Oil edged decrease on indicators that the US and Iran have made progress in nuclear talks, eroding a danger premium in benchmark futures costs.

West Texas Intermediate fell to settle close to $62 a barrel after Iranian International Minister Abbas Araghchi mentioned that the 2 international locations reached a “basic settlement” on the idea of a possible nuclear deal that will elevate sanctions on Tehran and ease the danger of battle within the Center East. Tehran’s negotiators are scheduled to return with a brand new proposal in two weeks, a US official mentioned Tuesday.

Success within the talks may pave the way in which for a long-lasting elimination of a geopolitical danger premium that has saved costs elevated for the reason that begin of the 12 months amid rising international oil provides.

The event erased earlier positive factors after Iran mentioned it might shut components of the Strait of Hormuz for a number of hours on account of army drills, although merchants have been skeptical of a significant disruption to the waterway that ships a few fifth of the world’s barrels. The US has additionally despatched a second plane service to the area.

The 2 sides will every draft and alternate texts for a deal earlier than setting a date for a 3rd spherical of talks, Araghchi mentioned, cautioning that the subsequent stage could be “harder and detailed.”

US Vice President JD Vance mentioned Tuesday that negotiations with Iran went properly however the nation has not but acknowledged President Donald Trump’s crimson strains.

What Bloomberg Strategists say:

“Agreeing on guiding rules to start drafting textual content will not be the identical as resolving enrichment limits, inspection protocols or sequencing of sanctions aid. The market appears to know that distinction. Implied volatility has eased from current highs, but spot costs stay comfortably above $60 a barrel. That resilience speaks to lingering skepticism that diplomacy will translate into something significant.”

— Brendan Fagan, Macro Strategist, Markets Dwell.

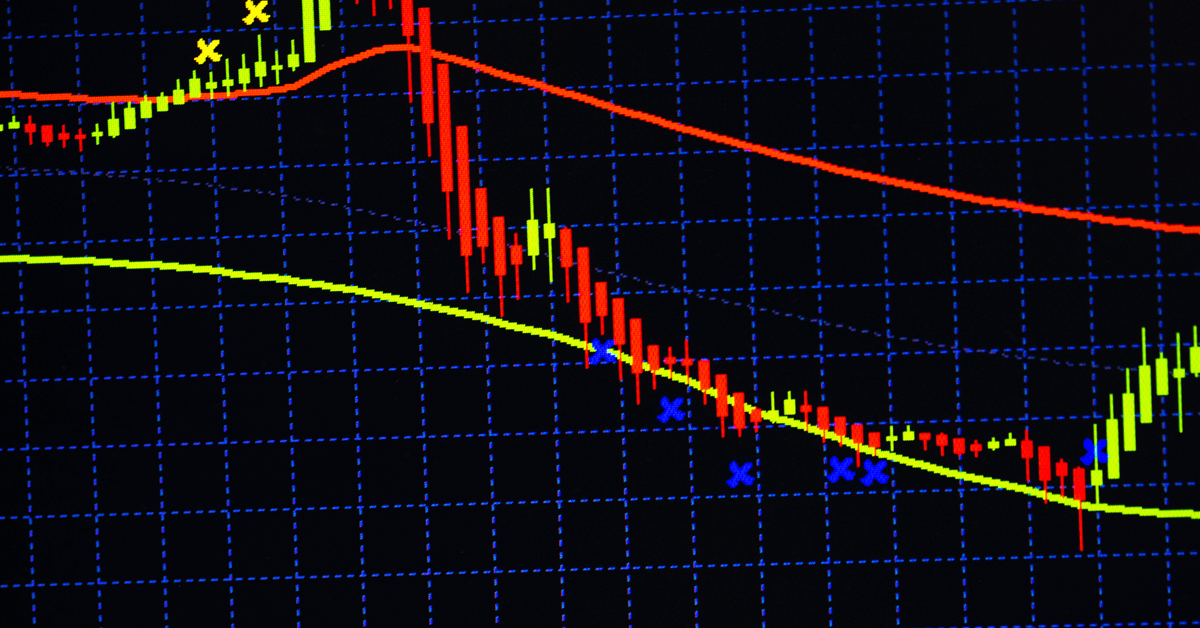

Pattern-following commodity buying and selling advisers positioned in WTI breached a number of promote triggers close to $62 a barrel, accelerating the value slide, based on knowledge from Kpler’s Bridgeton Analysis Group. The robotic merchants liquidated lengthy positions to take a seat at 27% brief in WTI on Tuesday, in contrast with 45% at first of the session, the agency mentioned.

Negotiations are additionally scheduled between Russia and Ukraine in Geneva over the subsequent two days. Nonetheless, the prospects of a speedy finish to the just about four-year-old battle and the return of Russian barrels look slim.

Crude is up nearly 10% to date this 12 months due to a mixture of provide disruptions, geopolitical danger and a buildup of sanctioned barrels. Whereas futures have settled in a band between $61 and $65 for many of this month, the end result of the flurry of diplomatic efforts within the coming days and hours may dictate the trail ahead for costs.

Oil Costs

- WTI settled at $62.33 a barrel in New York.

- There was no settlement on Monday due to the Presidents’ Day vacation.

- Brent for April settlement was down 1.8% to settle at $67.42 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share information, join with friends and business insiders and interact in an expert group that may empower your profession in power.