Santos Ltd. is concentrating on a ten p.c headcount discount after Australia’s second-biggest pure gasoline producer reported a hunch in revenue on decrease oil and gasoline costs.

The layoffs will embody short-term workers and contractors as main initiatives are accomplished and the corporate pursues price financial savings, Chief Govt Officer Kevin Gallagher stated in an interview on Wednesday. Santos has about 4,000 workers, in accordance with the submitting.

“The market ought to just like the focused headcount discount as an indication of decrease forecast working prices,” Jarden Group analysts Nik Burns and Joshua Mills-Bayne stated in a word.

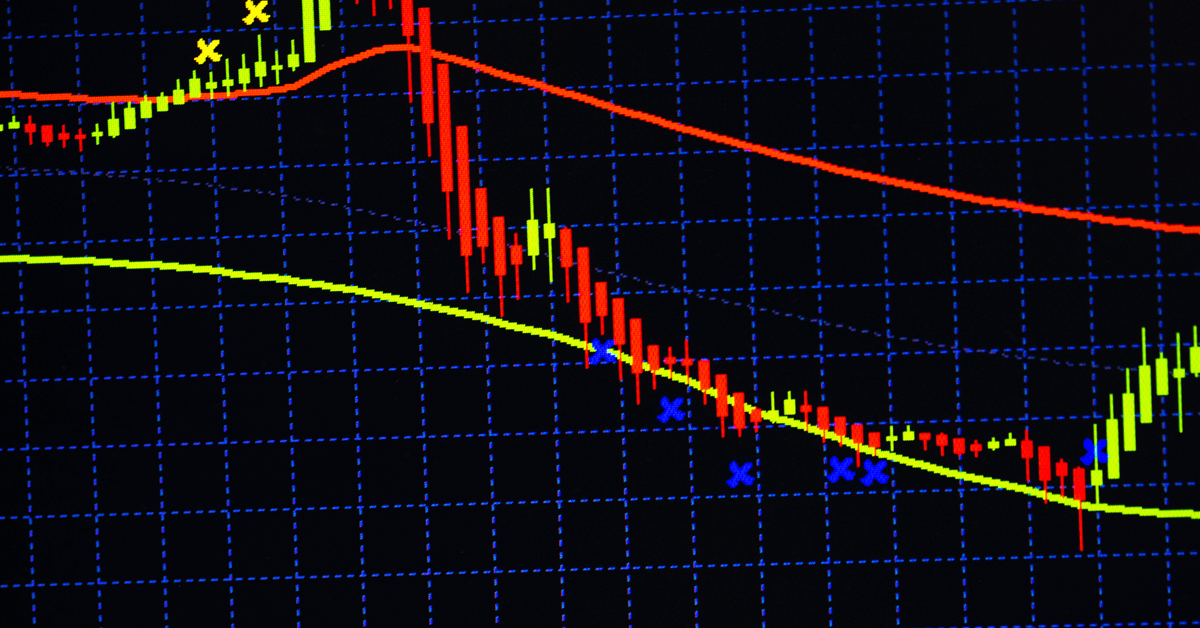

Attributable web earnings after tax fell by a 3rd to $818 million within the yr by means of December, the Adelaide-based firm stated. That was under all analyst expectations. Shares fell as a lot as 3.8 p.c, earlier than paring a few of these losses in Sydney.

Regardless of short-term uncertainty, demand for coal, oil and gasoline continues to extend, Santos Chair Keith Spence stated in an announcement. Geopolitical tensions and slowing financial development meant world power markets remained unstable final yr, he stated.

“Volatility is the brand new norm,” Gallagher stated within the interview. “Having flexibility in your product portfolio lets you react to that volatility when it happens. And hopefully opportunistically benefit from it.”

Santos is betting that Asia will underpin development in demand for liquefied pure gasoline, regardless of forecasts of a provide glut that would start as early as 2026 and mounting world strain on nations to speed up the shift away from fossil fuels and attain web zero commitments. The corporate argues that LNG supplies a decrease carbon different to coal for key import markets like Japan and South Korea.

“Asia stays on the heart of LNG demand development, with consumption forecast to develop strongly by means of to 2050,” Gallagher stated in an investor name, including that gasoline performs a “distinctive function” within the power transition.

“It’s the solely scalable, dispatchable gasoline able to supporting renewables whereas sustaining grid stability,” he stated. “That makes it a basis gasoline for economies which might be rising.”

There may be notably sturdy demand for the excessive heating worth LNG that contains 75 p.c of Santos’ portfolio, as prospects in Asia pursue power safety, he added within the interview.

The function of LNG within the power transition is very contested, with environmentalists arguing that the fossil gasoline trade isn’t correctly taking into consideration methane emissions and air pollution from transport the gasoline.

Santos’ common realized oil worth in 2025 dropped 14 p.c to $73.05 a barrel and LNG was down 10 p.c to $11.12 per million British thermal models. That contributed to an 8 p.c minimize in gross sales income to about $5 billion, it stated.

The beginning of manufacturing from the Barossa gasoline undertaking in September and first oil from the Pikka improvement in Alaska this quarter are forecast to elevate output to 101 million to 111 million barrels of oil equal in 2026.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in knowledgeable group that can empower your profession in power.