Saudi Aramco is in superior talks to promote a roughly $10 billion stake in midstream infrastructure serving the enormous Jafurah pure fuel mission to a bunch led by BlackRock Inc., in accordance with folks with data of the matter.

The consortium is backed by BlackRock’s World Infrastructure Companions unit and will attain an settlement as quickly as the approaching days, mentioned the folks, who requested to not be recognized discussing confidential info.

The deal will contain pipelines and different infrastructure serving the $100 billion-plus Jafurah mission, which Aramco is growing to provide home energy vegetation in addition to for export. It’s an unconventional subject, which means the fuel is trapped in hard-to-access rock formations and requires particular methods to extract.

Reuters reported on Thursday that GIP was nearing a deal, citing unidentified folks. Aramco didn’t reply to emailed queries exterior common enterprise hours in Saudi Arabia.

Bloomberg Information first revealed in 2021 that Aramco was contemplating introducing exterior buyers into elements of the Jafurah mission. Aramco was approaching infrastructure funds to gauge their curiosity within the midstream property, folks with data of the matter mentioned the subsequent 12 months.

State-controlled Aramco has been looking for to usher in worldwide capital and promote stakes in some property as the federal government pursues huge initiatives to construct futuristic cities and diversify its financial system. The dominion is pushing forward with an unlimited growth, together with growing new tourism locations and build up a producing base, to organize for a future wherein oil demand will start to wane.

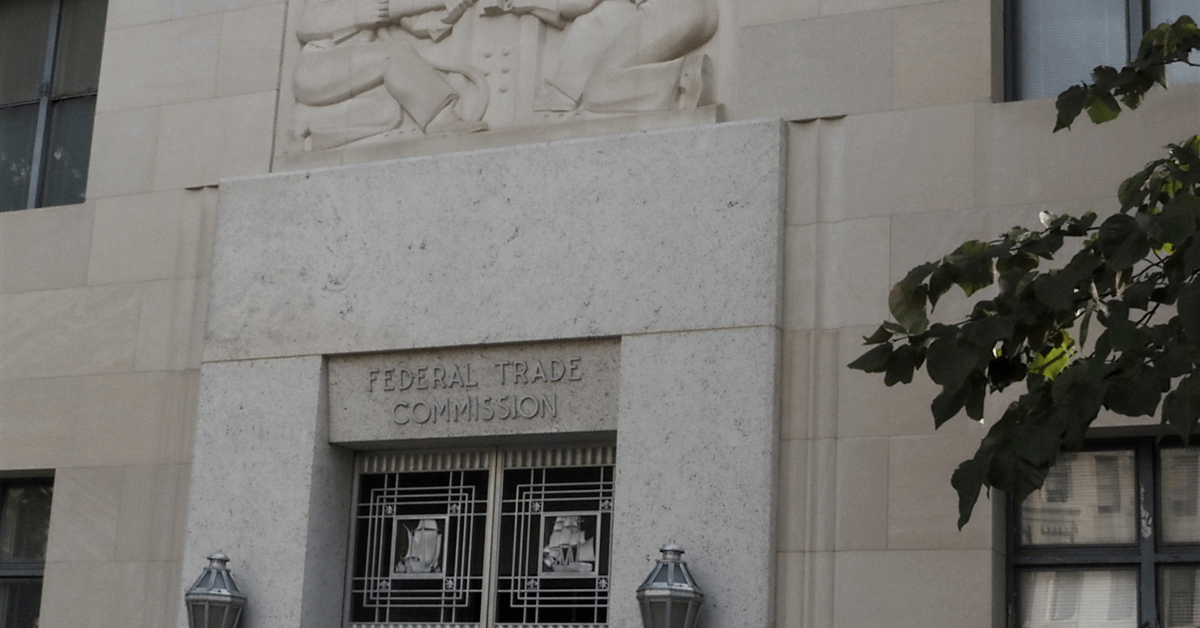

BlackRock was earlier amongst buyers that purchased stakes in Aramco’s nationwide fuel pipeline community.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback shall be eliminated.