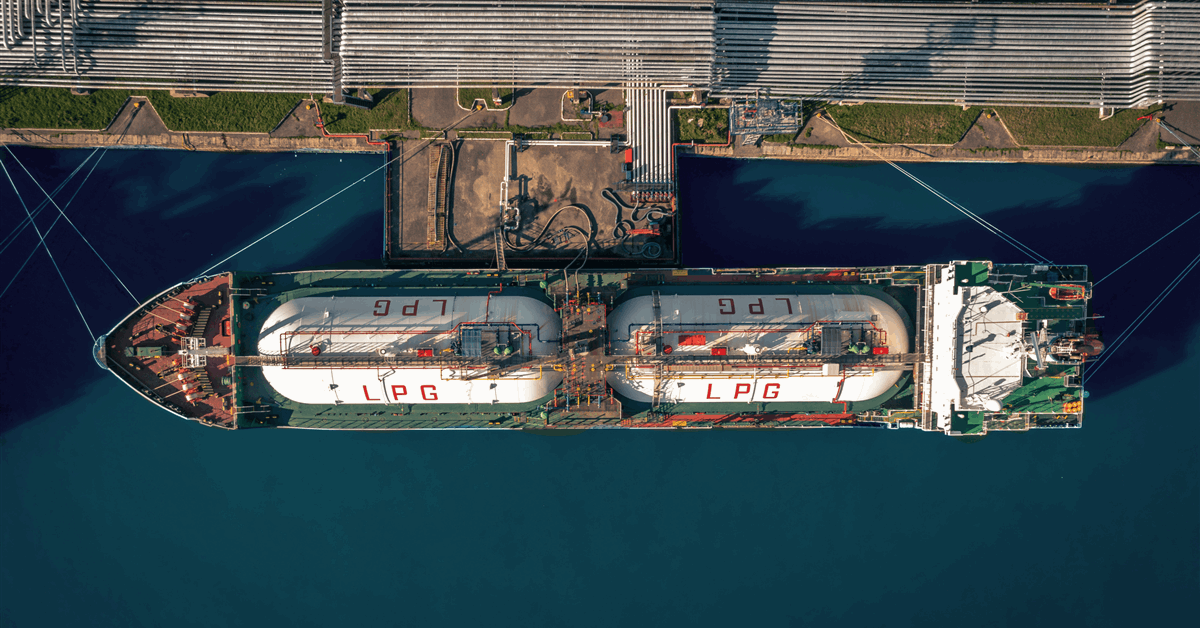

Chinese language plastics vegetation that purchase liquefied petroleum fuel are turning to the Center East to interchange tariff-hit imports from the US, disrupting world flows and reviving moribund freight charges.

The LPG patrons, looking for to swap US cargoes purchased earlier with options, have discovered that Persian Gulf producers together with Saudi Aramco are in a position to assist with these requests, in line with merchants.

As many as seven supertankers – or very-large fuel carriers – carrying US LPG and set to reach in China in Might and June will now head to India and Southeast Asia, the merchants mentioned, asking to not be named as they’re not licensed to talk publicly. In alternate, Center Jap shipments meant for these patrons can be provided to end-users in China.

Aramco didn’t reply to questions from Bloomberg throughout common working hours.

US-to-China flows of American LPG, ethane, liquefied pure fuel and crude oil have been within the highlight in latest weeks, following the roll-out of crippling tariffs. LPG and ethane have been the toughest hit as a consequence of sizable exports from the US shale patch and China’s insatiable urge for food for the fuels for plastics manufacturing. Some Chinese language factories face the chance of closure if they’ll’t get sufficient of the feedstocks.

China nonetheless faces an LPG shortfall of 470,000 tons monthly even after accounting for potential provide from the Center East, Citic Futures mentioned in a report launched Monday. But when the tariffs proceed, propane dehydrogenation (PDH) vegetation which are already working at a loss should lower exercise charges under the present 65 % to 70 % as their feedstock inventories run out, it mentioned.

The rerouting of LPG flows has resulted in a rise in what’s often known as ton-mile exercise for fuel carriers, the merchants mentioned. That’s precipitated freight charges to rebound, with prices for the US Gulf Coast to Japan route rising from the bottom in virtually 4 years, in line with Baltic Change. Freight charges from the Center East to Japan have additionally recovered.

Nonetheless, Chinese language patrons could discover alternative cargoes from the Center East an imperfect substitute for his or her authentic purchases from the US. That’s as a result of provides from the likes of Saudi Arabia are inclined to comprise each propane and butane, whereas US shipments are usually one hundred pc propane, which is extra coveted by Chinese language vegetation that flip the feedstock into plastics in PDH vegetation.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback can be eliminated.

MORE FROM THIS AUTHOR

Bloomberg