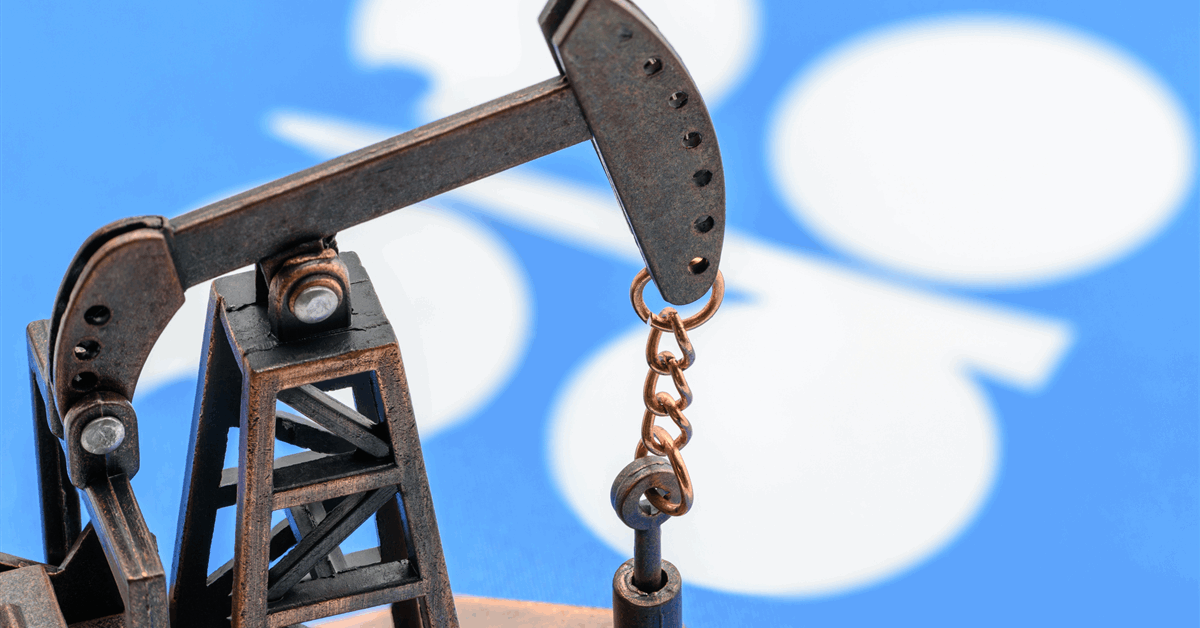

Oil ended the session on the highest ranges in over a month as President Donald Trump reiterated that the US might impose further levies on Russia except it reached a truce with Ukraine, stoking worries about tighter provides.

West Texas Intermediate oil settled at $69.21 a barrel whereas Brent settled above $72 a barrel, with each benchmarks on the highest since June.

Talking to reporters aboard Air Power One Tuesday, Trump warned of the potential for secondary sanctions if Moscow fails to succeed in a ceasefire inside ten days. Requested if he was anxious in regards to the affect further sanctions on Russia would have on the oil market, Trump stated he was not involved, suggesting that the US might ramp up its personal power manufacturing.

“I don’t fear about it. Now we have a lot oil in our nation. We’ll simply step it up, even additional,” he stated.

This week, bullish choices on the Brent crude benchmark flipped to a premium to bearish choices for the primary time in two weeks, signaling the optimistic sentiment prolonged past headline costs.

“The brand new deadline caught many analysts without warning and, if enforced, might tighten Russian crude and gasoline provides to the worldwide market,” stated Dennis Kissler, senior vice chairman for buying and selling at BOK Monetary Securities.

Earlier Tuesday morning, Kremlin made it clear that President Vladimir Putin is unlikely to vary course, after being attentive to the US President’s menace.

Trump’s warning follows the newest spherical of sanctions by the European Union concentrating on Russia, together with penalties on India’s Nayara Vitality, which has trimmed processing charges at a refinery on account of the measures. World markets are additionally centered on the US deadline to nail down commerce offers by Aug. 1, and the upcoming OPEC+ assembly that can determine provide coverage for September.

Oil was already increased for Tuesday previous to Trump’s remarks on Russia, with merchants embracing danger belongings. Fairness markets prolonged their positive aspects to all-time highs earlier within the session and US client confidence elevated greater than anticipated.

The brand new leg increased additionally pushed WTI futures previous their 200-day shifting common of about $68.17 a barrel, triggering a spate of technical shopping for simply forward of the market’s shut.

Commodity buying and selling advisers, which may speed up value momentum, deepened their bullish stance to take a seat at 55% internet lengthy in WTI on Tuesday, in contrast with 18% internet quick on July 28, in line with information from Bridgeton Analysis Group.

Crude costs are heading for a 3rd month-to-month acquire on indicators of tight stockpiles in some areas and strong demand throughout the Northern Hemisphere summer season, the height season for consumption. Nonetheless, the market is on observe for a glut towards the tip of the 12 months as OPEC and its allies proceed boosting provides.

Oil Costs

- WTI for September supply rose 3.7% at settle at $69.21 a barrel.

- Brent for September settlement gained 3.5% at $72.51 a barrel.

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in an expert neighborhood that can empower your profession in power.