The world’s greatest oil product market is hungry for barrels as merchants grapple with a summer season provide squeeze.

US stockpiles of diesel merchandise have dropped to the bottom for the time of yr since 1996, whereas in Europe benchmark futures are signaling a tighter market than throughout the top of the Israel-Iran battle. The price of the gas relative to crude — a key buying and selling metric often called the crack — is effectively above seasonal norms in each areas.

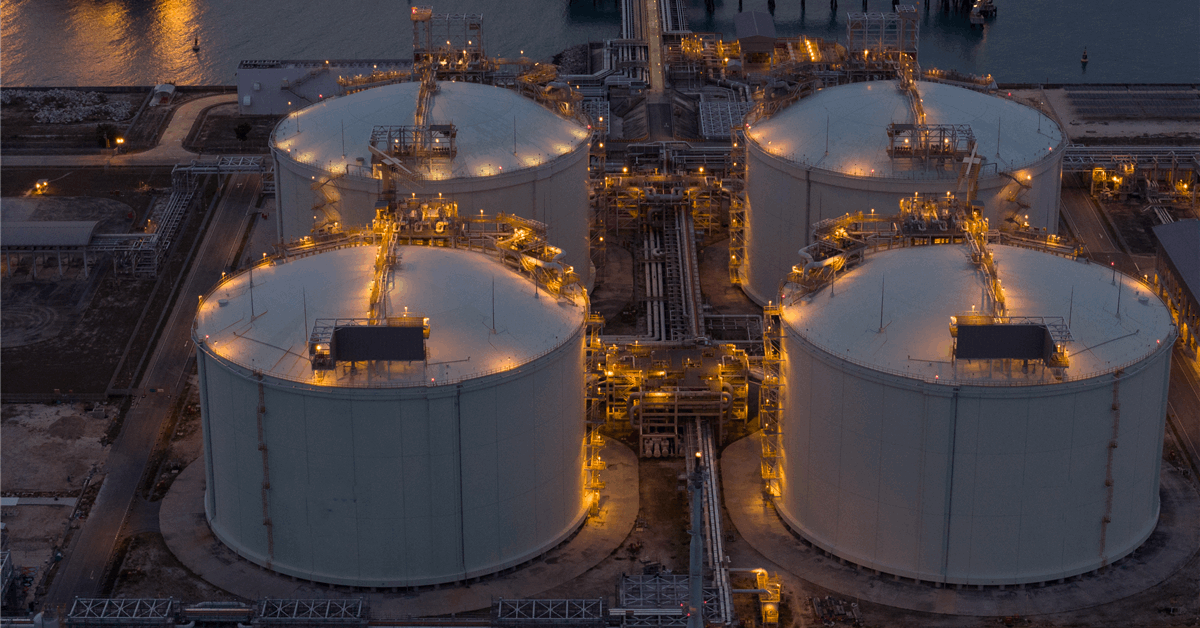

The strain on provides has been pushed by refinery closures on either side of the Atlantic and a slew of latest outages, in addition to the influence of manufacturing curbs by key OPEC+ producers. Final month, diesel accounted for simply 31.4% of world output of oil merchandise, effectively under the seasonal common, in accordance with figures from Power Points Ltd.

The scarcity is driving up costs for diesel, utilized in every part from building to move to heating. In northwest Europe, the premium for extra fast provides over the next month surged to $44 a ton on Friday; excluding the usually risky days when futures contracts expire, that’s the strongest since late-2022.

“The Atlantic Basin diesel steadiness is wanting more and more tight into autumn refinery upkeep season and peak winter demand,” mentioned Natalia Losada, an oil merchandise analyst at Power Points. “European inventories might not construct in July, which leaves them in a really fragile place.”

Diesel markets spiked final month when the combating between Israel and Iran threatened tens of millions of barrels of gas exports from the Persian Gulf. That danger has now receded, however provides stay below strain.

The most important of the OPEC+ output cuts got here from Saudi Arabia and Russia, each of which pump crude on the heavier finish of the spectrum. In the meantime, Kazakhstan boosted output of its very gentle Tengiz crude earlier this yr.

“OPEC+ cuts have been making crude slates lighter — refiners produce much less diesel with gentle crude,” mentioned James Noel-Beswick, an analyst at Sparta Commodities. Cracks must rise “to incentivize refiners to make extra diesel,” he added.

Within the US, diesel yields and stockpiles are anticipated to stay low in July, as a rebound in Canadian crude exports to the nation is simply seen in mid-to-late third quarter, in accordance with a June 30 report from consultancy FGE NexantECA. For Europe, the tightness of medium/heavy grades may last more.

To make certain, will increase in OPEC+ oil manufacturing — set to be even sooner than anticipated subsequent month — ought to supply some assist for diesel provide. Wholesome refining margins must also encourage vegetation to run laborious.

However there are additionally dangers. Summer season warmth waves can strain manufacturing, whereas the North Atlantic hurricane season is a possible hazard for US output of diesel and different fuels.

The immediate unfold for diesel futures getting wider in Europe — and really excessive premiums for bodily barges — underscore the tightness within the Amsterdam-Rotterdam-Antwerp oil buying and selling hub, mentioned George Shaw, an oil analyst at Kpler.

“With much less quantity coming into ARA, shares should not getting an opportunity to considerably replenish,” mentioned Shaw.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback shall be eliminated.