BP Plc dropped in London buying and selling after it warned of “considerably decrease” refining margins and predicted a writedown on the worth of a plant in Germany of $1 billion to $2 billion.

Decrease earnings from making fuels comparable to diesel and better ranges of upkeep may have an hostile influence on BP’s second-quarter earnings from oil merchandise of $500 million to $700 million, the corporate stated in an announcement on Tuesday. Outcomes from oil buying and selling are anticipated to be weak, it stated.

Shares of the corporate fell 3.5% to 458.15 pence as of 9:02 a.m.

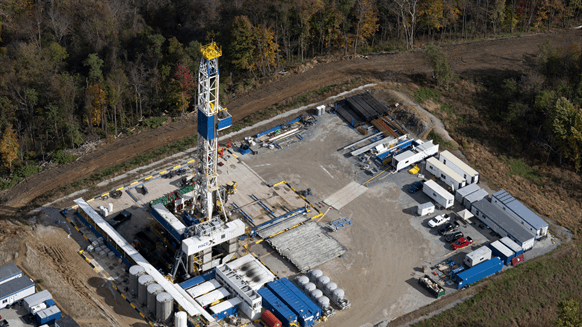

BP’s post-tax impairment cost pertains to the evaluation of the Gelsenkirchen refinery in Germany, which was introduced earlier this 12 months. The corporate plans to reduce its refining operations within the nation resulting from excessive prices and declining demand for fuels.

European refiners face growing competitors from gas imports originating within the Center East and Asia, the place capability is being elevated. The Gelsenkirchen advanced will develop into the second German plant to cut back crude consumption beginning 2025, with Shell Plc engaged on an identical transfer at a close-by facility. The UK’s Grangemouth website can be set to shut, whereas different services comparable to TotalEnergies SE’s Grandpuits are transferring towards biofuels and plastics recycling.

BP additionally stated on Tuesday that upstream manufacturing within the second quarter is now anticipated to be “broadly flat” in contrast with the prior quarter. That is an enchancment on earlier steerage for output to be barely decrease, RBC analyst Biraj Borkhataria stated in a be aware.

Nonetheless, that is offset by weak point elsewhere, notably the “common” efficiency seen gasoline advertising and buying and selling, he stated.

BP’s outcomes are anticipated to be revealed July 30.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback will probably be eliminated.

MORE FROM THIS AUTHOR

Bloomberg