Oil markets are awash in crude, maintaining a lid on costs and squeezing drillers. For US refiners, although, the glut is proving a windfall.

The massive three US refiners — Marathon Petroleum, Valero Power Corp. and Phillips 66 — all beat estimates in fourth quarter earnings outcomes reported in latest weeks. On calls with analysts, executives signaled a worthwhile outlook for 2026 and the years forward, not least as a result of they’re set to learn from an inflow of cheaper and extra available heavy crudes.

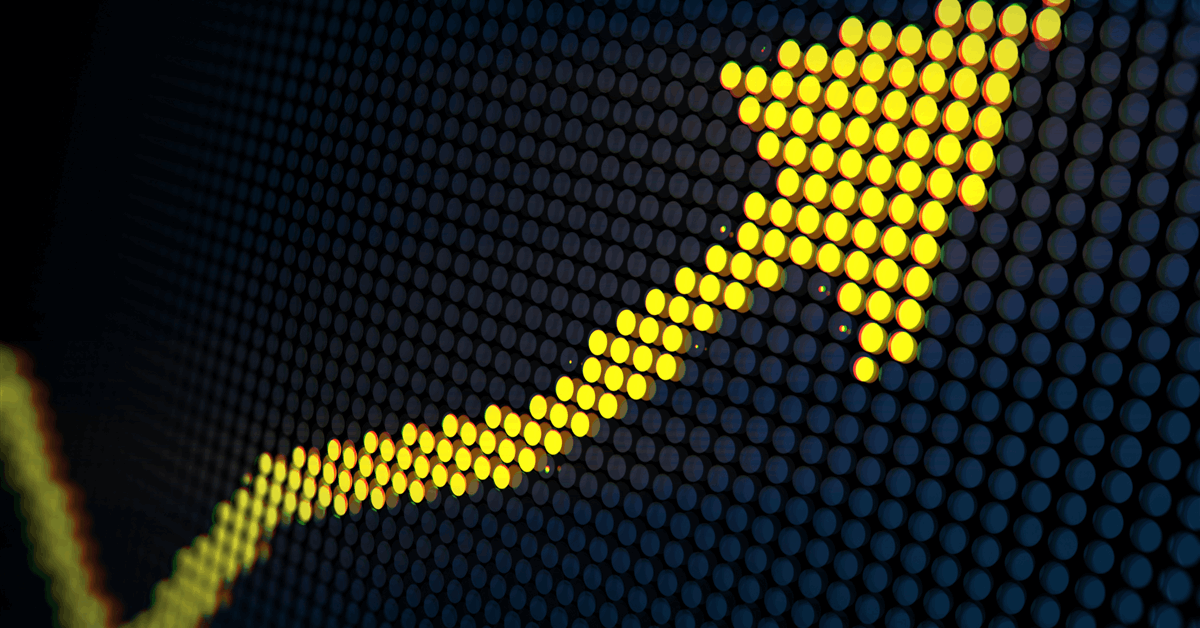

The divergence displays a rising imbalance in international gasoline markets: demand for gasoline, diesel and jet gasoline is rising quicker than new refining capability is rising, whilst oil producers proceed to pump extra crude than the world wants. That dynamic permits refiners to purchase cheaper feedstock whereas charging extra for completed fuels.

“We’re very bullish,” Phillips 66 Chief Govt Officer Mark Lashier stated on a Feb. 4 name with analysts. Gas demand is ready to develop in 2026, and international refining capability additions will fall brief, Lashier stated.

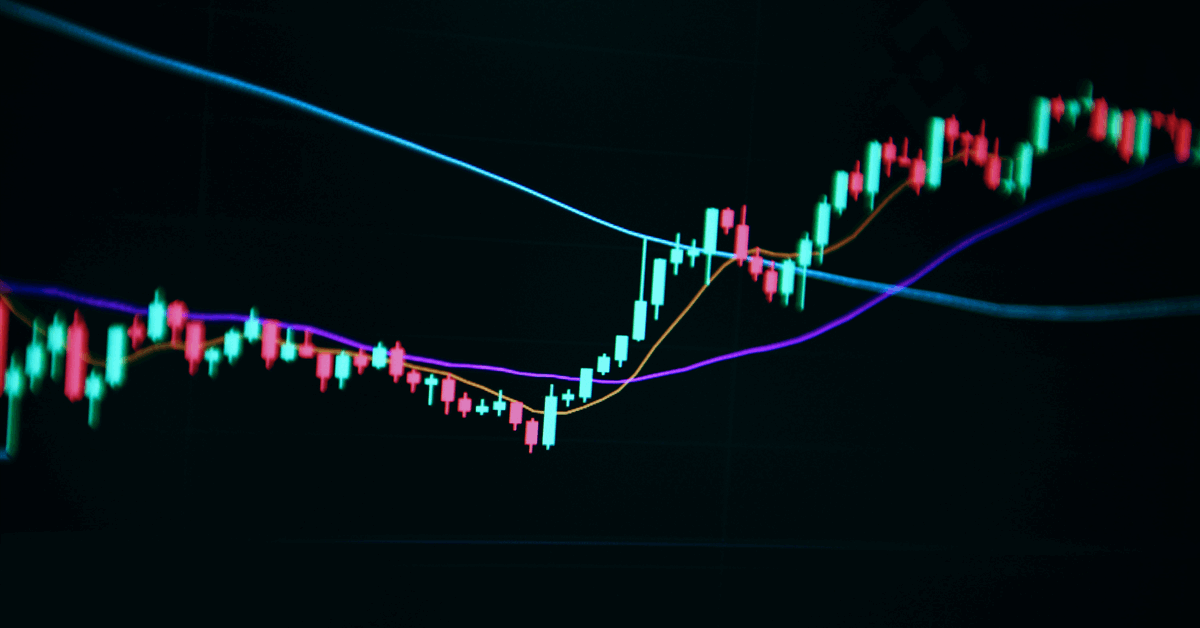

The upbeat tone is a far cry from early 2025, when President Donald Trump’s tariff uncertainty clouded the financial outlook and sparked considerations over gasoline demand. On the time, the business braced for a wave of plant closures. Since then, gasoline consumption has remained resilient whilst the availability glut drove oil costs decrease. Brent crude, the worldwide benchmark, is down about 10% over the previous 12 months.

Refining margins for America’s prime gasoline makers, who collectively course of some 8 million barrels of oil a day, ended 2025 with earnings that had been about $5 a barrel increased than the fourth quarter of 2024. With gasoline demand forecast to remain sturdy, the upward momentum for margins is prone to proceed. Advisor Rapidan Power, in its refined product outlook printed Monday, stated it sees little proof of a peak in transport gasoline demand.

The three-2-1 crack unfold, an indicator of the profitability of manufacturing diesel and gasoline towards the price of crude, was round $25 a barrel as of Wednesday, increased than the place it was at this level in 2025 and properly above lows seen later within the 12 months.

“Commentary signifies that 2026 might be one other sturdy 12 months for cracks given demand is outpacing provide,” Vikram Bagri, an analyst at Citigroup Inc., stated in a report.

Trump’s strikes to spice up crude flows from Venezuela are strengthening the case for US refiners, as corporations place themselves to course of the heavy oil popping out of the South American nation.

Gas makers usually purchase a variety of oil grades, with traits from heavy to mild. The heavier and harder-to-process crudes, equivalent to these normally exported by Venezuela, are normally cheaper, making them supportive of refiners’ backside strains.

Valero, Phillips and Marathon are main patrons of heavy crude, having retooled their vegetation to course of extra of the harder-to-refine oil. All three corporations stated they’re both buying or within the course of of buying Venezuelan crude. The additional barrels popping out of Latin America must also depress the value of Canadian oil, an analogous heavy grade.

Refiner shares have surged because of the enhancing margins. Valero, Phillips and Marathon have jumped about 25% year-to-date. The S&P 500, in the meantime, is up nearly 1%.

Nonetheless, it stays to be seen if the momentum will be sustained. Whereas gasoline demand has room to run, Rapidan expects the market to tighten extra meaningfully in 2027, with 2026 broadly balanced.

Executives say the information helps their outlook.

For the approaching 12 months, Valero expects there might be 400,000 every day barrels of internet capability additions, shy of the half-million barrels a day of sunshine refined product demand development, Chief Working Officer Gary Simmons stated on a latest name with analysts, citing guide information. Marathon’s CEO Maryann Mannen stated refined product demand development will rise round 1% yearly via the subsequent 10 years.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback might be eliminated.