Oil gained essentially the most since October as merchants weighed whether or not talks between the US and Iran might be sufficient to avert battle, following a report that American navy intervention might come prior to anticipated.

West Texas Intermediate was up 4.6% to settle close to $65 a barrel, whereas Brent crude closed above $70 for the primary time in over two weeks. Axios reported that any US navy operation would doubtless be a weeks-long marketing campaign, moderately than the pinpoint operation that occurred in Venezuela final month. Israel’s authorities is pushing for a state of affairs focusing on regime change, the report added.

A possible conflagration would put crude flows in danger within the Strait of Hormuz, the choke level for power exports from the world’s prime oil-producing area that Iran mentioned on Tuesday it will briefly shut for navy drills. US President Donald Trump dangers angering voters forward of mid-term elections this 12 months if a spike in crude costs makes gasoline costlier on the pump.

“I am a cynic and nonetheless don’t imagine Trump would threat greater pump costs at house in an election 12 months the place affordability is excessive on the agenda,” mentioned Ole Sloth Hansen, head of commodities technique at Saxo Financial institution, including the Axios report was driving up costs on Wednesday.

Talks up to now have been inconclusive, with Tehran saying it reached a “normal settlement” with Washington on the phrases of a possible nuclear deal. A US official mentioned Iranian negotiators would return to Geneva with a brand new proposal in two weeks. The US on Wednesday introduced visa restrictions on Iranian officers and executives for repressing latest anti-regime protests and chopping off web entry.

“The readout from US-Iran talks in Geneva signifies that the diplomatic monitor is nearing a lifeless finish,” Rapidan Power Group wrote in a word. The agency assigned greater odds of 30%, up from 20%, that an Iranian retaliation to potential US strikes on the main oil producer would lead to a considerable disruption in Gulf power flows.

In the meantime, a second day of US-brokered conferences in Geneva between Russia and Ukraine broke up after barely 90 minutes as Ukrainian President Volodymyr Zelenskiy accused Moscow of making an attempt to delay the method. The top of Russia’s delegation mentioned talks had been troublesome and businesslike, including the subsequent assembly will happen quickly.

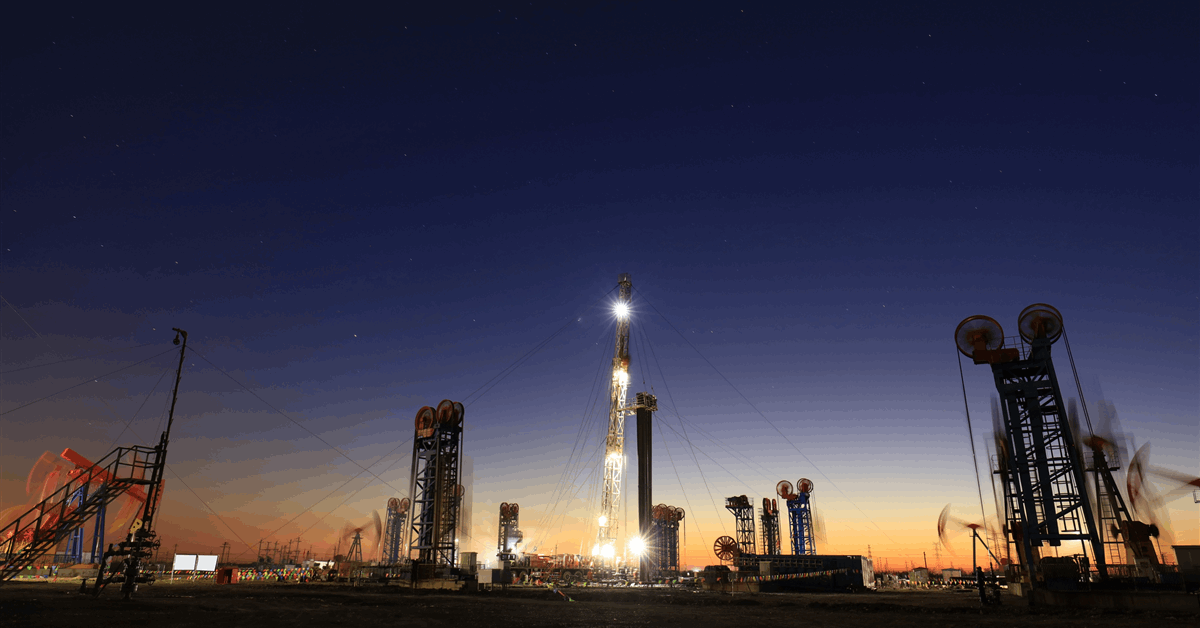

Crude has benefited up to now this 12 months from sturdy cross-commodity momentum, in addition to geopolitical issues which have outweighed warnings {that a} international glut out there will drag down costs. The standoff with Iran, which was rocked by anti-government protests in January, has fanned issues amongst merchants that oil output or very important provide routes might be interrupted by navy clashes.

Oil Costs

- WTI for March supply rose 4.6% to settle at $65.19 a barrel in New York.

- Brent for April settlement gained 4.4% to settle at $70.35 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and have interaction in an expert group that can empower your profession in power.