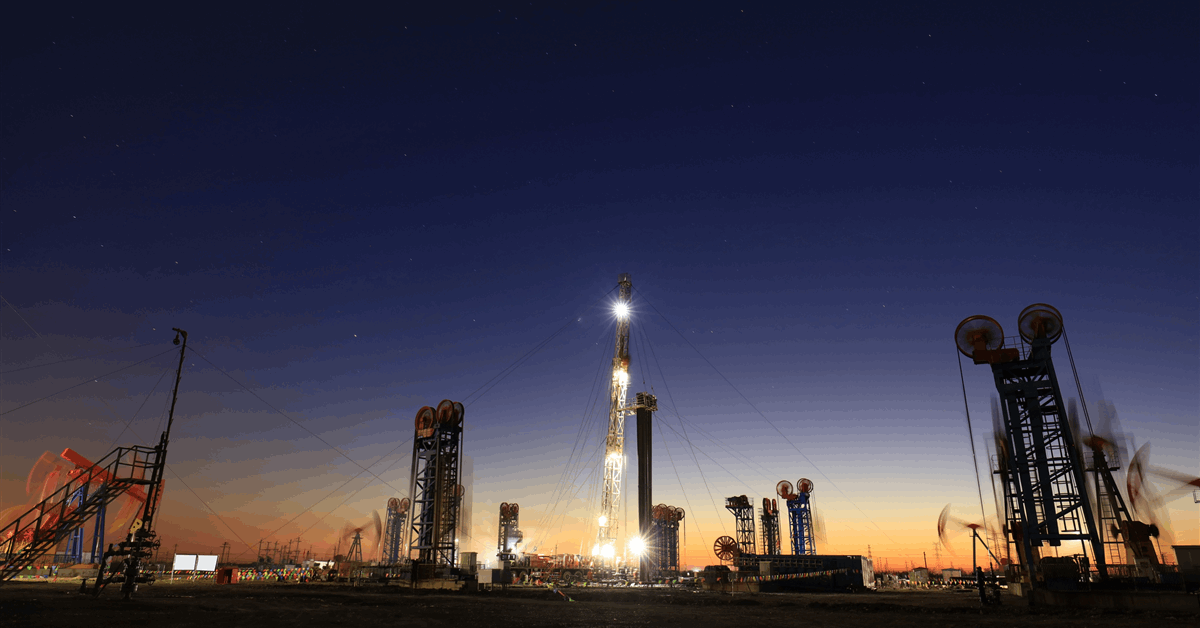

Abu Dhabi Nationwide Oil Co. PJSC (ADNOC) achieved Friday what it stated is the most important placement on the Abu Dhabi trade, elevating about $2.84 billion from issuing 3.1 billion shares in its built-in gasoline processing arm to institutional traders.

The so-called marketed providing, the primary within the United Arab Emirates in response to ADNOC, was priced at AED 3.4 ($0.93) per share, about 43 p.c greater than ADNOC Gasoline PLC’s preliminary public providing (IPO) worth of AED 2.37 in March 2023. Elevating round $2.5 billion and leading to a market capitalization of roughly $50 billion, the IPO was the most important on the Abu Dhabi bourse then in response to ADNOC.

Friday’s providing, which attracted Gulf and worldwide traders, represents 4 p.c of ADNOC Gasoline’ issued and excellent share capital and can elevate its free float to 9 p.c headline, ADNOC stated in a web-based assertion. ADNOC retains an 86 p.c stake in ADNOC Gasoline.

“The next free float can be anticipated to supply a pathway in the direction of inclusion within the Morgan Stanley Capital Worldwide Rising Market Index and the Monetary Occasions Inventory Alternate Rising Market Index, which can happen on the subsequent quarterly evaluate, topic to ADNOC Gasoline assembly all of the related inclusion standards”, ADNOC stated. “Index inclusion of ADNOC Gasoline would contribute to the diversification of the Firm’s investor base and considerably broaden consciousness of its worth proposition”.

The providing was oversubscribed 4.4 occasions, ADNOC stated, noting the ultimate provide worth represented a 5 p.c low cost to ADNOC Gasoline’ closing worth Thursday.

ADNOC expects settlement February 26. BofA Securities, Citi, EFG-Hermes, First Abu Dhabi Financial institution, HSBC and Worldwide Securities acted as joint world coordinators and joint bookrunners.

ADNOC chief monetary officer Khaled Al Zaabi stated, “The distinctive demand and aggressive low cost supplied by the worldwide and home investor group displays the sturdy confidence in ADNOC Gasoline’ observe document and development prospects”.

In 2024 ADNOC Gasoline achieved its highest-ever yearly web revenue at $5 billion, pushed by pure gasoline demand within the UAE.

Web revenue for the fourth quarter of 2024 totaled $1.38 billion, ADNOC Gasoline’ highest quarterly end result since its public itemizing in 2023, it reported February 6, 2025.

Annual gross sales volumes grew two p.c to three,616 million MMBtu. ADNOC Gasoline provides about 60 p.c of the UAE’s gross sales gasoline wants, in addition to provides over twenty nations, in response to the corporate.

Adjusted income for 2024 rose seven p.c year-on-year to $24.43 billion. “The corporate’s sturdy top-line efficiency for 2024 translated into a powerful EBITDA [earnings earlier than curiosity, taxes, depreciation and amortization) development of 14 p.c to $8.65 billion with a excessive, secure margin of 35 p.c”, ADNOC Gasoline stated.

For the fourth quarter, adjusted income was $6.06 billion and EBITDA $2.28 billion. “The sturdy enchancment was pushed by a number of components together with a richer mixture of gasoline, producing extra liquids, and improved industrial phrases within the home market”, ADNOC Gasoline stated.

Yr-end free money movement was $4.58 billion, with the October-December interval contributing $1.22 billion.

ADNOC Gasoline declared a dividend of $3.41 billion for 2024, half of which was paid September 2024. It expects to distribute the remaining half this April.

“The ultimate dividend for FY 2024 is consistent with the corporate’s sturdy coverage to extend the annual dividend by 5 p.c yearly and displays the corporate’s sturdy free money movement, which exceeds the dividend dedication by over $1 billion”, it stated.

To contact the writer, e mail jov.onsat@rigzone.com