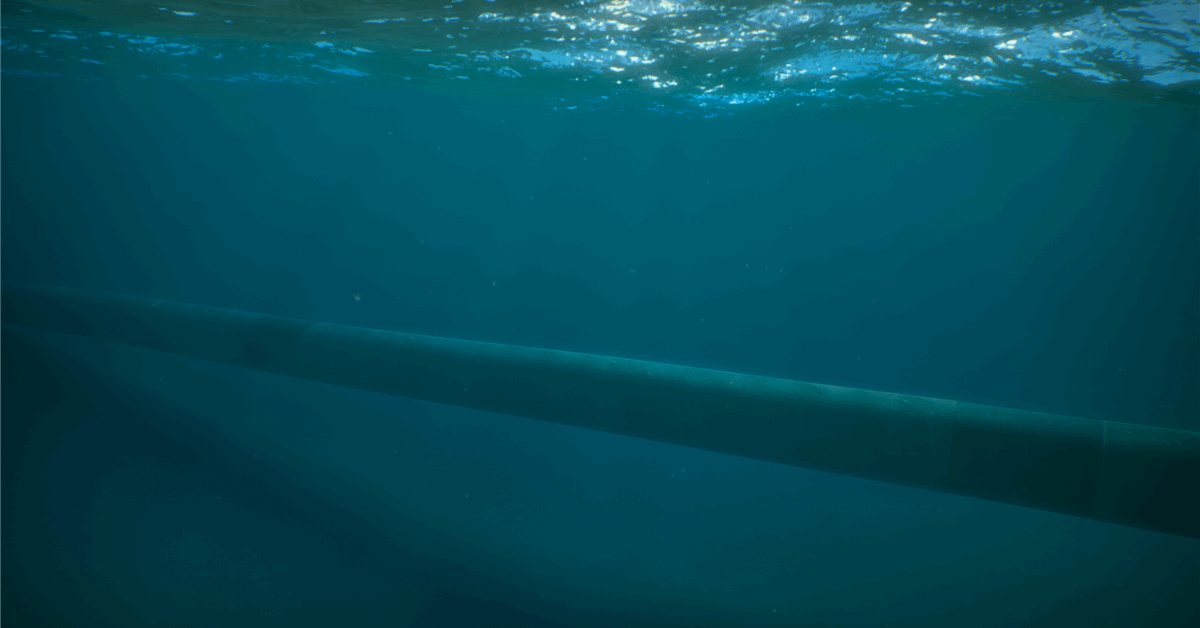

Canadian Pure Sources Ltd. is allotting $63.53 million (CAD 90 million) for carbon seize initiatives.

The corporate is earmarking $4.34 billion (CAD 6.15 billion) for its working capital finances, of which $2.26 billion (CAD 3.2 billion) will likely be for “typical E&P” and $1.98 billion (CAD 2.8 billion) for “thermal and oil sands mining and upgrading,” in accordance with a latest information launch.

Canadian Pure mentioned it’s aiming to drill 361 internet wells throughout its crude oil and liquids-rich pure fuel property. The corporate’s program contains 97 internet mild crude oil wells, primarily within the Montney, Dunvegan and Mannville, in addition to 82 internet liquids-rich pure fuel wells, primarily in its not too long ago acquired Duvernay property and in its Montney property.

The corporate can also be concentrating on to drill 174 heavy crude oil wells, of which 156 are multilateral wells primarily within the Mannville.

Canadian Pure has set a goal manufacturing steering vary of 1.51 million barrels of oil equal per day (MMboepd) to 1.56 MMboepd in 2025, which represents progress of roughly 12 p.c over 2024 ranges, based mostly on the midpoint of the vary, in accordance with the discharge.

Canadian Pure President Scott Stauth mentioned, “Our 2025 working capital finances of roughly $6 billion targets to ship worth progress and robust returns on capital”.

“This vital company progress contains the beforehand disclosed strategic acquisition of the AOSP and Duvernay property accomplished in 2024. With our present shareholder returns framework, this progress is focused to ship manufacturing per share progress of 12 p.c to 16 p.c, based mostly upon latest strip pricing,” Stauth added.

The corporate’s focused manufacturing combine consists of roughly 47 p.c high-value mild crude oil, pure fuel liquids (NGLs) and artificial crude oil (SCO), 26 p.c heavy crude oil and 27 p.c pure fuel, based mostly upon the midpoint of its company manufacturing steering. Pure fuel manufacturing is focused to vary between 2.425 billion cubic ft per day (Bcfpd) to 2.48 Bcfpd, representing absolute progress of roughly 14 p.c over 2024 ranges, based mostly on the midpoint of the 2025 vary.

Canadian Pure CFO Mark Stainthorpe mentioned, “With our disciplined 2025 capital finances, low upkeep capital necessities and a long-life low decline asset base, we goal to generate robust returns on capital and proceed to ship returns to our shareholders whereas additionally lowering our internet debt, as per the corporate’s free money move allocation coverage”.

Final month, Canadian Pure closed the acquisition of Chevron Corp.’s stakes in producing and undeveloped oil sand, liquid and pure fuel properties in Alberta province for $6.5 billion in money.

The transaction consisted primarily of Chevron’s 20 p.c curiosity within the Athabasca Oil Sands Venture (AOSP) and 70 p.c stake within the Duvernay play. It additionally included stakes in a number of different non-producing oil sands leases with combination acreage of about 100,000 internet acres, in accordance with an earlier assertion.

The AOSP portion, which incorporates the Muskeg River and Jackpine mines, the Scotford Upgrader and the Quest Carbon Seize and Storage facility, has raised operator Canadian Pure’s stake to 90 p.c. Shell plc holds the remaining 10 p.c.

To contact the writer, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will likely be eliminated.