Carlos Slim, Latin America’s richest man, plowed $1 billion this 12 months into rising his crude-oil producing and refining portfolio in a wager that demand for fossil fuels isn’t going away anytime quickly.

Slim, 84, made his fortune largely by constructing the telecom behemoth America Movil SAB, however has diversified in recent times into different property together with the oil investments, actual property in Spain and a brand new stake within the UK’s BT Group Plc.

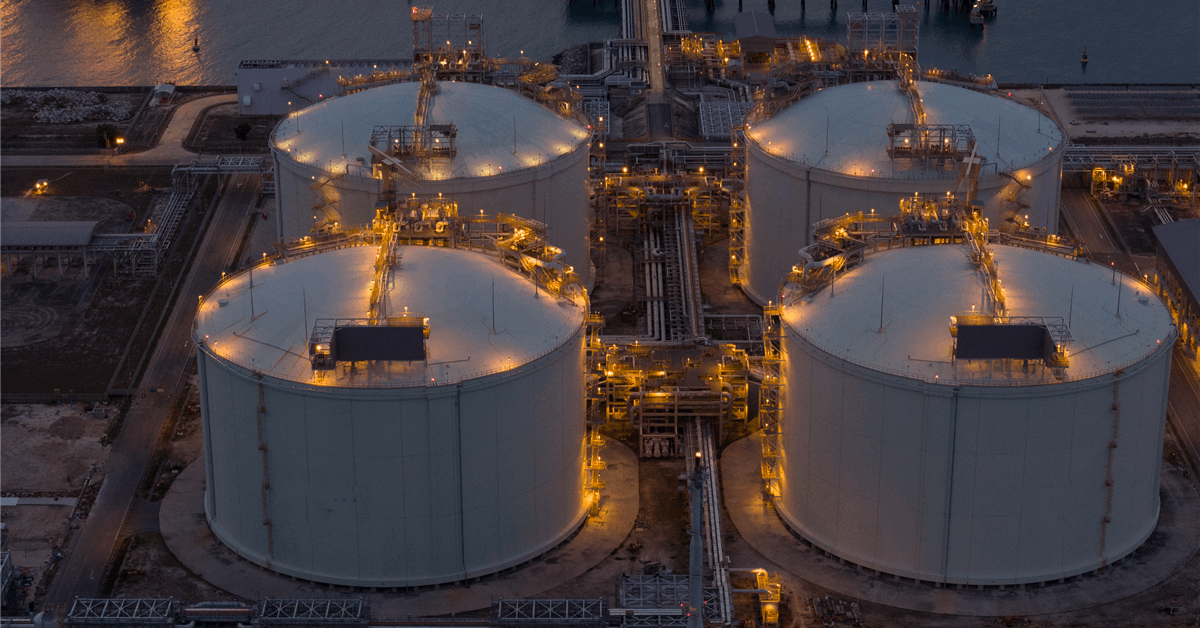

By way of his household funding workplace Management Empresarial de Capitales, Slim invested $602 million in US refiner PBF Power Inc., based on regulatory filings, boosting his stake to 25%. He additionally purchased $326 million value of shares in Houston-based oil producer Talos Power Inc.

Slim now owns 24.2% of Talos, prompting the board in October to introduce a poison capsule to forestall him from buying greater than 1 / 4 of the inventory. He additionally not too long ago boosted his stake in a Mexico three way partnership with Talos to 80% from 49.9% for an mixture buy value of $82.7 million.

After his internet value rose above $100 billion for the primary time, Slim’s fortune has taken successful this 12 months, falling 22% to $81.8 billion, based on the Bloomberg Billionaires Index. Whereas a part of the transfer could be chalked as much as the drop within the Mexican peso after years of relative power, his largest property are additionally down for the 12 months, led by a 40% decline in holding firm Grupo Carso SAB.

Slim spokesman and son-in-law Arturo Elias Ayub didn’t reply to a request for touch upon the oil investments. Slim stated in February he was making a much bigger push into oil with plans to study extra about refining and petrochemicals. He additionally stated he was trying to accomplice with companies with expertise in and across the Gulf of Mexico.

Slim’s purchases of PBF and Talos shares have typically come when the inventory value was falling. Talos is down 35% in 2024 whereas PBF has dropped 42%.

Slim’s transfer this month to spice up his stake within the Mexico three way partnership with Talos offers his household higher management over the anticipated windfall from the Zama oil subject, one in every of Mexico’s most promising new discoveries in many years.

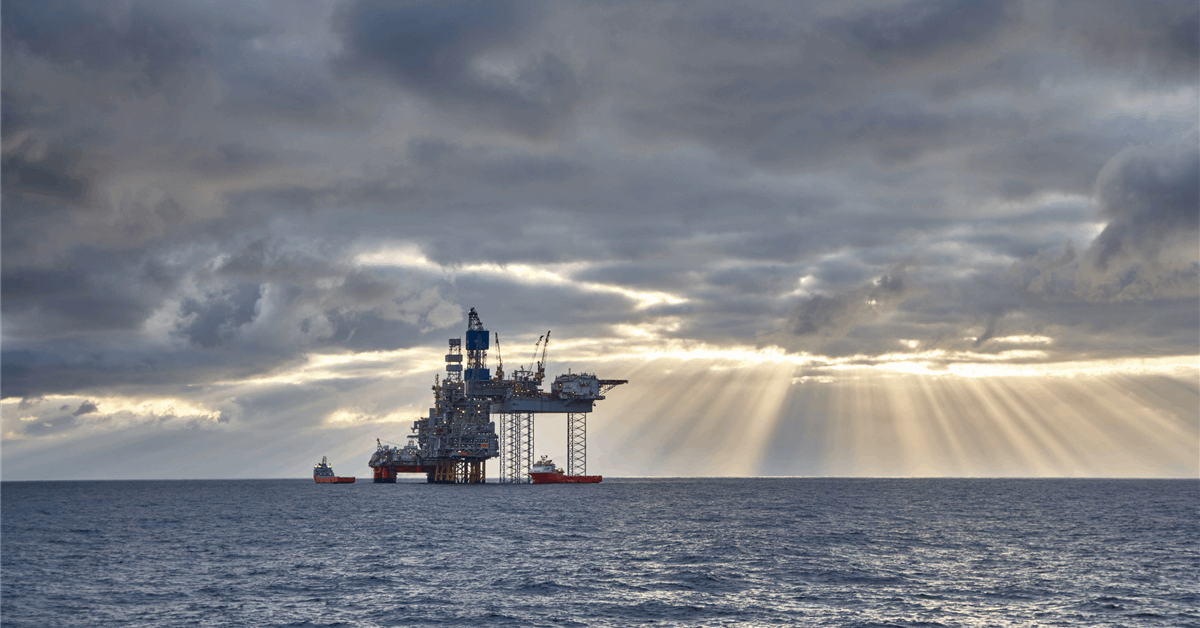

In July, he vowed to take a position $1.2 billion to develop the Lakach offshore fuel subject by way of Grupo Carso, at the side of state oil agency Petroleos Mexicanos. Carso will work with Talos and an area unit of Spain’s Fomento de Construcciones y Contratas SA for the undertaking.

Slim owns greater than 80% of FCC, because the Spanish agency is understood.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback can be eliminated.

MORE FROM THIS AUTHOR

Bloomberg