generated to the place it’s wanted.

Whereas the UK has lengthy been a pacesetter in offshore wind and local weather insurance policies, each have change into more and more politicized, notably after US President Donald Trump rolled again help for renewable initiatives within the US, a shift that has weighed on the operations of a number of European builders there.

Throughout a go to to Scotland final yr, Trump reiterated his opposition to wind farms, particularly initiatives proposed off the coast close to his golf programs. Whereas Scotland is looking for to pivot from its oil-dependent previous to change into a world chief in wind power, Trump as an alternative described Aberdeen because the “oil capital of Europe” and urged additional growth of the sector.

Together with extra nascent floating offshore wind capability, the entire procured capability on the current public sale was 8.4 gigawatts.

“The outcomes of the federal government’s offshore and floating offshore wind public sale characterize a major step ahead in delivering the UK’s evolution to scrub power,” mentioned James Alexander, chief govt officer of the UK Sustainable Funding and Finance Affiliation.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback shall be eliminated.