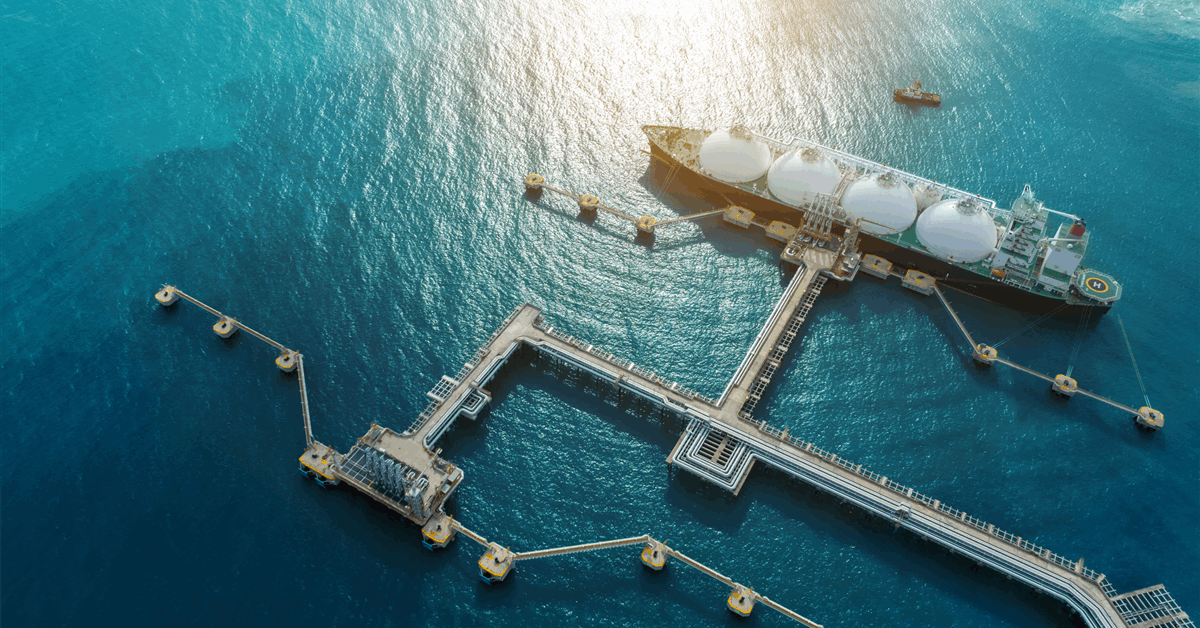

Devon Power Corp. and Ridgemont Fairness Companions are divesting their pursuits in a pure gasoline pipeline serving the Permian Basin with a capability of about 2.5 billion cubic toes a day.

Put onstream November 2024, the Matterhorn Specific Pipeline is totally contracted. The system consists of a 510-mile mainline and related compression that carries gasoline from the Waha space to Wharton, Texas. It additionally has supply capabilities for Katy, Texas, in addition to laterals within the Midland Basin, in response to operator WhiteWater Growth LLC.

The stake gross sales by Devon and Ridgemont will end in WhiteWater, MPLX LP and Enbridge Inc. proudly owning 65 %, 10 % and 10 % of the pipeline respectively, in response to a joint assertion.

“WhiteWater’s fairness curiosity within the Matterhorn Specific Pipeline shall be collectively backed by [infrastructure investors] FIC and I Squared, and WhiteWater will proceed to function the Matterhorn Specific Pipeline”, stated the assertion posted on WhiteWater’s web site. The events count on to finish the transactions within the second quarter.

MPLX individually stated its facet of the transaction consists of a 5 % acquisition that may elevate its stake to 10 % for a purchase order worth of $151 million.

Devon individually stated it should obtain about $375 million in proceeds. “Proceeds from the divestiture shall be used to additional strengthen the corporate’s investment-grade monetary place”, it stated in its quarterly report. “The monetization of Devon’s fairness possession is not going to change the phrases or circumstances of the corporate’s secured capability on the pipeline”.

In a separate transaction, Devon stated within the report its partnership with BPX for the Blackhawk area within the Eagle Ford shale had been dissolved. That dissolution has resulted in Devon proudly owning round 46,000 web acres with a stake of 95 % and operatorship.

For the primary quarter (Q1), Devon reported $494 million in web revenue. That was down from $639 million for the prior three-month interval regardless of income rising from $4.4 billion to $4.45 billion. Devon booked an impairment of $254 million from the sale of two company actual property belongings.

“Adjusting for gadgets analysts sometimes exclude from estimates, the corporate’s core earnings have been $779 million, or $1.21 per diluted share”, Devon stated. That missed the Zacks Consensus Estimate of $1.27 per share.

Q1 2025 outcomes have been boosted by a quarter-on-quarter enhance in pure gasoline costs however dampened by a decrease manufacturing of 815,000 barrels of oil equal a day. Oil manufacturing totaled 388,000 barrels per day (bpd). Pure gasoline liquids manufacturing got here at 203,000 bpd. Pure gasoline totaled 1.35 billion cubic toes a day.

Working actions generated $1.94 billion in web money, up from $1.66 billion for This fall 2024. Money, money equal and restricted money stood at $1.23 billion on the finish of Q1 2025.

Devon declared a hard and fast quarterly dividend of $0.24 per share. Through the interval it repurchased 8.5 million shares for $301 million.

To contact the writer, e-mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in knowledgeable neighborhood that may empower your profession in vitality.