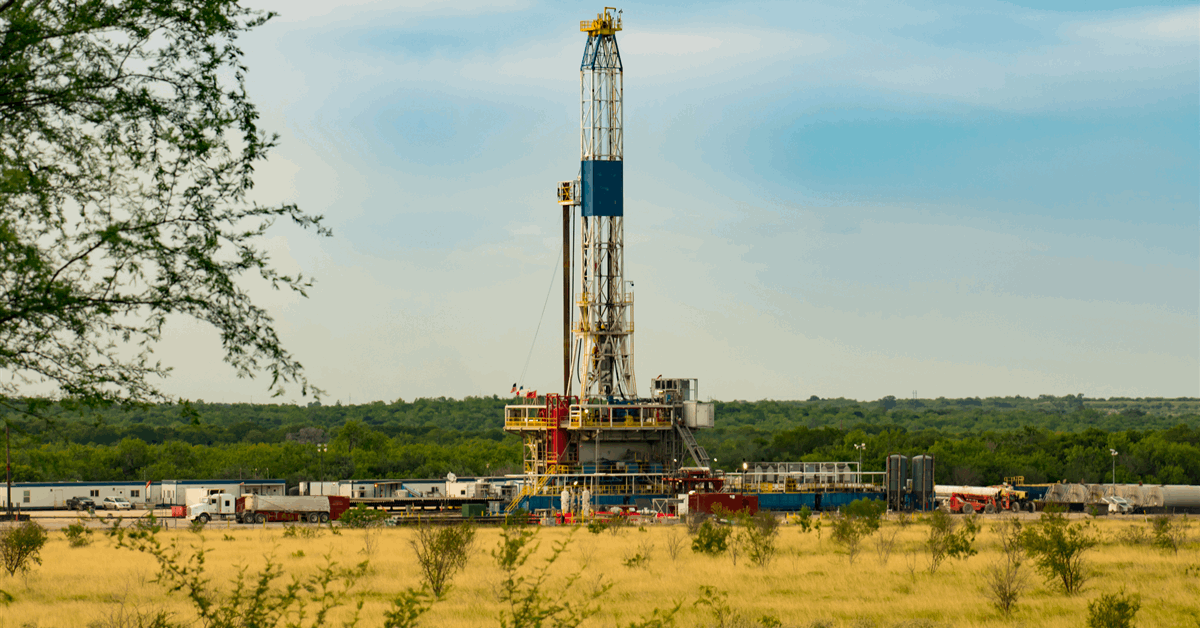

Diversified Vitality Co. PLC and Carlyle have fashioned a partnership to take a position as much as $2 billion in confirmed developed producing (PDP) pure gasoline and oil property throughout the US.

“This unique partnership will mix Carlyle’s deep credit score and structuring experience, led by Carlyle’s asset-backed finance (ABF) group, with Diversified’s market-leading working capabilities and differentiated enterprise mannequin of buying and optimizing portfolios of present long-life oil and gasoline property to generate dependable manufacturing and constant money stream”, a joint assertion stated.

“Beneath the phrases of the settlement, Diversified will function the operator and servicer of the newly acquired property”, the businesses added. “As investments happen, Carlyle intends to pursue alternatives to securitize these property, searching for to unlock long-term, resilient financing for this essential phase of the nation’s power infrastructure”.

Diversified Vitality chief government Rusty Hutson Jr stated, “This association considerably enhances our means to pursue and scale strategic acquisitions in what we imagine is a extremely compelling atmosphere for PDP asset consolidation”.

“Diversified is a number one operator of long-life power property and a pioneer in bringing PDP securitizations to institutional markets”, commented Akhil Bansal, head of Carlyle ABF. “We’re excited to convey institutional capital to high-quality, cash-yielding power property which are core to US home power manufacturing and power safety.

“This partnership underscores Carlyle’s means to originate differentiated funding alternatives by means of proprietary sourcing channels and search entry to secure, yield-oriented power publicity”.

Carlyle ABF, a part of Carlyle’s World Credit score platform, focuses on personal mounted revenue and asset-backed investments. Carlyle ABF helps companies, specialty finance corporations, banks, asset managers and different originators and homeowners of diversified swimming pools of property. It has deployed round $8 billion since 2021 and has about$9 billion in property underneath administration as of the primary quarter of 2025, in line with Washington-based Carlyle.

Birmingham, Alabama-based Diversified Vitality is concerned in pure gasoline and liquids manufacturing, transport, advertising and marketing and nicely retirement.

In an earlier acquisition partnership, Diversified Vitality introduced March it has teamed up with FuelCell Vitality Inc. and TESIAC eyeing a portfolio of 360 megawatts of energy to cater to information facilities throughout Kentucky, Virginia and West Virginia.

The three agreed to create an acquisition and growth firm “targeted on delivering dependable, cost-efficient, net-zero energy from pure gasoline and captured coal mine methane to fulfill the hovering demand of information facilities for dependable energy”, a joint press launch stated.

“The collaboration amongst the three corporations would leverage in-basin pure gasoline manufacturing, superior power technology by way of gas cell know-how, and infrastructure financing to create a extremely environment friendly, scalable, and sustainable power answer tailor-made for the speedy growth of information heart energy capability necessities.

“Pure gasoline or CMM, extracted from coal mines by Diversified Vitality and delivered by way of pipeline to gas cells, would generate energy by means of the electrochemical conversion of methane to hydrogen, after which to electrical energy.

“This combustion-free course of is nearly freed from air air pollution emissions, dashing air allowing and enabling the system to be introduced on-line quicker than combustion-based methods.

“Warmth that’s co-generated by the gas cells will be harnessed and transformed to chilling for the info heart, thus rising general system effectivity and additional enhancing financial worth.

“Importantly, this course of qualifies for established environmental and tax credit which have the potential to offer significant money stream along with the financial advantages of gasoline and energy gross sales”.

To contact the creator, electronic mail jov.onsat@rigzone.com