Antler International Ltd has signed a deal to promote 40 % within the EG-08 manufacturing sharing contract offshore Equatorial Guinea to Fuhai (Beijing) Power Ltd.

The transaction was introduced Tuesday by London-based Europa Oil & Gasoline (Holdings) PLC, which owns 42.9 % of Antler.

Antler would retain a 40 % working curiosity, Europa stated. State-owned Guinea Equatorial de Petróleos owns 20 %.

Fuhai, a part of Dongying, China-based Fuhai Group New Power Holding Co Ltd, would in return fund “95 % of the prices (the Fuhai carry) of the Barracuda properly, as much as a cap of $53 million for the whole properly value”, Europa stated. “Antler shall fund the remaining 5 % of the whole properly value”.

“Any value overruns above the $53 million cap will probably be shared equally between Fuhai and Antler”, Europa added.

“Upon business hydrocarbon gross sales Fuhai could have a preferential restoration proper to get better the Fuhai carry. Forty-five % of the Fuhai carry will accrue curiosity, capped at 5 % every year, which is able to accrue from funding till full restoration from asset cashflows. Curiosity will probably be canceled if the Barracuda prospect doesn’t end in a business discovery”.

The transaction wants approval from authorities within the Central African nation and Abroad Direct Funding approval from the Shandong provincial authorities, Europa stated.

Antler expects to safe the approvals “inside the coming months and as such have now entered a interval of detailed engineering and procurement to be able to spud the properly as quickly as doable”, stated Europa chief government William Holland.

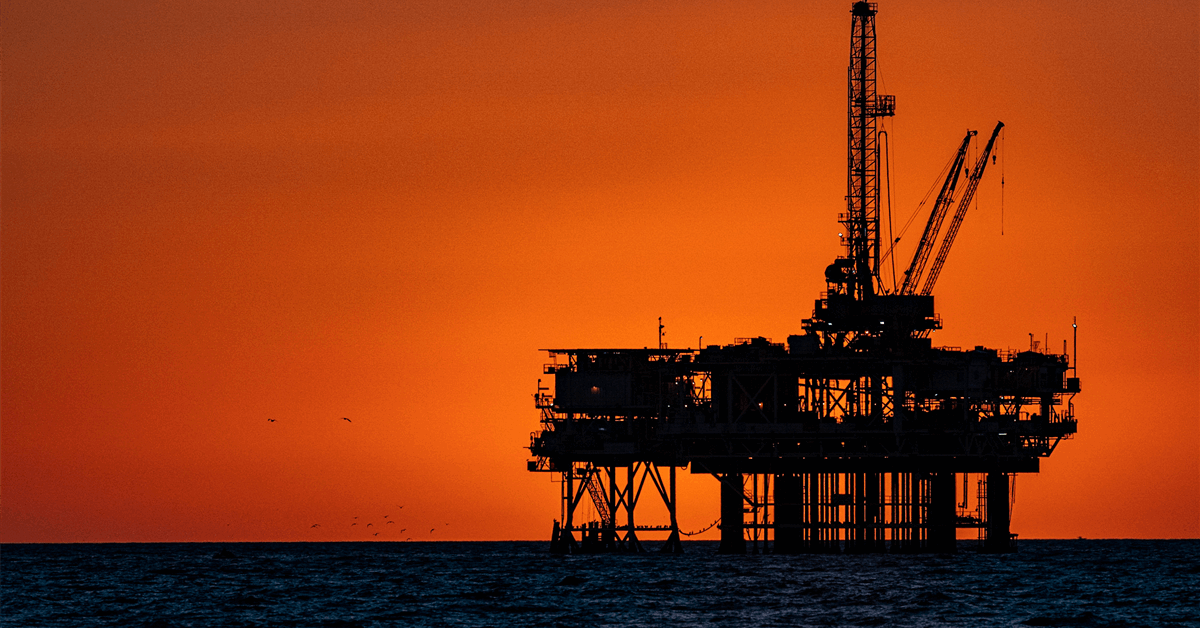

Europa expects the drilling marketing campaign for Barracuda to begin subsequent 12 months.

“Following additional geophysical evaluation of the EG-08 block the potential volumes have remained broadly according to earlier iterations whereby Antler now believes that the block accommodates 2.213 trillion cubic ft (Pmean), with the first prospect being Barracuda”, Europa stated.

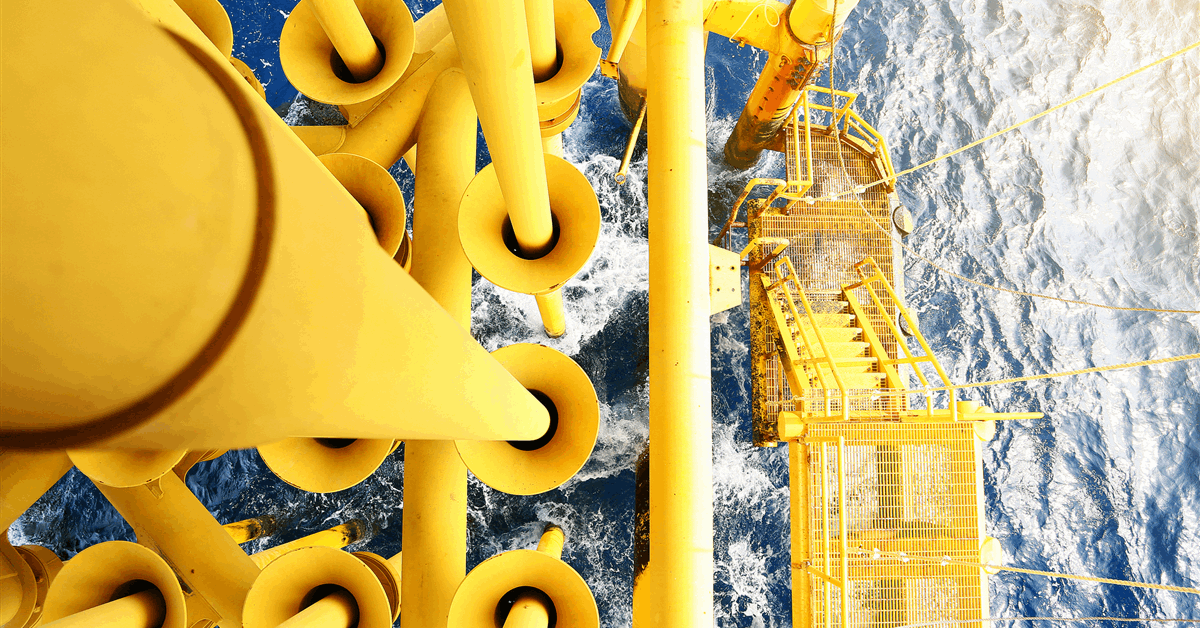

The exploration block spans 731 sq. kilometers (282.24 sq. miles) within the Douala Basin and sits subsequent to Chevron Corp’s Alen and Anseng fields, in line with Europa.

Earlier this 12 months Europa obtained a one-year extension to EG-08’s preliminary two-year time period from Equatorial Guinea’s Hydrocarbons and Mining Improvement Ministry.

“Because of the extension, the primary sub-period of part I of the PSC will expire on 4 October 2026”, Europa stated in a press launch October 6.

To contact the writer, e-mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in knowledgeable neighborhood that can empower your profession in power.