Abu Dhabi Nationwide Oil Firm (ADNOC) introduced, in an announcement posted on its website not too long ago, the signing of a “landmark structured financing transaction of as much as $11 billion … to monetize Hail and Ghasha’s midstream future fuel manufacturing”.

Within the assertion, ADNOC described the non-recourse financing transaction as distinctive for an vitality challenge of this scale and complexity, including that it allows ADNOC “to comprehend upfront worth for its merchandise at aggressive charges”.

“Along with offering quick entry to capital, the financing construction introduces an revolutionary industrial mannequin that ring-fences midstream processing amenities and operations, which allows ADNOC and its companions to boost low-cost funding whereas retaining strategic and operational management of the property,” ADNOC stated within the assertion.

“This financing transaction is the most recent in a collection of ADNOC-led pioneering infrastructure growth partnerships which have been executed over the previous decade,” it added.

ADNOC highlighted within the assertion that the midstream processing part of Hail and Ghasha contains infrastructure for processing, dealing with, and delivering pure fuel, condensate, and pure fuel liquids. The corporate said that, underneath the financing construction, ADNOC and its companions “commit to produce the outlined pure fuel merchandise via the midstream processing amenities, guaranteeing long run product flows that underpin the financing framework”.

The corporate stated the financial institution consortium consists of Abu Dhabi Business Financial institution, Abu Dhabi Islamic Financial institution, Agricultural Financial institution of China, Financial institution of China, Citibank, The Improvement Financial institution of Singapore, Dubai Islamic Financial institution, Emirates Improvement Financial institution, Emirates NBD, First Abu Dhabi Financial institution, Gulf Worldwide Financial institution, Industrial and Business Financial institution of China, Mashreq Financial institution, Mizuho Financial institution, MUFG Financial institution, Natixis, Nationwide Financial institution of Kuwait, Sharjah Islamic Financial institution, Sumitomo Mitsui Banking Company, Saudi Nationwide Financial institution, and Normal Chartered Financial institution.

“This landmark transaction builds on ADNOC’s profitable monitor report of world vitality partnerships and unlocks capital to drive progress at Hail and Ghasha, one of many world’s most bold offshore fuel tasks,” Ahmed Al Jaber, UAE Minister of Business and Superior Know-how and ADNOC Managing Director and Group CEO, stated within the assertion.

“The distinctive demand from over 20 main world and regional monetary establishments reinforces confidence in ADNOC’s worth creation technique, revolutionary method to financing, and experience in delivering mega tasks,” he added.

“Hail and Ghasha is a vital contributor to ADNOC’s fuel technique and is on monitor to generate vital worth for ADNOC, our companions, and the UAE, whereas unlocking essential new fuel assets for our prospects,” he continued.

ADNOC stated in its assertion that its newest financing mannequin “follows a collection of landmark midstream and infrastructure transactions”. The corporate outlined that that these embody a $4.9 billion oil pipeline partnership and a $10.1 billion fuel pipeline settlement “with a number of the world’s main world infrastructure and institutional traders”, in addition to “pioneering build-own-operate-transfer (BOOT) tasks such because the $3.8 billion … challenge to energy and decarbonize offshore operations and the $2.2 billion … challenge to ship sustainable water provides to onshore operations”.

ADNOC went on to state that the “revolutionary financing construction for Hail and Ghasha provides a replicable mannequin for large-scale greenfield tasks”.

“The transaction is anchored by ADNOC’s reliability as an upstream developer and long-term offtaker, in addition to its environment friendly capital administration and revolutionary financing monitor report,” it stated.

“It additionally supplies financiers with strong long-term money flows from high-quality property, supported by robust contractual and structural protections,” it continued.

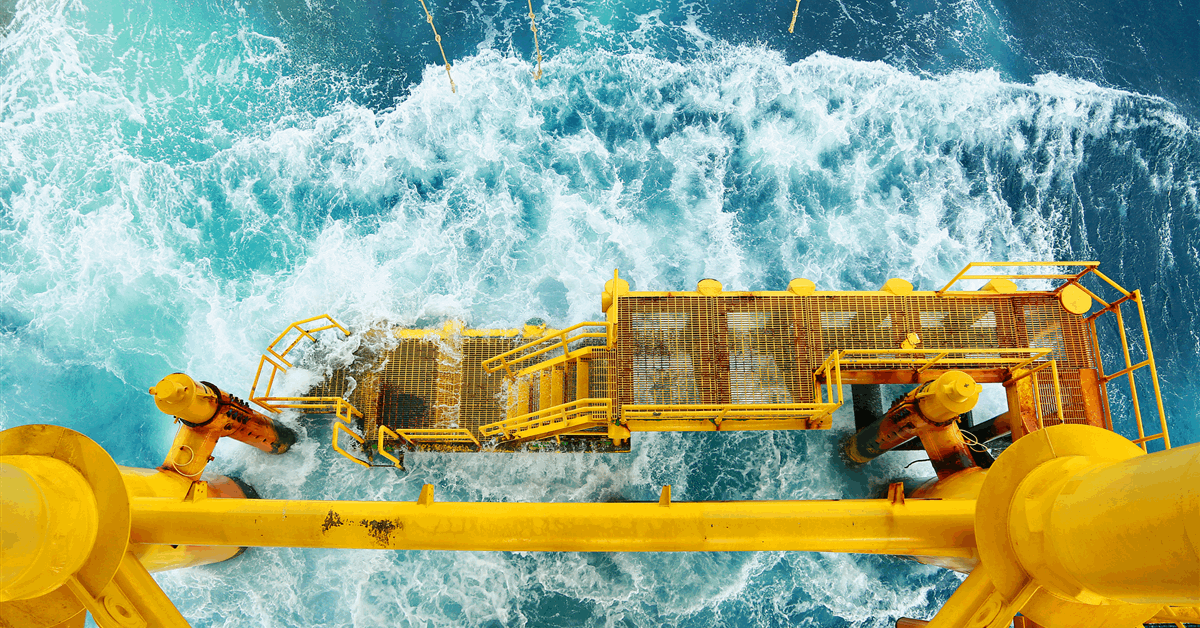

Hail and Ghasha is a part of the bigger Ghasha Concession, positioned offshore Abu Dhabi, which is predicted to provide 1.8 billion customary cubic toes per day (bscfd) of fuel, ADNOC highlighted in its assertion.

“It is usually the world’s first offshore fuel challenge of its variety that goals to function with internet zero emissions, capturing 1.5 million tons per 12 months (mtpa) of carbon dioxide (CO2), equal to eradicating over 300,000 automobiles off the highway yearly,” the corporate highlighted.

On its website, ADNOC states that the Hail and Ghasha challenge “will play an important position in assembly the UAE’s objective of fuel self-sufficiency and rising demand for exports”.

In an announcement posted on its website on December 19, ADNOC introduced that it had signed a $2 billion inexperienced financing settlement backed by Korea Commerce Insurance coverage Company to fund decrease carbon tasks throughout its operations.

“The deal reinforces ADNOC’s ambition to combine sustainable finance into its progress plans,” ADNOC stated in that assertion.

“This marks ADNOC’s first inexperienced financing facility backed by a Korean export credit score company (ECA), following a $3 billion … transaction with the Japan Financial institution for Worldwide Cooperation (JBIC) in 2024,” it added.

“Collectively, these offers carry ADNOC’s complete inexperienced funding to $5 billion … in simply 18 months, strengthening its monitor report in inexperienced finance,” it continued.

To contact the creator, e-mail andreas.exarheas@rigzone.com